What recession? Google is churning on like always, growing both their top and bottom line in the most recent quarter.

What recession? Google is churning on like always, growing both their top and bottom line in the most recent quarter.

For the first quarter, Google’s new numbers fell in line with analyst expectations. While that might sound unimpressive, Google had a great three months. Total revenues were 6.77 billion USD, an increase of 23% from the first quarter of 2009.

Operating income, on a GAAP basis, was $2.49 billion, which was 37% of revenues and up $610 million dollars year over year. To put that in perspective, if you took this quarter four times over, and the first quarter of last year four times over, Google would profit $2.4 billion more than before. Google is, in the common parlance, killing it.

Google revenue is broadly divided in to two parts: revenues from Google controlled websites, and from partner properties. For the most recent quarter, $4.44 billion came from Google websites and just over two billion came from partner websites. This is roughly a 2: ratio.

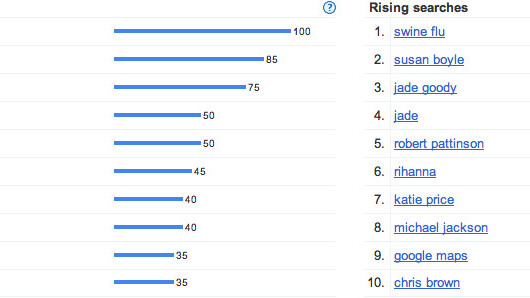

In more specific terms, total aggregate paid clicks rose 15%, and the cost per click rose around 7%. Impressive, Google showing a rise in both the total units sold, and the price per unit.

And since today is Tax Day here in the United States, what was Google’s income tax rate? Some 22%. Yours was higher, right?

A great quarter for Google, showing strength in the internet as a whole across advertising, search, and content monetization. Hopefully Google can keep up the momentum in the current quarter.

Full Google statement:

MOUNTAIN VIEW, Calif. – April 15, 2010 – Google Inc. (NASDAQ: GOOG) today announced financial results for the quarter ended March 31, 2010.

“Google performed very well in the first quarter, with 23% year over year revenue growth driven by strength across all major verticals and geographies,” said Patrick Pichette, CFO of Google. “Going forward, we remain committed to heavy investment in innovation — both to spur future growth in our core and emerging businesses as well as to help build the future of the open web.”

Q1 Financial Summary

Google reported revenues of $6.77 billion for the quarter ended March 31, 2010, an increase of 23% compared to the first quarter of 2009. Google reports its revenues, consistent with GAAP, on a gross basis without deducting traffic acquisition costs (TAC). In the first quarter of 2010, TAC totaled $1.71 billion, or 26% of advertising revenues.

Google reports operating income, operating margin, net income, and earnings per share (EPS) on a GAAP and non-GAAP basis. The non-GAAP measures, as well as free cash flow, an alternative non-GAAP measure of liquidity, are described below and are reconciled to the corresponding GAAP measures in the accompanying financial tables.

GAAP operating income in the first quarter of 2010 was $2.49 billion, or 37% of revenues. This compares to GAAP operating income of $1.88 billion, or 34% of revenues, in the first quarter of 2009. Non-GAAP operating income in the first quarter of 2010 was $2.78 billion, or 41% of revenues. This compares to non-GAAP operating income of $2.16 billion, or 39% of revenues, in the first quarter of 2009.

GAAP net income in the first quarter of 2010 was $1.96 billion, compared to $1.42 billion in the first quarter of 2009. Non-GAAP net income in the first quarter of 2010 was $2.18 billion, compared to $1.64 billion in the first quarter of 2009.

GAAP EPS in the first quarter of 2010 was $6.06 on 323 million diluted shares outstanding, compared to $4.49 in the first quarter of 2009 on 317 million diluted shares outstanding. Non-GAAP EPS in the first quarter of 2010 was $6.76, compared to $5.16 in the first quarter of 2009.

Non-GAAP operating income and non-GAAP operating margin exclude the expenses related to stock-based compensation (SBC). Non-GAAP net income and non-GAAP EPS exclude the expenses related to SBC and the related tax benefits. In the first quarter of 2010, the charge related to SBC was $291 million, compared to $277 million in the first quarter of 2009. The tax benefit related to SBC was $65 million in the first quarter of 2010 and $64 million in the first quarter of 2009. Reconciliations of non-GAAP measures to GAAP operating income, operating margin, net income, and EPS are included at the end of this release.

Q1 Financial Highlights

Revenues – Google reported revenues of $6.77 billion in the first quarter of 2010, representing a 23% increase over first quarter 2009 revenues of $5.51 billion. Google reports its revenues, consistent with GAAP, on a gross basis without deducting TAC.

Google Sites Revenues – Google-owned sites generated revenues of $4.44 billion, or 66% of total revenues, in the first quarter of 2010. This represents a 20% increase over first quarter 2009 revenues of $3.69 billion.

Google Network Revenues – Google’s partner sites generated revenues, through AdSense programs, of $2.04 billion, or 30% of total revenues, in the first quarter of 2010. This represents a 24% increase from first quarter 2009 network revenues of $1.64 billion.

