Shared mobility must reinvent itself somewhat to adapt to the coming challenges resulting from COVID-19. Operators, software developers, vehicle manufacturers, and public services will all need to be creative in order to find ways to deal with a wide range of social/technical/business issues created or exacerbated by the pandemic.

In this article (in 6 parts), we will explore a few ideas on how to build resilient shared mobility solutions for the near future.

1. Safety & hygiene: reconnect with riders

Hygiene is perhaps the most significant psychological barrier to shared mobility usage in this era of COVID-19. While scooters, bikes, and mopeds all have the built-in feature of social distancing, due to their one-at-a-time ridership, shared usage makes it vital to address the issue of disinfection of contact points.

In the upcoming battle to regain market share, those operators who can convince users that their vehicles are the safest will have a significant advantage over those who might not have the resources to do so.

Different measures can be taken to make the risk more manageable, some of which are outlined below.

Upgrade the hardware: The use of self-cleaning materials to cover the vehicles’ contact points can reduce viral transmission. American operator Wheels has already partnered with NanoSeptic to cover grips and brake levers with this kind of product. Doing so reduces the need for thorough cleaning between riders. Another option is the installation of hand sanitizer and/or disposable glove dispensers, though this may be more complex and less secure, given the potential for theft.

[Read: 3 possible scenarios for restoring public transport after COVID-19]

Adapt operations procedures: If resources are available, operators must optimize the frequency of cleaning and sanitizing their equipment. This might be tricky, though; during this period of decreased ridership (and accordingly diminished staff), French operators Dott and Pony have each confirmed that disinfecting vehicles every eight to ten rides is the best they can do for now.

Improve user behavior: While some operators might not be able to increase their cleaning and disinfection frequency, they can develop innovative marketing campaign solutions to improve users’ hygiene practices through education and reminders.

2. Communication: set the right tone

Shared mobility operators should adapt their marketing and communication to reflect the very specific circumstances brought on by COVID-19. For at least a couple of months after lockdown ends, operators’ usual messages of “fun” and “freedom” will sound out of touch, even anachronistic. Various companies’ announcements of service suspension already display a clear change of pace, with messages focused on health and responsibility.

Operators will need to find the right language to attract new riders who are more fearful of the risk of infection on public transportation (buses, metros, tramways, etc.). These potential users will likely be more receptive to reliability and safety arguments in considering shared scooters, bikes, or mopeds as options for their commutes.

However, operators should not completely give up on their core values; they must find a way to communicate the pleasure of freedom of movement in a way that still feels appropriate and cognizant of the current times.

This might also be a good time for shared mobility companies to use their messaging to assert their good standing in the market. During the lockdown, many operators who chose to keep their services running highlighted their commitment to serve a community and its residents, turning their offerings into reliable and essential transportation options.

3. Strategy: focus on the locals

While lockdown measures will soon slowly ease up in most countries, national and regional borders will likely remain closed, effectively pausing tourism for an unknown period of time. As a consequence, shared mobility services will, at least for now, solely serve locals.

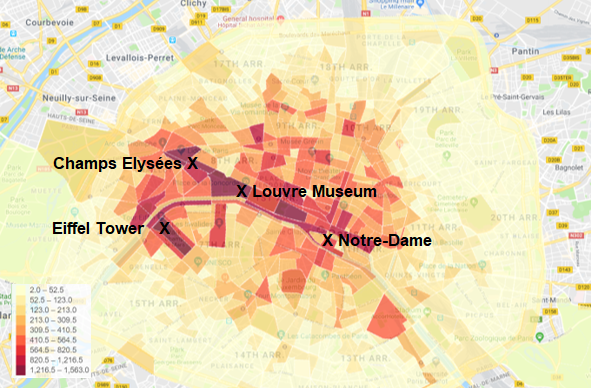

This is a major paradigm shift for some operators who had been heavily reliant on revenues generated by tourists. In Paris for example, tourists account for 40% of all scooter rides, and this number increases to as high as 70% in the months of July and August. Services like shared mopeds are much less impacted by the decrease in tourism, as they have always been used primarily for professional and personal trips on weekdays.

Operators impacted by the reduction in tourism will have to completely reevaluate the way they manage their vehicle fleets. Taking again the example of Paris, it would make little sense to continue to place as many scooters near the Eiffel Tower and the Louvre Museum.

Operators will need to pay close attention to flows of people going to and from train/metro/tram stations and to analyze the best ways to deploy their fleets accordingly. This is a considerable challenge, as flows associated with commuting between home and work are often unbalanced, and can lead to an accumulation of vehicles in the same zones at the same time. This will also highlight the need for licenses and service caps to ensure fair coverage of the city and avoid oversupply in its most profitable areas.

A shift from tourists to local users also means a shift from casual users to regulars, and operators will have to adapt their pricing schemes, most of which are currently not tailored to regular usage. The COVID-19 crisis initiated a change in the business model for some operators, who now offer long-term rentals for shared scooters or bikes. Membership benefits or offers were often previously limited to cheaper prepaid credits or waived unlocking fees. But we will likely now see offers of monthly subscriptions to maintain a low cost per ride for all the new regular users.

