Editor’s note: This story was written by Henn Idan and Yaniv Feldman and was originally published in Hebrew by Newsgeek, the largest tech blog In Israel.

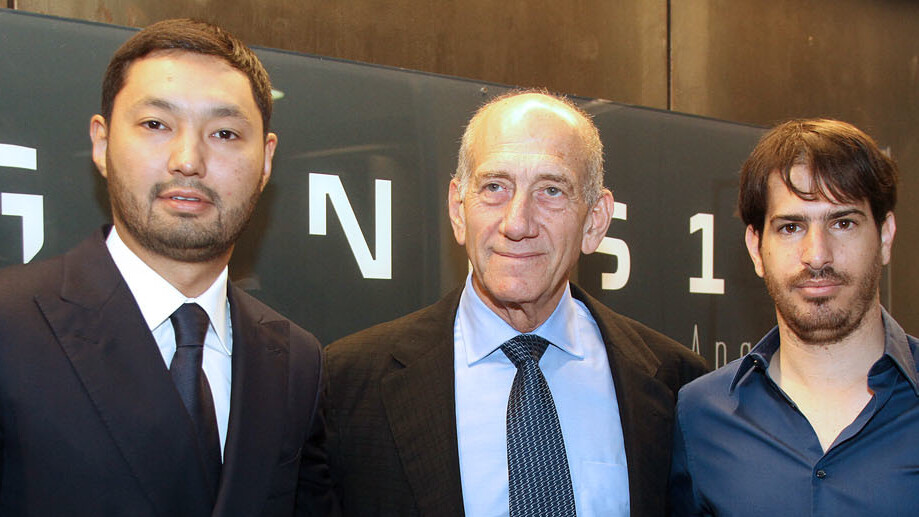

At an unofficial press conference held yesterday, former prime minister of Israel, Ehud Olmert announced the founding of a new venture capital fund named Genesis Angels. The fund was founded by Kazakh businessman Kenges Rakishev, who formerly invested in several startups, among them two Israeli companies (Triplay and Mobli), and Moshe Hogeg, the Founder and CEO of Mobli. Both founders will serve as General Partners in the fund while Olmert will serve as its Chairman.

According to plans, the fund will be involved primarily in early stage seed funding, in the fields of robotics, augmented reality, artificial intelligence and other technologies that are going to affect the way humanity grasps and communicates with reality.

During yesterday’s event, Rakishev said the fund has already raised “tens of millions of dollars” but a precise sum was not specified. In an interview to Newsgeek, Hogeg said that a number of large investment firms have already showed substantial interest in investing in the fund and that investment firm Forbes Manhattan has already committed this week to invest a sum of $10 million.

At this point, the fund is mostly comprised of investments made by Rakishev himself, who in the past was rated by Forbes as one of the 50 most influential people in Kazakhstan with a value net worth of over $2 billion. Rakishev has previously invested more than $20 million in Mobli and $5 million in Triplay, both of which were founded in Israel.

In an interview with the AP, Olmert remarked that Israel’s relative advantage in technology is not an unchangeable state, and can easily diminish if there aren’t enough investments in rising technologies (such as those the new fund will focus on).

Olmert also stated that during his term as Prime Minister, Israel invested in R&D more than any other country in the world, relative to size of course. On the other hand, Israel is not investing in its relative advantage and it’s time to change that and allow fields other than mobile applications to grow and develop.

Q&A with Genesis Angels partner, Moshe Hogeg

Moshe Hogeg explained to us that Genesis Angels is not your typical venture capital fund. “As an entrepreneur, I have raised over $30 million from private investors and not VCs, since I didn’t want the headache that comes with working with the funds. At the end of the day, a venture capital fund is financial institute that’s trying to get a 10 or 20 per cent dividend on their investment. There’s no ideology nor do they really want to help entrepreneurs change the world or do new things.

“It’s not that the people in the VCs themselves are bad people, but rather their LP’s (limited partners – the fund’s investors) want their annual 10% and that has consequences. When you make a seed investment you won’t see a return on your investment in the short term, it takes 3-4 years to know, if ever, if you have something good in your hands.

