In the face of myriad studies, statistics, fundings, and exits among Israeli startups and venture capitalists in the past couple of years, we have decided to undertake an in-depth analysis. Here, we will examine the data in a more comprehensive way to understand the trends and where the industry is headed in the coming years.

In the current report, we chose to review the hi-tech sectors (technology, internet, mobile, software, and hardware) only, and not include life sciences. Also, we did include an analysis of companies with Israeli connections operating overseas, such as companies that were founded in Israel and then moved to the United States, or founders who chose to register their company in the U.S. for various reasons. But most companies have an active Israeli component.

It is important to understand that our research is based on fundings, exits, and deals that were publicized in the hi-tech and technology sectors; we did not include companies that were sold or transferred ownership within our count of exits and funding totals.

Our goal was and continues to be to present the numbers as they are publicly expressed, and then read between the lines.

Let’s get started.

2015: The bubble reaches Israel

In the past two years, we’ve seen a significant growth in the sums of capital raised by Silicon Valley startups, as well as large volumes of transactions that were rarely seen in Israel. Several “unicorns” (companies valued at over $1 billion) have already emerged from Israel, such as Waze, Taboola, and Outbrain. But the statistics for 2015 reflect a decisive growth in the number of investments, capital raised, and the sheer average volume raised in a funding round – suggesting that the Silicon Valley phenomenon has begun to trickle over to Israel.

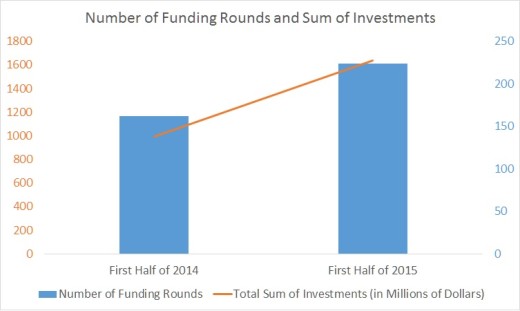

In the first half of 2015, Israeli startups managed to raise no less than $1.64 billion. By comparison, this sum is 65 percent higher than the sums raised by Israeli startups in the first half of 2014, which totaled “only” $0.99 billion. The number of funding rounds also grew significantly, although at a more conservative rate of “only” 38 percent compared to Q1 and Q2 in 2014 – 224 funding rounds in the first half of 2015 in contrast to 162 rounds in the first half of last year.

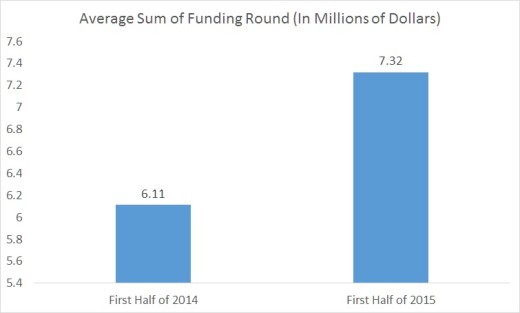

If we examine the average sum of each funding round in these two years, we can see that in the first half of 2015, the total amounted to $7.32 million, whereas in the first half of 2014 it stood at only $6.11 million.

Building the Scaleup Nation

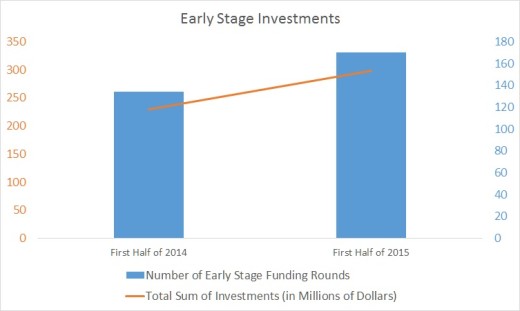

When we examine the growth based on the startups’ stages, an even more interesting picture emerges. The number of investments in early stage startups in the first half of 2015 (170 investments) was 26 percent greater than it was in last year’s equivalent time frame (134), a statistic that indicates increased investment in early stage startups – and to a greater number of startups receiving funding early on.

