“Bitcoin ought to be outlawed.”

Those were the ominous words of economist Joseph Stiglitz in an interview with Bloomberg last week.

He’s not the first to say it and he certainly won’t be the last.

In its short lifetime, Bitcoin managed to survive against all odds

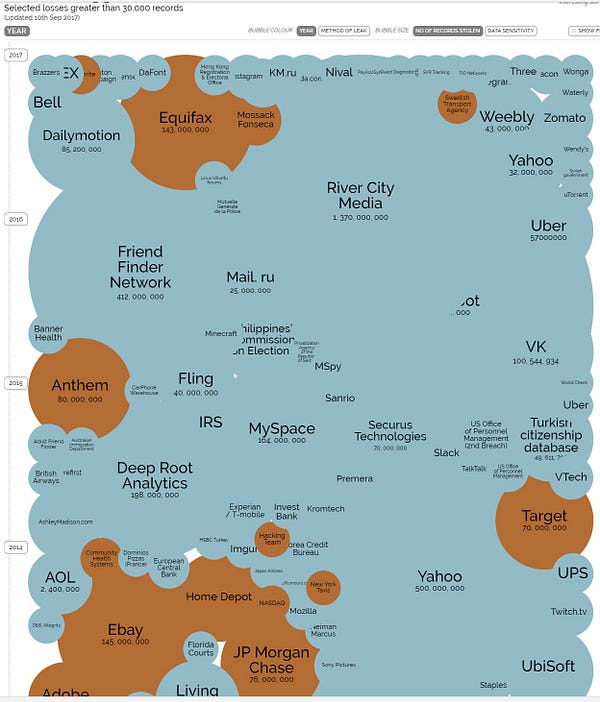

It kept grinding through the collapse of Mt Gox. It outlasted critics and doubters who declared it dead again and again and again. It outwitted an exchange and ICO ban from China. It hasn’t suffered a major security breach, even as it moves billions of dollars around the world in the blink of an eye, something almost no major company or government’s website can claim.

When you think about just how many major corporations suffered hacks, from Equifax to Sony to Apple to JP Morgan (who’s CEO laughably called Bitcoin a fraud when he can’t even protect his own systems), as well as supposedly secure government websites, from the NSA to the Department of Defense to the Army, Bitcoin’s incredible security is almost unbelievably mind-boggling.

But Bitcoin’s biggest battle is yet to come.

Governments and banks

Master investor Naval Ravikant calls governments and the old world banking elite the “final boss.”

Final boss. https://t.co/7uAi96lPPD

— Naval (@naval) November 29, 2017

For a time, the powers that be only laughed at the little currency that could. But they aren’t laughing anymore. As Bitcoin surges higher and higher, the eye of Sauron turns.

And if you think central powers can’t do major damage to crypto, think again. They wield the ultimate power:

The violence hack.

That’s power to kill you or put you in jail.

Back in October 2017, former Federal Reserve chairman Ben Bernake said: “eventually governments will take any action necessary to prevent Bitcoin.”

He wasn’t kidding. The only question is whether the distributed design of cryptos can survive the assaults to come? Only time will tell.

But the efforts to reign in the decentralized money engine have already started.

Proof of Work mining is the biggest choke point of the Bitcoin system.

It leads to heavy centralization with specialized chips. Miners process transactions around the world and mint new coins. While China has so far laid off on attacking mega-miners like Jihan Wu, Russia already set the stage for the assault: Registration.

By forcing miners to register they can keep track of them and tax them and if necessary seize their mines and take all the coins for themselves.

In a time of war, that is exactly what they’ll do, take the mines by sending in men with guns. It’s hard to pick up a few thousand ant-miners and move them somewhere else. And because they pull so much electricity they’re easy to spot.

Alternative consensus protocols can stop this attack, like Proof of Stake. But more work is needed and Proof of Stake needs to prove itself with a major coin.

Other consensus protocols will develop in the coming years, ones that don’t burn as much energy but still provide proof that a job was done in the correct way and nobody cheated.

But it’s now a race against time

Congress is looking to expand its money laundering law to target crypto by making it a crime to hide any wallets or crypto you own with Senate Bill S.1241.

It makes it illegal to conceal a digital wallet and cryptocurrency for any reason and while crossing the border.

So just declare it, right? You’re a good, law-abiding citizen. You pay your taxes including your crypto taxes. You’ve got nothing to hide.

Except the border control folks have the right to steal it from you without just cause.

In other words, they can take the money just because they feel like it and they don’t even have to tell you why.

