Credit card issuers made 40 billion dollars in credit card profits last quarter alone. Two-thirds of that was from interest. Meanwhile, one-third of America is in credit card debt, which means approximately 100 million people are weighed down with revolving debt. These facts are not only depressing, but crippling to our national economy.

“My girlfriend came out of grad school with $24,000 in credit card debt. We were poking around figuring out what her options were for the first month or two before she found a job. She was trying to figure out — Should I bankrupt? Should I choose debt management? Debt settlement? And many of our friends were in the same situation. How many millions of people don’t have a single place they can go to online to figure out what the best options are when dealing with credit card debt?”

-Ready for Zero Co-Founder Rod Ebrahimi

In just one month since launch, Ready for Zero Co-Founders Rod Ebrahimi and Ignacio Thayer have helped thousands of users answer this question: “I’ve got this debt and here’s my cash flow situation. Now, what can I do?”

![]() Ebrahimi and Thayer may be new to the debt disruption field, but both have incredibly impressive backgrounds in disruptive technology. Ebrahimi began his career in Silicon Valley at the ripe age of 17 building scalable infrastructure for high traffic e-commerce sites. He then went on to study cognitive sciences, specializing in the human-computer interaction. Prior to RFZ, Ebrahimi worked at a startup were he helped lead the productization of memcached for companies like Zynga and Heroku. His Co-Founder Thayer specializes in machine learning and translation systems. Previous to Ready for Zero, he spent 5 years at Google rolling out Google Translate. He holds 2 degrees in Computer Science from Carnegie Mellon and UCLA and is currently on leave (to pursue Ready for Zero) from Stanford’s Computer Science Ph.D. Program.

Ebrahimi and Thayer may be new to the debt disruption field, but both have incredibly impressive backgrounds in disruptive technology. Ebrahimi began his career in Silicon Valley at the ripe age of 17 building scalable infrastructure for high traffic e-commerce sites. He then went on to study cognitive sciences, specializing in the human-computer interaction. Prior to RFZ, Ebrahimi worked at a startup were he helped lead the productization of memcached for companies like Zynga and Heroku. His Co-Founder Thayer specializes in machine learning and translation systems. Previous to Ready for Zero, he spent 5 years at Google rolling out Google Translate. He holds 2 degrees in Computer Science from Carnegie Mellon and UCLA and is currently on leave (to pursue Ready for Zero) from Stanford’s Computer Science Ph.D. Program.

“The debt situation in our country is totally messed up. It’s ridiculous. No wonder people don’t want to figure something out in this space,” says Ebrahimi.

If you’ve never had to deal with credit card debt, you have to understand that the current search process is terribly complicated and confusing. It is also a world full of crookery. Ever heard the guys on TV or radio broadcasting, “Settle your debt for 50 cents on the dollar!” Those promotions are 99% scams. The reason they can put an ad on TV during prime time is because they’re making loads of money off of innocent victims.

If you’ve never had to deal with credit card debt, you have to understand that the current search process is terribly complicated and confusing. It is also a world full of crookery. Ever heard the guys on TV or radio broadcasting, “Settle your debt for 50 cents on the dollar!” Those promotions are 99% scams. The reason they can put an ad on TV during prime time is because they’re making loads of money off of innocent victims.

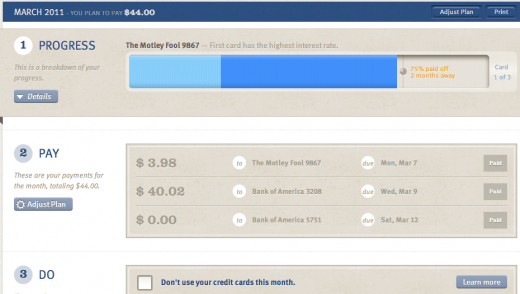

Ready for Zero wants to change all that. The Silicon Valley based startup officially launched February 2nd, 2011 and now has over 26 million dollars in people’s credit card debt in its system. Essentially, the free service is the Mint.com for people in debt. But if you’re in debt, you want to get out of it before you graduate to a tool like Mint. So, think of RFZ as Mint’s precursor. Sign up, log in and link your credit cards and checking accounts just like you would on Mint. Ready for Zero then works its software magic to provide users with handy debt counseling tools to help them get out of debt quickly and on their own.

