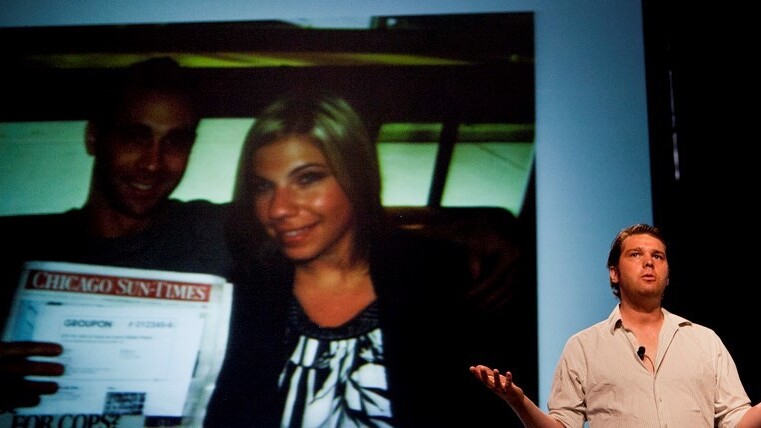

Update: Andrew Mason’s severance package won’t cost Groupon investors much. In place to receive half a year’s salary from the company, Mason will be paid a total of $378.36. His annual salary of $756.72 isn’t doing him any favors, even now that it has stopped.

—

Following his public sacking yesterday, Andrew mason has left Groupon’s board of directors. An 8-K form filed with the SEC by the company indicated that he had resigned, and that he will receive compensation for his removal:

No new compensatory or severance arrangements were entered into in connection with these leadership changes. Mr. Mason is entitled to receive severance benefits for termination without cause as provided in his employment agreement.

His termination, decidedly with cause, thus appears to have been put together under friendly conditions.

Mason’s exit from the firm yesterday led to a bump for the company in after hours trading. It had fallen sharply on the day following a calamitous fourth quarter’s earnings. Mason joked that he was leaving to take more time with his family, which he then stated was not the case, and that he had been fired.

TNW has reached out to Groupon for information concerning the nature of the termination, and the size of the severance. If and when we hear back, we will update this post.

In regular trading today, Groupon rose more than 12 percent. The market, plainly, is glad to see Mason out. Succession is already underway, as TNW reported yesterday:

According to the official release executives Lefkosky and leonsis will step in to cover his role on an “interim basis.” A search for a new CEO is underway.

Even with today’s market gains, Groupon is trading billions in market capitalization below the Google buyout offer it spurned before going public.

Top Image Credit: TechCrunch

Get the TNW newsletter

Get the most important tech news in your inbox each week.