If that sounds like legalized robbery, it’s because that’s exactly what it is

The ACLU documents thousands of cases of everyday citizens robbed of their life savings.

It’s called Civil Asset Forfeiture. And lest you think only liberal-leaning organizations see it as a problem, think again. The arch-conservative Heritage Foundation has a page dedicated to the ever growing problems with the practice.

It’s one of those rare issues where both the left and right agree. When Attorney General Jeff Sessions looked to roll back Obama era restrictions on asset forfeiture he faced an immediate backlash from both sides of the aisle.

So why do we still have state sponsored theft?

Greed.

Mostly the money is used to pad law enforcement pockets in a time when budgets are falling.

According to the Washington Post the people who are supposed to protect us stole more money from Americans in 2014, over $5 billion dollars, than all the burglars in the US combined, who only managed to nab a measly $3.5 billion.

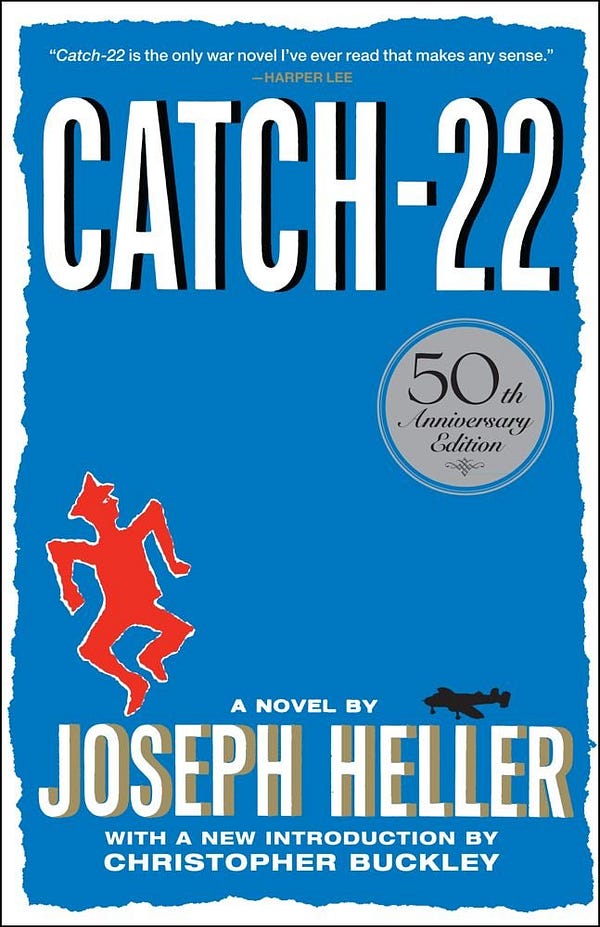

The new Senate law creates a nasty dilemma that runs headfirst into the wall of civil asset forfeiture. If you fail to tell border agents you’re carrying $10,000 or more in crypto you could spend 10 years in jail.

If you do tell them, they can take it from you, by holding you indefinitely and demanding your password, even without charging you with a crime.

It’s a living, breathing Catch-22

These are the kind of things the healthy democracies don’t do but that failing, flawed democracies with crumbling infrastructure and institutions do with impunity.

That’s why the United States crashed out of the top of the Democracy Index that lists full and thriving democracies and smashed down into the “flawed democracies” range.

The Founding Fathers are rolling in their graves.

Not for a second would they have allowed a law like that to pass unchecked. They would have tossed it in with the Intolerable Acts that lead to war with England.

The Founding Fathers wanted to protect your private property at all costs. To them property was sacred. The government couldn’t take it without a damn good reason. That’s what the 4th amendment was all about and why they created it.

“ The right of the people to be secure in their persons, houses, papers, and effects, against unreasonable searches and seizures, shall not be violated, and no warrants shall issue, but upon probable cause, supported by oath or affirmation, and particularly describing the place to be searched, and the persons or things to be seized.”

Don’t get me wrong. The Founding Fathers didn’t want criminals and terrorists keeping their profits, and I sure as hell don’t either. But they wanted due process, rule of law, proof, and convictions.

They didn’t want us turning into some banana republic, with arbitrary search and seizure and crooked cops ripping people off like they’re Mexican cops rolling tourists for cash at a traffic stop.

They did this because they lived in an authoritarian state. They knew exactly what it meant. The English government could force you to put a soldier up in your house and foot the bill.

They sometimes charged people in secret courts, called Star Chambers with no possibility of appeal.

The Constitution was specifically designed to halt these abuses but today they’re running rampant because the people alive now have never lived in anything but a free society and don’t know what it means to not live in one.