After you’ve linked your accounts, Ready for Zero pulls your credit report (this is a soft inquiry and will not affect your credit rating). After collecting your information it offers the best options for debt management and helps keeps users up to speed with a handy progress bar. For payments, you can choose data driven or monthly payment plans. Because RFZ links to your credit cards, it can detect when you’ve made payments. If you paid below the recommended amount, it adjusts your plan accordingly or makes realtime recommendations such as, “You made an extra $100 this week, make that $50 payment on this card now.” Ebrahimi has seen people simply copy and paste RFZ recommendations into their bill pay every month.

Ready for Zero will show you how to lower your interest rates by aggregating financial data from other users and adjusting its recommendations based on that information. Their software looks at the data, picking up on discrepancies such as “Why is this person paying 15% and this person 10%?”, etc. It then lets you know, “Hey if you make it to this 3 month mark, you can lower your interest rate by 3%.”

Oftentimes, RFZ will recommend using an alternative vendor, such as Lending Club, one of its trusted partners. The FDIC regulated, completely transparent, peer-to-peer loan service is literally regular Americans lending to regular Americans. Lending Club processed 15 million in loans last month, with 60% of the loans incurring high interest debt. As a service, they’re growing exponentially and RFZ accounted for almost 10% of the growth in monthly loan originations. RFZ has saved people thousands of dollars using this model by getting them lower interest rates.

In the future, Ready for Zero will feature payment automation similar to debt management companies, but without the consequences. Existing debt management companies today will give you one payment without negotiating a lower interest rate and close all your accounts. The consequence is that closing your accounts affects your credit score. By applying software for better recommendations, the web app not only helps consumers get out of credit card debt but also helps banks prevent default. So banks and credit card companies love it too.

Ready for Zero earns a little bit of money on consolidations, just 1% of the loan origination, which barely covers their costs. As the startup scales and continues to facilitate transactions, they will likely implement a premium model for automation of payments, but the more exciting payday is on the issuer side.

When people start missing payments, issuers fast track them to collection services. Generally, you have 180 days before they can sell you to a collections company, but once you’re sold, you’re gone and the going rate is 15 cents on the dollar. So banks are losing billions of dollars on this sale. In fact, Citibank lost 4 billion last quarter by selling the debt and losing customers. Ebrahimi believes Ready for Zero can make money by becoming a consumer advocate and charging the issuer. “If we can say to a bank such as Citi, ‘Look, these people are having trouble. Let us give them another option. If we can get them back on track, give us money as opposed to selling them off and losing the customers,” explains Ebrahimi.

When people start missing payments, issuers fast track them to collection services. Generally, you have 180 days before they can sell you to a collections company, but once you’re sold, you’re gone and the going rate is 15 cents on the dollar. So banks are losing billions of dollars on this sale. In fact, Citibank lost 4 billion last quarter by selling the debt and losing customers. Ebrahimi believes Ready for Zero can make money by becoming a consumer advocate and charging the issuer. “If we can say to a bank such as Citi, ‘Look, these people are having trouble. Let us give them another option. If we can get them back on track, give us money as opposed to selling them off and losing the customers,” explains Ebrahimi.

Of the 26 million in the system, Ready for Zero has helped people consolidate $110,000 in debt this month. “Were trying to solve this as quickly as we can and we’re just three guys,” says Ebrahimi. Ready for Zero also wants to open up its platform for other kinds of debt such as student loans and mortgages.

Ready for Zero has raised $260,000 in funding from a handful of angel investors including Nils Johnson, David McClure and Steve Chen. They are aiming to raise another round very soon.

The promising web app services solely U.S. residents for now. So are you Ready for Zero?

Get the TNW newsletter

Get the most important tech news in your inbox each week.