For a look at how Chinese tech firms are increasingly making a mark on the US tech scene, just turn to e-commerce giant Alibaba.

Alibaba is well on its way to recording the world’s largest ever tech IPO in the US, which may explain its increased activity there — but it is definitely not the only Chinese company eyeing the US tech scene.

Chinese firms’ big US hires

To that extent, Alibaba has been extremely active in the US tech scene, as a series of recent events show. It is not obviously carving its way into the US — its very first US retail site doesn’t have a clear Alibaba branding — but its influence is clear in terms of money and movements.

The Chinese company announced today that it has hired former Google’s head of investor relations, Jane Penner, to take up the same role at Alibaba. This comes after it hired Jim Wilkinson, a former senior PepsiCo executive, as its head of international corporate communications back in May.

These US hiring ambitions from Chinese tech companies are not only coming from Alibaba — a high-profile move last year was Xiaomi’s hiring of former Android executive Hugo Barra, for example.

And why are Chinese tech firms seeking talent from the US? Other than the obvious fact that they have links to the US tech scene, it also adds a layer of credibility to the companies. China has been traditionally viewed as a place that copies ideas, but that is gradually changing, and having a big US hire speaks volumes about this transition.

An eye on startups

People aren’t the only ones to get noticed by Chinese tech companies seeking a slice of the Silicon Valley pie: startups are increasingly getting attention. In particular, Alibaba has been doling out hundreds of millions of dollars to startups that catch its eye.

Earlier today, it was announced that Alibaba had invested $120 million into Kabam, a California startup that publishes mobile games. The deal would see Kabam’s games being distributed across Alibaba’s mobile apps including its Taobao marketplace and Laiwang messaging app.

This comes a day after reports surfaced that Alibaba was in talks to invest into Snapchat, which Bloomberg said would value the ephemeral messaging app at $10 billion. It’s not only Alibaba that is interested — another Chinese internet giant, Tencent, is already an investor in Snapchat.

Earlier this year, Alibaba had already led a $280 million round of funding into US messaging app Tango, after pumping money into a $250 million funding round for car-for-hire service Lyft. Last year, it led a $206 million investment in US e-commerce site Shoprunner, and also a $50 million round in app search engine Quixey.

These mobile efforts come as Alibaba seeks desperately to fend off competition from Tencent-owned popular messaging app WeChat, which has become a veritable channel for e-commerce and payments, games and online-to-offline services. Alibaba is keen to not miss out on the mobile era — to this extent, it has already taken steps to woo consumers to shop on their mobile devices, such as giving mobile shoppers free data and giving away free smartphones to merchants.

However, there is only so much it can do by itself. Tapping on already-existing resources in the form of startups is an easier way to beef up its mobile products and allow it to face up to Tencent’s threat faster.

Meanwhile, Alibaba’s competitor Tencent also made the headlines last October for leading a $150 million investment in design website Fab.

The appeal of US startups

Alibaba and other Chinese tech firms see a mine of readily-packaged resources up for grabs, built up by Silicon Valley. China may have an increasingly active startup scene, but it is still nascent compared to what is commonly acknowledged as the world’s leading tech hub. As Silicon Valley startups seek out investments, and as Chinese firms are increasingly willing to bet on American insights that could eventually better their business in China — their interests align.

It is little wonder that Alibaba, and other Chinese tech firms, are having so much more of an influence on the US tech scene.

And even though people may dismiss it simply as just monetary appeal for Silicon Valley startups — and even big hires — there’s a lot more to that on the flip side. As Chinese internet firms become more innovative and are increasingly stepping out of that shadow of copying ideas, the US also has much to learn from them. What’s more, China is going through explosive internet growth, and getting a foot in the door will serve these Silicon Valley talents well.

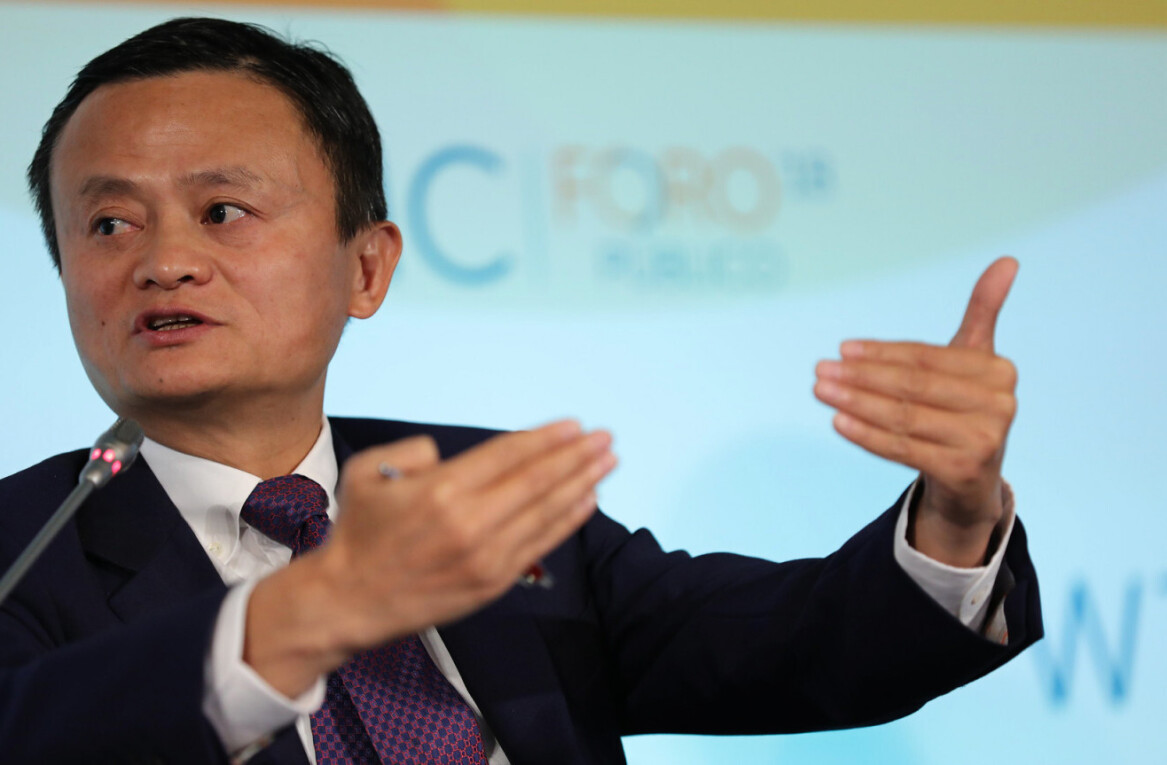

Headline image via Peter Parks/AFP/Getty Images, Getty Images and Tango

Get the TNW newsletter

Get the most important tech news in your inbox each week.