Finance is an industry that gives a lot of advice. If it’s on the Web and their title is analyst, they have to know what their doing right? Well, it’s not so simple.

As with most things in life, not all experts are created equal. For people who work in the industry, it’s easy to know whose advice is good and whose is not; for the individual investor it’s harder to keep track of what is worth listening to. TipRanks is a powerful browser plug-in that scores equity analysts based on their published recommendations. In other words, it tells you just how many times the analyst has actually hit home runs on their predictions.

The “financial accountability engine” collects any digitally published stock recommendation and ranks over 5,000 analysts by performance so that investors can see their success rate.

I contacted Uri Gruenbaun, CEO and Co-Founder of TipRanks, to find out why he created the company.

“I, like many other good people, followed many recommendations that all turned out to be very bad decisions. The experts vary from high profiled equity analysts and technical analysts through financial reporters and stock forums contributors. Out of curiosity I took one of the analysts I followed (after he rated a stock as a “Strong Buy”) and I Googled him. I started calculating his performance by imitating all the operations he recommended historically (Buying when he rated Buy and selling when he rated sell).

“It was a tedious task but the results were negatively shocking. After doing some more research I noticed that almost every time he posted a rating the stock behaved accordingly during that day and the trading volumes were way over the average trading volumes, meaning I was far from being the only one taking his advice. Clearly there was a problem.

“So with my engineering background I figured that this is something that can be solved using technology.”

Getting TipRanks is simple and painless. Just go to the website and click on the big orange button telling you to “Get TipRanks, it’s free”, click on Add and you’re done. If you use Chrome (and if you don’t, really? why?) the plug-in will simply show up in the corner. It’s that easy.

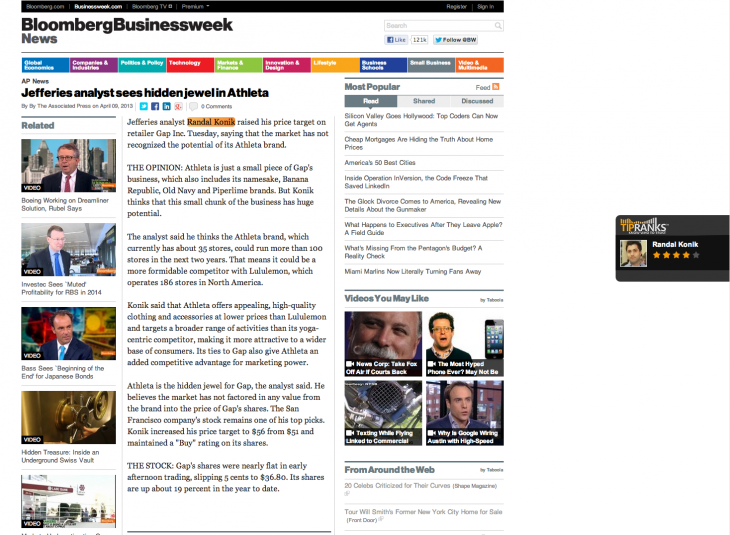

The thank you page gives a few suggestions to articles you can start testing TipRanks on. After that, you’re sorted. Start checking out Bloomberg and see just how well your favorite analyst scores. If you’re in finance, I would cancel all of your plans for the rest of the day – this is going to be a massive time-suck.

The TipRanks bar shows up on the right side of the browser window, giving you which analysts are found in the article.

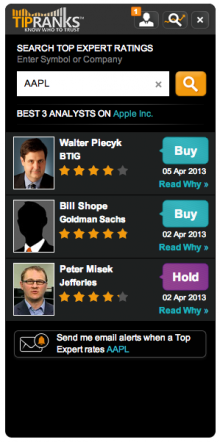

Click on the face or name of the analyst and the full bar comes out giving the rank of the analysts performance, how their return rate is compared to the average return over S&P 500 and how high their success rate is.

According to the finance classes I took during my Kellogg MBA, it’s almost impossible to beat the market (you basically have to be the Michael Jordan of trading to do that). If you see this persons average is higher than the S&P500 – pay attention. Also, don’t be surprised that a high ranked analyst has a lower than 50% success rate.

Wonder what analysts say about a certain stock? You can look it up and find out what the top analysts have to say.

There’s some cool technology behind this as well. I asked Uri about the IP:

“Technical IP:

1) We constantly scan the web (all English speaking financial websites)

2) We detect articles that have Sell Side advice in them (e.g. David Smith from Credit Suisse was bullish on Facebook stocks and gave them a “BUY)

3) We extract the information using NLP algorithms we developed that understand who said what on what stocks.

4) We understand who is the analyst and give you a full report on his recommendation accuracy since 2009 with his success ratio and measured average return compared to the SP500.

5) We also understand what stocks is he talking about so we show you what higher ranked analysts recently said about the stock.

6) So basically when you are going through a relevant article with a “hidden” advice inside you will automatically see the analysts measured performance, his full portfolio and what higher ranked experts think.”

Impressive.

Image credit: Thinkstock

Get the TNW newsletter

Get the most important tech news in your inbox each week.