International Revenues – Revenues from outside of the United States totaled $3.58 billion, representing 53% of total revenues in the first quarter of 2010, compared to 53% in the fourth quarter of 2009 and 52% in the first quarter of 2009. Excluding gains related to our foreign exchange risk management program, had foreign exchange rates remained constant from the fourth quarter of 2009 through the first quarter of 2010, our revenues in the first quarter of 2010 would have been $112 million higher. Excluding gains related to our foreign exchange risk management program, had foreign exchange rates remained constant from the first quarter of 2009 through the first quarter of 2010, our revenues in the first quarter of 2010 would have been $242 million lower.

Revenues from the United Kingdom totaled $842 million, representing 13% of revenues in the first quarter of 2010, compared to 13% in the first quarter of 2009.

In the first quarter of 2010, we recognized a benefit of $10 million to revenues through our foreign exchange risk management program, compared to $154 million in the first quarter of 2009.

Paid Clicks – Aggregate paid clicks, which include clicks related to ads served on Google sites and the sites of our AdSense partners, increased approximately 15% over the first quarter of 2009 and increased approximately 5% over the fourth quarter of 2009.

Cost-Per-Click – Average cost-per-click, which includes clicks related to ads served on Google sites and the sites of our AdSense partners, increased approximately 7% over the first quarter of 2009 and decreased approximately 4% over the fourth quarter of 2009.

TAC – Traffic Acquisition Costs, the portion of revenues shared with Google’s partners, increased to $1.71 billion in the first quarter of 2010, compared to TAC of $1.44 billion in the first quarter of 2009. TAC as a percentage of advertising revenues was 26% in the first quarter of 2010, compared to 27% in the first quarter of 2009.

The majority of TAC is related to amounts ultimately paid to our AdSense partners, which totaled $1.45 billion in the first quarter of 2010. TAC also includes amounts ultimately paid to certain distribution partners and others who direct traffic to our website, which totaled $265 million in the first quarter of 2010.

Other Cost of Revenues – Other cost of revenues, which is comprised primarily of data center operational expenses, amortization of intangible assets, content acquisition costs as well as credit card processing charges, increased to $741 million, or 11% of revenues, in the first quarter of 2010, compared to $666 million, or 12% of revenues, in the first quarter of 2009.

Operating Expenses – Operating expenses, other than cost of revenues, were $1.84 billion in the first quarter of 2010, or 27% of revenues, compared to $1.52 billion in the first quarter of 2009, or 28% of revenues.

Stock-Based Compensation (SBC) – In the first quarter of 2010, the total charge related to SBC was $291 million, compared to $277 million in the first quarter of 2009.

We currently estimate SBC charges for grants to employees prior to April 1, 2010 to be approximately $1.2 billion for 2010. This estimate does not include expenses to be recognized related to employee stock awards that are granted after March 31, 2010 or non-employee stock awards that have been or may be granted.

Operating Income – GAAP operating income in the first quarter of 2010 was $2.49 billion, or 37% of revenues. This compares to GAAP operating income of $1.88 billion, or 34% of revenues, in the first quarter of 2009. Non-GAAP operating income in the first quarter of 2010 was $2.78 billion, or 41% of revenues. This compares to non-GAAP operating income of $2.16 billion, or 39% of revenues, in the first quarter of 2009.

Interest Income and Other, Net – Interest income and other, net increased to $18 million in the first quarter of 2010, compared to $6 million in the first quarter of 2009.

Income Taxes – Our effective tax rate was 22% for the first quarter of 2010.

Net Income – GAAP net income in the first quarter of 2010 was $1.96 billion, compared to $1.42 billion in the first quarter of 2009. Non-GAAP net income was $2.18 billion in the first quarter of 2010, compared to $1.64 billion in the first quarter of 2009. GAAP EPS in the first quarter of 2010 was $6.06 on 323 million diluted shares outstanding, compared to $4.49 in the first quarter of 2009 on 317 million diluted shares outstanding. Non-GAAP EPS in the first quarter of 2010 was $6.76, compared to $5.16 in the first quarter of 2009.

Cash Flow and Capital Expenditures – Net cash provided by operating activities in the first quarter of 2010 totaled $2.58 billion, compared to $2.25 billion in the first quarter of 2009. In the first quarter of 2010, capital expenditures were $239 million, the majority of which was related to IT infrastructure investments, including data centers, servers, and networking equipment. Free cash flow, an alternative non-GAAP measure of liquidity, is defined as net cash provided by operating activities less capital expenditures. In the first quarter of 2010, free cash flow was $2.35 billion.

We expect to continue to make significant capital expenditures.

A reconciliation of free cash flow to net cash provided by operating activities, the GAAP measure of liquidity, is included at the end of this release.

Cash – As of March 31, 2010, cash, cash equivalents, and short-term marketable securities were $26.5 billion.

On a worldwide basis, Google employed 20,621 full-time employees as of March 31, 2010, up from 19,835 full-time employees as of December 31, 2009.

Get the TNW newsletter

Get the most important tech news in your inbox each week.