They might want to study the history of the countries at the bottom of the Democracy Index because bad laws are a slippery slope that can slide a country right to the bottom of the list almost overnight.

Check out Venezuela where they went from thriving democracy to utter collapse. Take a look at Zimbabwe, which suffered insane levels of hyperinflation, or any of the cutthroat political regimes of central Africa like Rwanda. Rwanda didn’t just suffer a genocide in 1994, they’ve been suffering them for a hundred years as one ousted group regains power and takes revenge on the other side yet again.

These laws are only the beginning. More will follow.

Yet all hope is not lost

Some countries, like Japan and Switzerland, have already taken an enlightened approach to crypto.

They see cryptos as a game-changing technology that will help create more wealth and prosperity than any other technology in the history of the world. Smart countries are embracing it with open arms.

Other countries should learn from these smart countries.

But less enlightened regimes are taking a dark view of cryptos, particularly the ones that worship power and control at all costs.

Vietnam has already banned crypto. Indonesia did the same, despite the fact that their money is essentially worthless and most of their population is completely unbanked.

None of these efforts will work in the long run.

The decentralized nature of cryptos make them hard to completely stamp out but central powers can do serious damage to them in the short run and create a lot of pain and suffering for regular people, while utterly failing to stop the bad guys.

Cryptos are not going away.

Every day more and more traditional powers join the crypto party. The CME Group starts trading Bitcoin futures in a few weeks. The CBOE beat them to it and starts trading on the 10th.

The more money that floods into them, the more incentive they have to protect them.

Cboe Futures Exchange plans to offer trading in bitcoin futures beginning at 5 p.m. CT on Dec. 10 at the start of Global Trading Hours. See the press release, https://t.co/dNPUXcZgzv #bitcoin $XBT pic.twitter.com/ciexv3OVoI

— Cboe (@CBOE) December 4, 2017

And a worldwide ban is never happening.

In today’s fractured society, there’s almost zero chance that all the countries in the world will agree on anything. Some countries will oppose a ban just to spite their rivals or because they see it as a way to get around global sanctions.

That means there will always be nodes running somewhere in the world to process transactions.

Crypto is changing with the new threats, morphing, and shifting.

Anonymity technology is surging in popularity with privacy-focused coins like Zcash and Monero leading the charge.

If governments push too hard, they’ll only make it harder and harder to get a better handle on their uses for illicit purposes.

Better to embrace them openly and bring them into the light. Make them mainstream. Let people buy kittens and Snickers and books on Amazon!

Cryptocurrencies are incredibly resilient, world-changing technologies. They’re unlike any other asset class that has ever existed. For all the doubters who try to pigeonhole them as digital gold, they’re really missing the boat.

They’re programmable money.

You can’t program a dollar to self-escrow in a smart contract that pays out every month. But you can do that with Ethereum.

They’re also a path to self-sovereignty and control of the money you earned.

A refugee fleeing a war-torn country can simply delete their wallet, memorize its special phrase and recreate it once they get to a safe haven. No more will ruthless regimes rob the poorest people of everything they have as they’re fleeing the battles of psychopathic monsters.

Cryptos can and will change the world for the better

But to get there they’ll have to face the final boss, a relentless one that will do anything to keep control of the money supply. Never forget that money is power. And nobody gives up power without a fight.

The war on crypto is coming like a dark storm.

Governments will sell it with the same tired old song, as a way to stop criminals and terrorists.

But it’s never really about that.

It’s about control.

It’s about whether they can take your money just because they feel like it.

Cryptos have central powers scared.

All the people who benefited from the collateralized debt obligations while you lost your house got away with their crimes.

They didn’t just get away with it, you helped bail them out. You gave retirement packages to the biggest perpetrators who are now living in even bigger mansions and laughing.

Of course, it’s always the short-sighted and the wicked who try to stop new technology to make sure they maintain their own position at all costs.

It’s just that this time it won’t work.

Countries that stand against the blockchain will find that it blows back on them and punishes them severely, while the rest of the world roars past.

They won’t get to play in the new sandbox. They’ll watch as other economies leave them in the dust, armed with brand new financial technology that makes the snail speed of current fintech worthless.

And the people who robbed the world of its wealth and the dictators who crashed their economies and lived in palaces while their people starved will pay a terrible price.

The world won’t miss any of them.

This story is republished from Hacker Noon: how hackers start their afternoons. Like them on Facebook here and follow them down here:

Get the TNW newsletter

Get the most important tech news in your inbox each week.