“Something new always flows out of Africa,” said Pliny the Elder 2000 years ago. Wired, Ventureburn and PCWorld all agree.

African e-commerce is exploding, and it’s just the beginning.

In seven Subsaharan countries, e-commerce makes up one to three percent of GDP, and is predicted to make up 10 percent of total retail sales in key markets by 2025, with 40 percent annual growth over the next 10 years. The total retail economy is projected to grow rapidly, along with the population as a whole and its spending power per capita (for instance, see this KPMG report).

African e-commerce companies

Africa has a rapidly growing communications infrastructure, with broadband fiberoptic cables being deployed along the coast and 4G networks rolling out internet to the interior. The smartphone market is also growing rapidly, allowing an increasing portion of the population (which is growing and getting richer) to use those networks to their full capacity.

All of this adds up to one thing – massive economic growth for e-commerce in Africa.

But to have opportunity, you need challenges and inefficiency. Africa has those in heaps. E-commerce companies focused on Africa have been closing almost as fast as they’ve been opening. This great article in Harvard Business Review by Ekekwe pours a bucket of cold water on the sunny predictions and lists the major roadblocks to success.

Let’s start a conversation about gaps that have to be filled to realize the massive growth projections for African e-commerce, and some ways entrepreneurs and startups can fill those gaps.

Distrust and fraud

But COD causes massive problems for sellers: theft, cost of returns, which wipe out losses from successful sales, couriers returning cash late, etc.

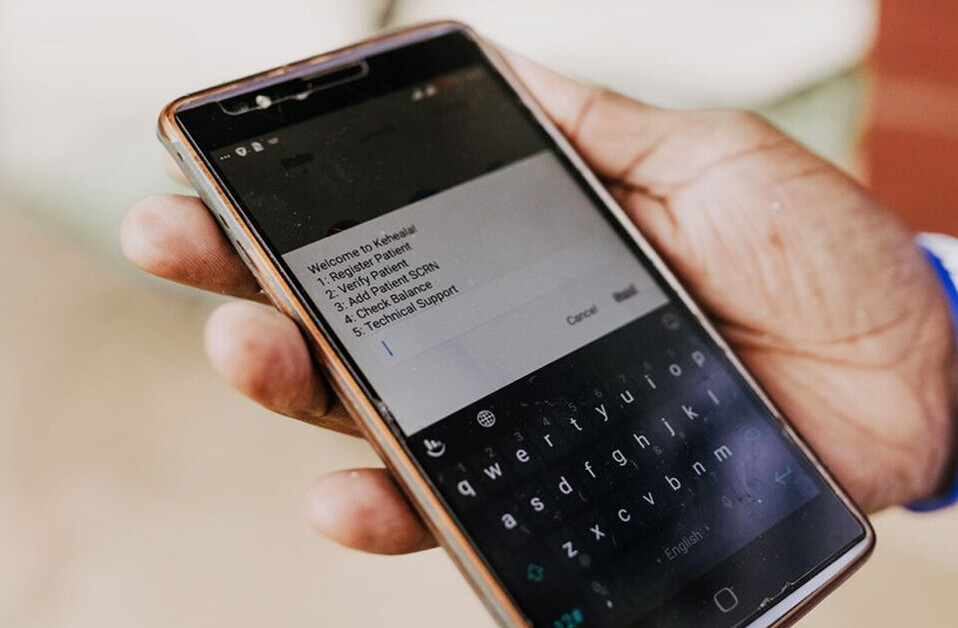

One of the emerging solutions is mobile-based e-commerce third party payments. In general, there is a huge opportunity for startups which can act as a trusted third party between buyer and seller to handle money.

Broadband cost

Political risk and instability translate into economic risk, meaning that companies have to charge a higher price to justify the riskier investment. Internet based on mobile networks is inherently more expensive than wired internet.

Cable theft is a major risk, costing just South Africa’s economy half a billion dollars per year. In this environment, internet companies will rely on more expensive wireless transmission as much as possible, and pass the costs on to the consumer.

Startups which can minimize the consumer’s bandwidth usage while allowing him full e-commerce functionality can profit tremendously from this opportunity. My startup, Bontact, has solved the contact part of the problem-site visitors who do not want to use their bandwidth for chat can start a conversation via SMS or request a callback.

Delivery

This problem is not unique to Africa – I live in Israel, and a package recently took three months to go 30 kilometers from Tel Aviv to my house – but it is more pronounced there. Businesses use motorbike delivery for the last few miles, but this is expensive and inefficient, not to mention the difficulty in scaling it to deliver packages over hundreds of miles.

Ways startups can solve this problem and capitalize on the corresponding opportunities include crowd shipping (using a social network to deliver parcels) and drone delivery networks (using fixed wing drones for medium/long range hauls and rotary-wing for delivery in cities, with a pay-on-delivery solution built in.

Competition from the gray/black market

An e-commerce business necessarily creates transaction records and accesses the banking system, which means that it must pay taxes. Its competitors in the informal, cash-based economy do not have to pay anything (except for bribes.) This makes price competition difficult.

Entrepreneurs can compete via scale (using positional advantage to buy volumes at a heavy discount), quality (offering a money-back guarantee,) or politics (lobbying the local government for tax exemptions/reductions.)

Literacy rates

Chat-based selling (as seen in China’s We Chat and Facebook Messenger’s current incarnation) can be adjusted to call-based selling. And with smartphone-based virtual reality coming online (Samsung’s S6 and Gear combination is an indicator,) literacy may soon not be needed to shop online.

The more things change, the more they remain the same. Pliny the Elder would not be surprised by Africa’s e-commerce boom. The enormous challenges reviewed above have a flip side: the entrepreneurs who handle them successfully will make a lot of money. I would not be surprised to see the first African e-commerce billion dollar acquisition within the next 10 years.

Read next: The smartphone is an information weapon: White people! Stop lecturing Africa about tech

Get the TNW newsletter

Get the most important tech news in your inbox each week.