“Today, if you approach a VC with a prototype for a flying carpet, even if it already works and all you need is 5 years of R&D to bring it to market, the VC will tell you to come back in 4 years.”

So how is Genesis Angels different?

“People on Rakishev’s level are not interested in $50 million exits because that’s not what’s going to change their lives. It’s nice and all, but it’s not what’s really important to them. What’s interesting to people like Kenges is innovation. Kenges told me he wants to do revolutionary things, he wants to invest in things that only mega companies like Google and Microsoft… invest in, because it takes 5 or 7 years to develop.

“In my point of view there is no greater dream to an entrepreneur then an investor that’s with him for the long haul, for a 5 year period since he’s not looking for the quick exit but rather sees the big trends in the world and wants to invest in them.”

So what companies do you intend on investing in and in what stages?

“Today, the information age is approaching its end of days. It’s not there yet, but it is well on its way. Most of the information today is already online and accessible. When we were young, we all used Encyclopedia Britannica at school, but if you ask kids today what Encyclopedia Britannica is, they wouldn’t have the first clue. They only know Wikipedia and Google. Even medical and scientific information is becoming more and more accessible.

“Companies like Google, Facebook and Twitter are making everything more accessible and convenient and the best thing about it is that these companies give everyone access to their data and API which allows people to build the next level of technology.

“Things like big data, artificial intelligence, robotics and augmented reality are only a fraction of what’s going to change our lives in the near future. I’m not sure if the first version of Google Glass will change the world, but I have no doubt that this is a breakthrough that will present the world in a completely different way five years from now. Our ability to look at our reality and communicate with interactive information is revolutionary and innovative, not in the cool way but rather in a more efficient way. If I walk down the street and immediately get answers to questions, if the camera analyses what we see and gives us relevant information, that’s fantastic and revolutionary.”

Are you still in your fundraising stages? When are you planning to start investing and what will be your investment strategy?

“The fund itself already has tens of millions of dollars and we are continuing to raise money and plan on raising hundreds of millions. Today, the biggest VC in robotics is 25 million dollars strong and I don’t know of any other VCs investing in these fields in an orderly fashion.

“Right now, we already have two active companies in our portfolio, Beyond Verbal founded by Yuval Mor, a voice analysis company, and Infinity Augmented, a publicly-held American company that creates software for the augmented reality industry.

“Strategically, we are planning on being involved with companies, but not in the regular VC fashion. We are not “dumb money” but at the same time we’re not looking to harass and surely we don’t want to call the shots on what the company does and how it develops, but rather just try and help and make use of our experience. Our only rule in terms of involvement with the companies, and that rule is stated on our term sheet, is the subject of synergy between our different companies. We have already created a connection between the 2 companies in our portfolio and they are currently working on joined application.”

One if the biggest questions asked in yesterday’s announcement event is how Ehud Olmert is related to the fund and what will happen if and when he decides to return to Israeli politics. In answer to this question, Olmert responded that he is not interested in returning to politics and much prefers to invest in Israeli hi-tech because that’s where the future of the country is.

Hogeg explained that the reason Olmert is the chairman of the fund is that he is a powerful man with a lot of connections who understands the importance of technology to the state of Israel. “He understands how important this field is to Israel’s survival and that’s why he’s investing so much of his time and energy in this. A man who understands the technological importance and is willing to invest is a valuable asset.

“Furthermore, we want to open the doors to our portfolio and he will know how to do this better than anyone else. If we want to sit at a table with the CEO of GM tomorrow, I can’t do that, he can. Nearly any company in the world we want to talk to is now listening because of him.

“The third piece of the puzzle is reputation. Olmert would not be part of a venture like this without inspecting it and its people inside and out. The fact that we have Olmert is undoubtedly a stamp of approval for our project and I’m sure whoever we will work with, whether its entrepreneurs or investors, will see it too.

“But after all this, at the end of the day, the real reason Olmert wants to be with us is because we are doing something great for the state of Israel. You can’t take Israel’s technological standing for granted. You need to work hard to preserve it.”

Get the TNW newsletter

Get the most important tech news in your inbox each week.