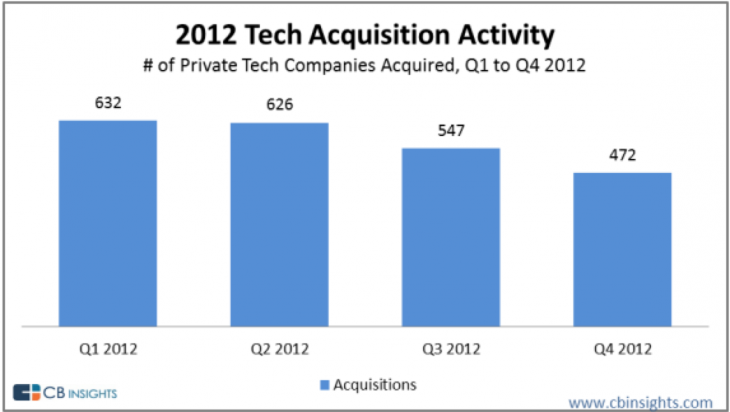

Publicly disclosed merger and acquisition activity for private tech companies reached $46.8 billion last year across 2,277 transactions, according to a new report from CB Insights.

The $46.8 billion figure comes from just 331 deals where the valuations were disclosed, as only 15% of transactions made the financial terms public.

Google and Facebook were the most active acquirers with 12 private acquisitions each. Five of Facebook’s deals were talent acquisitions, or “acqui-hires”.

Interestingly, the bulk of acquired companies had not raised investment. 76% of private tech companies that were bought up last year had bootstrapped instead of turning to VCs.

As expected, California saw the most private tech M&A deals last year, more than the next five states combined. North Dakota was the only US state that didn’t host a private tech acquisition in 2012. Internationally, the UK was the top acquirer, followed by Canada. India emerged as an up-and-comer at the third top international market.

Web and mobile commerce were the most popular types of companies to acquire, comprising 173 of overall deals.

Notable acquistions in 2012 included: Facebook purchasing of Instagram, Microsoft snatching up Yammer, and Twitter acquiring Posterous.

An earlier report on the venture capital market found that $28.3 billion in investments had been made last year, down from $30.6 billion in 2011.

Header image via Flickr / 401(K)2013

Get the TNW newsletter

Get the most important tech news in your inbox each week.