This insight is further strengthened when we examine the growth in overall dollars invested in early stage startups. Whereas in 2014, the total sum raised was around $230 million, the first half of 2015 alone saw $298 million invested in these startups, a growth of 30 percent.

Combining these two facts indicates not just the sums of capital being invested in early stage startups has risen, but also a growth in volume occurred.

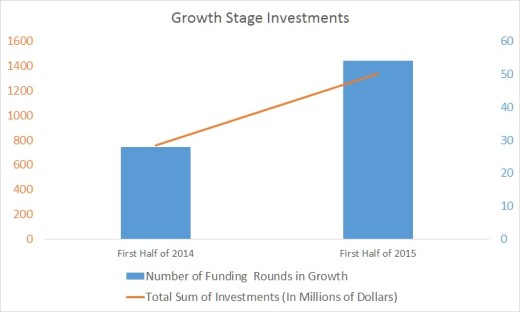

If for a moment you thought that the surge in initial funding rounds was large, it’s worth noting that in the growth funding stages, there has been a 76 percent increase in the number of growth funding rounds raised by companies between 2014 to 2015.

In the first half of 2015, 54 companies raised a total of $1.34 billion, whereas only 28 companies raised $760 million within the same time frame in 2014. Although the number of growth funding rounds is significantly lower than the early funding rounds, the growth rounds have raised a very respectable amount of capital.

The greatest single funding round of the first half of 2015 was that of SimpliVity, an IT infrastructure company founded by Doron Kempel. In the framework of the Series D funding round, the company raised $175 million after being evaluated at $1 billion before the round. In contrast, the biggest funding round in the first half of 2014 was that of Kaltura, which raised “only” $47 million.

In terms of average investment size, we can see that between 2014 and 2015, there was an increase in the total sums raised by early stage startups, which in most cases indicates a similar increase in volume of early stage startups.

Has the Series A crunch also reached Israel?

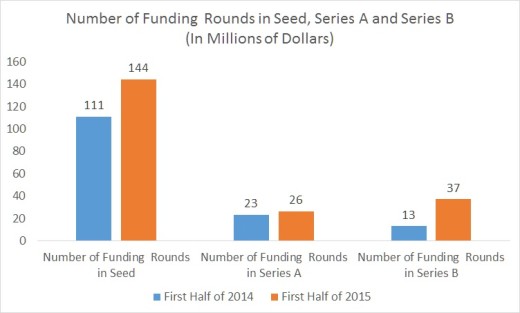

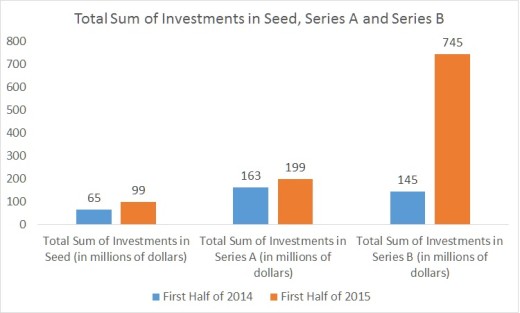

An examination of the distribution of early stage funding rounds implies further insights: In the first half of 2015, seed rounds reached a total of $99 million in 144 rounds, Series A rounds totaled $199 million in 26 rounds, and Series B rounds totaled $745 million in 37 rounds. By comparison, a breakdown of the funding rounds in the first half of 2014 shows that 111 seed rounds raised $65 million, 23 Series A rounds raised $163 million, and 13 Series B rounds raised $145 million.

In other words, many startups that were able to entice private investors in their seed rounds were unable to demonstrate concrete results or persuade their investors about their future, which creates a sort of “chasm” in the Series A funding rounds. On average, startups that overcome this obstacle can continue to enjoy funding from existing investors, attract new investors, and raise more funding in their consecutive Series B rounds.

