When Facebook calls together the media for a meeting, the markets take note: if the company decides in invade another firm’s territory, it could have sweeping implications. Given its size, Facebook could swamp smaller firms, perhaps now more than ever given its strong post-IPO cash position.

Given its focus today on search, the companies most impacted were those that deal with information in an indexed format. Google and Microsoft are obvious candidates, but in today’s news LinkedIn and Yelp were also key players.

In the following space we will examine each of the companies, starting with Facebook, to gauge market sentiment regarding their position the now Graph Search era of search. Let’s begin. All data via Google Finance.

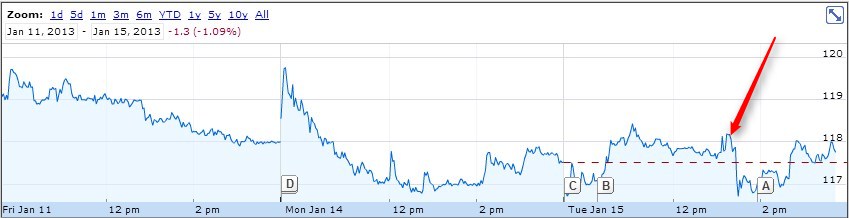

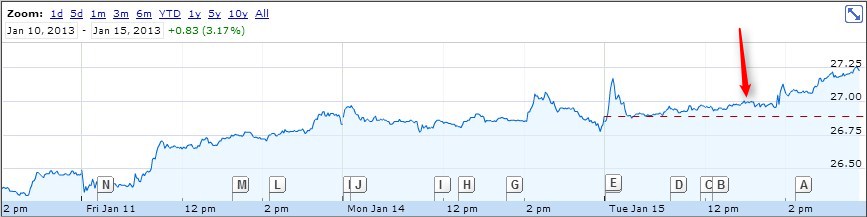

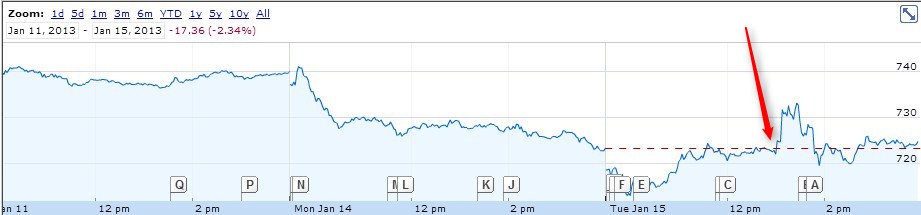

In each example, the red arrow will point to 1 pm Eastern, the moment in which Facebook kicked off its event.

Investors have mildly punished Facebook for what it did not announce today. Instead of a product, device, or service that would be instantly monetizable and thus impactful to its bottom line in the short term, Facebook announced Graph Search, which it stated will not contain advertisements for the time being. Thus, it will be a revenue-free service.

There are other dynamics at play, naturally, including the possibility that some investors were holding out against all logic for an actual Facebook smartphone. Whatever the case, Facebook is down a few points today as investors were unimpressed.

Yelp

Ouch. Yelp took a whacking following the news, and not for a reason that is immediately grokkable; why would Yelp be worth less if Facebook is worming its way into the search market? Simply this: the data that local businesses input to Facebook is now eminently easier to access via Graph Search. Thus, there is less need for Facebook users to leave the service to ascertain the very data that Yelp serves.

Thus, Yelp loses pageviews, and influence, and thus revenues. The market knocked about 7.5% of its valuation off today, following Facebook’s conference. If the conduits by which many people reach Yelp shrink, so too does Yelp slim down.

If Graph Search isn’t a compelling experience, Yelp can still be served in Facebook results via the social service’s Bing connection. However, the thrust is clear: for what Yelp provides, Facebook wants you to lean on its data, and on its Pages. That excludes Yelp.

LinkedIn is an odd case, given that it spiked negative, and then back up. What caused the decline was Facebook’s comment that Graph Search could be used for hiring searches. That is a LinkedIn domain that it wishes to retain control over.

However, as the event went on, the limited release of the product, its beta status and more appear to have removed LinkedIn investors’ jitters. The company will likely end the day in the black, despite not having done much of anything.

Microsoft

Microsoft didn’t move much during the announcement, perhaps as the impact of Graph Search on its Bing product’s relationship with Facebook wasn’t clear until later. Bing remains a key part of search on Facebook, if in a diminished role that may contract in time.

Still, Microsoft investors, perhaps fearing a total exclusion, bid up the company as one of its key partners decided to stay with it. Also, Zuckerberg stated following a question that Google wasn’t too cooperative with it; this puts Microsoft in a stronger position as a willing partner.

Google investors initially dug Facebook’s search project. Maybe. Perhaps they viewed as a strong enough move from Bing that it would weaken the only web search engine that might challenge Google’s hegemony.

However, following the spike, Google retracted, perhaps as more details of what Graph Search became known; as with Yelp, Google could lose search traffic to Facebook’s new tool. However, the impact was minor, as Google ended the day flat.

For now, it appears that investors are watching Facebook, and its search efforts carefully, but that they are not yet certain what the results will be. Other than that Yelp is now worth less.

Top Image Credit: Emmanuel Huybrechts

Get the TNW newsletter

Get the most important tech news in your inbox each week.