These changes will have a significant impact on shared mobility operators, and it’s likely that some businesses won’t survive the upheaval. It might be helpful to see this as a necessary period of maturation for an industry essential to the daily life of millions of citizens.

4. Business: experiment with additional revenue sources

The current lockdown period has forced shared mobility operators to experiment with a variety of different commercial offerings. Already barely profitable before the pandemic hit, they’ve now been pushed to find innovative sources of revenue.

Companies such as Voi, Dott, and Gotcha have launched B2B partnerships, offering up their fleets to ferry goods to those sheltering in place around the world. Despite their limited capacity to carry cargo, these vehicles have been useful in the delivery of, among other things, pharmaceutical products, groceries, and takeout. This is a risky experiment for these companies, however: as operators are offering access to their vehicles at a discount in these partnerships, their margins will get even thinner.

Another option for companies is to pivot to the offer of longer-term rentals (daily, monthly, etc.), which would allow them to eliminate the time-consuming disinfection between riders required under their normal model, and would still ensure good rates of vehicle usage. Despite potential advantages, this option is still very much in the beta testing phase, as evidenced by the major price discrepancies among the monthly rental offers from Pony (US $43), Spin (US $60) and Wheels (US $89). These might serve as good “try before you buy” options for riders; both Wheels and Pony (through its Adopt-A-Pony program) are now also selling their vehicles directly to consumers.

As regular commuting will represent a greater share of ridership as lockdowns ease up, operators can work directly with companies keen on offering their employees alternatives for getting to the office. Launching B2B offers is another effective way to attract new riders, as their employers would subsidize subscriptions or ride credits. In Paris, Velib and Cityscoot have released “Pro” offers in anticipation of the end of the confinement period; Voi and Tier had already had these sorts of offers available, though their conditions were not publicly disclosed.

5. Operations: cooperation over competition?

Pre-COVID19, shared mobility operators worked primarily in their own interests, competing for markets; however, the crisis will likely serve as a catalyst to the ongoing market transformation from fully private to public-private partnerships. Operators will be able to start working hand-in-hand with one another through collaborations secured with cities via RFP processes.

As operators work to improve their unit economics, pooling resources and operations might offer significant help. Last December, in the French city of Lyon, Bird, Dott, Lime and Voi launched a first-of-its-kind cooperative parking management team. The group is managed by a third party, and could easily widen its purview to include balancing, for example.

During the lockdown, vehicle disinfection became a major challenge generating extra costs for operators (see Section 1). Putting in place a dedicated team to disinfect any and all shared vehicle grips and brake levers, no matter the vehicle’s brand, could significantly ease operators’ logistical and financial burden, allowing them to focus on doing what they do best: maintenance and balancing.

Developing the shared mobility industry is also about building the future. In order to have real bargaining power, operators must unite and speak with one voice. CoMoUK in the UK and NABSA in North America are non-profit organizations lobbying for shared mobility-friendly laws, and improving community knowledge through conferences and resource libraries. In Spain, 17 operators have joined together to create Smart Mobility, an organization that works to ensure high socio-environmental standards and facilitates the local collaboration of shared mobility operators across the country.

Developing a common vision of the meaning of shared mobility is integral to its adoption by governments and citizens around the world.

6. Public Affairs: strengthen government partnerships

Experience has shown that operators working hand-in-hand with national and local authorities is the most effective way to integrate their services with existing transport infrastructure and to best adapt to cities’ individual needs. This kind of cooperation is a clear path to building sustainable services.

The COVID-19 pandemic brought this home, as citizens and companies alike were reminded of just how much power rests in the hands of governments; they used their authority to determine whether or not shared mobility services would be considered essential during the period of lockdown. Cultivating strong relationships with the public sector is, therefore, more crucial than ever.

The current crisis also reshuffled the cards of shared mobility financing, as many venture capital firms (previously the main source of funding in the sector) froze their investments during this period of market uncertainty. Money could potentially now come from a new partner: cities themselves. Local authorities had already been keen to include shared mobility services in their transportation offers, and will now need them more than ever in order to compensate for the decreased ridership permitted on public transit.

Shifting from imposing fees to subsidizing free-floating operators (public-private partnership) is a natural next step for authorities, following the introduction of RFPs to regulate the market. With dock-based bike-shares, cities are able to impose SLAs and monitor their operation to ensure quality and fairness of use. Implementing this model more broadly would also ensure that both industry and government are working together in the longer term to offer the best service possible for users. Public transit, from trains to bike-shares, is already largely subsidized, so why not extend this to free-floating transportation?

The Urban Mobility Daily is the content site of the Urban Mobility Company, a Paris-based company which is moving the business of mobility forward through physical and virtual events and services. Join their community of 10K+ global mobility professionals by signing up for the Urban Mobility Weekly newsletter. Read the original article here and follow them on Linkedin and Twitter.

This article was written by Alexandre Gauquelin, Founder of Shared Micromobility and Julien Chamussy, Co-founder & Vice President of Marketing at fluctuo.

Get the TNW newsletter

Get the most important tech news in your inbox each week.