This phenomenon is known as the “Series A Crunch,” and it applies to Valley startups as well, who are able to raise decent sums in their seed rounds but then discover that to raise Series As they must demonstrate buyers, traction, popularity, or need, which were normally only expected for Series B rounds.

The greatest claim in the Exit Nation versus Scaleup Nation argument gets punched in the face when viewing data from 2015. The growth in the total number of investments in 2015 refutes one of the strongest assertions that has been levied against Israeli ventures and founders in the last several years – that they do not know how to effectively scale, and therefore sell their startups in their early stages.

Cyber Nation

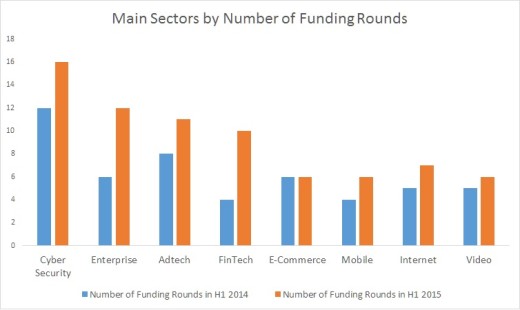

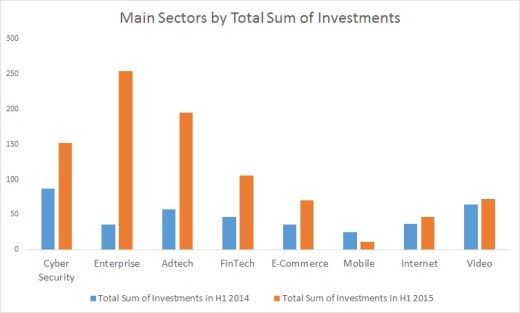

Unsurprisingly, the sector that received the largest number of investments in the first half of 2015 was that of cyber technology and information security, with 16 rounds of funding totaling $152 million, followed by the enterprise and organizational platforms sector with 12 funding rounds totaling $254 million. In third place comes the ad tech sector, with 11 rounds totaling $194.6 million.

Because of its relative youth, the cyber technology sector still holds a lot of opportunities, both for attackers discovering breaches in security and weaknesses in organizational systems, as well as for security companies that aim to stave off these threats. There is no doubt that any publicized vulnerability or information leak raises the value – and necessity – of these various security companies.

With that said, and despite the fact that cyber technology companies received the greatest number of investments, organizational software startups raised almost twice as much total funding. The reason for this is because the latter represent more established companies with a proven product, which require greater sums to expand to new markets.

Relative to the first half of 2014, the breakdown between the different sectors is quite similar, except for the fact that we see a spike both in the number of investment rounds and the scope of the investments. Cyber technology raised 12 investments totaling $87.1 million, and ad tech raised eight investments totaling $57 million. The sectors of e-commerce, which raised $35.4 million, and enterprise software, which raised $115 million, both received the same number of investments (6).

The Exit Nation is still here, but it’s more proportionate

Corresponding to the spike in the number of investments in early stage startups, we also see that Israelis are not quick to give up on thedream of a successful exit. In the first half 2015, there was a 65 percent spike in the number of acquisitions, with a total of 33 startup exits compared to just 20 in the first half of 2014.

IPOs

In the last 18 months, we’ve seen nine Israeli hi-tech startups* issue IPOs: Three of them occurred in the first half of 2015, two in the first half of 2014, and four in the second half of 2014.

The biggest issue in the last six months was that of the SolarEdge energy company, which raised $125 million in NASDAQ based on a valuation of $500 million. In the first half of 2014, Varonis Systems had the largest IPO, raising $106 million at a $524 million valuation.

*In this study, we refer to Initial Public Offerings by Israeli startups only (excluding biotech companies and secondary offerings).

Read Next: 5 reasons behind Israel’s startup success

Image credit: Shutterstock

This post first appeared on Geektime.

Get the TNW newsletter

Get the most important tech news in your inbox each week.