Digital currency startup Circle today emerged from stealth with the launch of its banking service that it believes will take Bitcoin mainstream. The company made the announcement at the Bitcoin 2014 conference in Amsterdam.

Circle bills itself as doing for virtual currency what Skype did for Voice over IP by building a consumer-ready product to supplant paid services (long-distance calls) with technology that made calling free. In a similar way, Circle is utilizing the benefits of Bitcoin – instant, secure, global and free – to help customers store money and make payments.

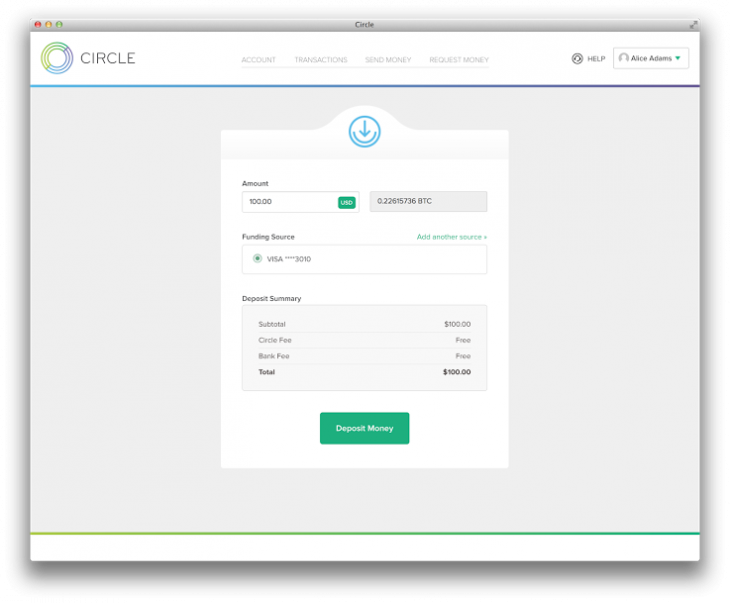

The core Circle product is completely free. The company is a registered financial institution, keeps full reserve on its Bitcoins, and offers full insurance on customer accounts.

“There have been a lot of barriers and friction and complexity to digital money formats over the past year or so,” Circle co-founder Jeremy Allaire told TNW. “What we’ve tried to do with the service is remove a great deal of the complexity.”

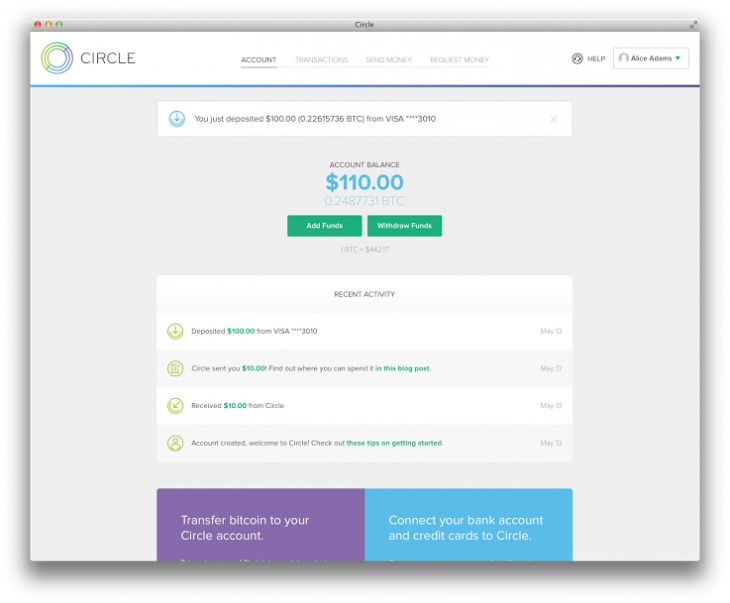

In order to be more consumer friendly, the service downplays the role of Bitcoin. For Circle, Bitcoin is effectively the backend for storing and transporting money. To that end, this isn’t a service for people who are interested in speculating on Bitcoin value or treating it like an investment. When you interact with the money in your account, it’s presented to you in dollars.

Circle already has a sizable waiting list to work through, so the service is invite-only at launch. Initial accounts will get $10 worth of Bitcoin credited to their account. Customers will need to link a bank account, credit card or debit card to add money. Circle aims to process deposits within minutes instead of days, like some exchanges.

Circle also isn’t catering to the anonymous Bitcoin community. In order to stay properly regulated, Circle has to verify the identities of its users in order to monitor for fraud and money laundering. Bitcoin owners looking to squirrel away their dark Web drug money should probably head elsewhere.

Another consumer touch to Circle is the inclusion of full phone customer support. The company is headquartered in Dublin with a presence in the US.

With high profile exchanges like Mt. Gox falling victim to alleged thefts, security is a dominant concern for Bitcoin companies. Circle will have its core systems audited by a national cyber security firm, conduct ongoing penetration attacks, and keep currency in geographically-distributed offline cold storage vaults with armed guards and multiple layers of security.

According to Allaire, it’s “almost impossible for a criminal to wage an attack” on Circle. We’ve certainly heard that before, but at least Allaire is a seasoned entrepreneur (ColdFusion, Macromedia, Brightcove) and not some anonymous hacker you met in a chat room.

With Circle having raised a total of $26 million before launch, the company doesn’t have to worry about making revenue right at launch. Allaire said the company has plenty of ideas on value-added services that it can introduce without having to charge for its core service.

“We want to make it as frictionless as possible, like in other industries that the internet has changed for consumers. The baseline service of storing and sending your money should be free. We, as a business, have a pretty good handle on what we think it will cost us to run that service, bring in those users,” Allaire said.

Since Circle is powered by Bitcoin, customers will see some fluctuation in their account balances, which will be listed in real-world currency, as its exchange rate moves up and down. That could, of course, work in your favor, but if you don’t want your savings in Bitcoin, you can use the service to make near-instant payments in order to minimize your exposure to the virtual currency’s volatility. Additionally, as Bitcoin becomes more mainstream, it’s less likely to go through the wild swings that it did in its early days.

When I imagine the future of banking – the vehicle for how I store, access and spend my money – it looks a lot like Circle. Allaire and team have recognized the potential for Bitcoin not as a currency, but as a technology. In other words, Bitcoin is valuable not because of what you can trade it for, but because of what you can do with it.

For the past couple decades, we’ve watched the power of the internet systematically reinvent entire industries – communications, transportation, commerce. While financial institutions have tended to be more resistant to change, banking’s time has come. Whether it’s Circle, or another startup that comes along, we’re on the verge of free, instant access to our funds from any device and anywhere in the world. As for me, my money’s on Circle.

Get the TNW newsletter

Get the most important tech news in your inbox each week.