We’re exposed to risk every day. From crossing the road to using our phones on the toilet. Every decision is a gamble and, subconsciously or consciously, we weigh up the likelihood of something going wrong.

The insurance industry is built on this principle. Policies offer protection in the event the odds aren’t in your favor. The trick is, insurers need to be able to protect their customers while making sure they’re on the right side of the risks they’re writing.

The field of actuarial science is devoted to this cause. Actuaries use mathematical formulas based on historical trends to model events of uncertainty. This gives insurers an idea of the likelihood of a certain event taking place.

But what about when there’s no historical data to base these assumptions on? Have you ever thought about what it takes to insure a pilotless chunk of metal hurtling through the air at 100mph? How about a robot designed to put out fires in an Amazon warehouse?

Understanding emerging risks

Scientific and technological developments are constantly changing the way we live our lives. From asking Siri to turn on your Philip’s Hue, to ordering an Uber or Deliveroo. 10 years ago, that last sentence would have made no sense at all.

All of this new technology is introducing new risks into the world we live in. In the insurance industry, they’re known as ‘emerging risks.’ They’re Donald Rumsfeld’s ‘unknown unknowns,’ or risks we didn’t even know existed. So what kind of risks are we talking about?

Cyber

Our increasingly connected world is creating new opportunities for criminals to exploit technology around us. For the last decade, Hackers have targeted individuals with blackmail scams, global companies like Sony have been held to ransom, and power plants have been taken offline.

And it’s only going to get worse. As every case is different and nuanced, issuing a single ‘cyber’ protection policy is almost asking for trouble. Instead, risks must be constantly monitored and any intrusion nipped in the bud before it becomes an issue.

In the current climate where everyone is working from home, there are suddenly thousands more attack vectors for bad actors to exploit. It’s likely this has invalidated many of the static cyber policies companies had in place previously.

Drones

This one is close to my heart as it’s an area we’ve pioneered at Flock. The new risks introduced by commercial drone operators like Skyports delivering medical supplies in busy cities, or Nordic Unmanned monitoring emissions in global shipping lanes, are currently only truly understood by a select few.

As we start to see drones more closely integrated with existing air traffic management systems, insurance will become a requirement globally in the same way it is for planes. Both NATS and the Civil Aviation Authority are doing amazing work in this space, but there’s much more to be done before any of us will be getting a fully insured air taxi from the airport to the city center.

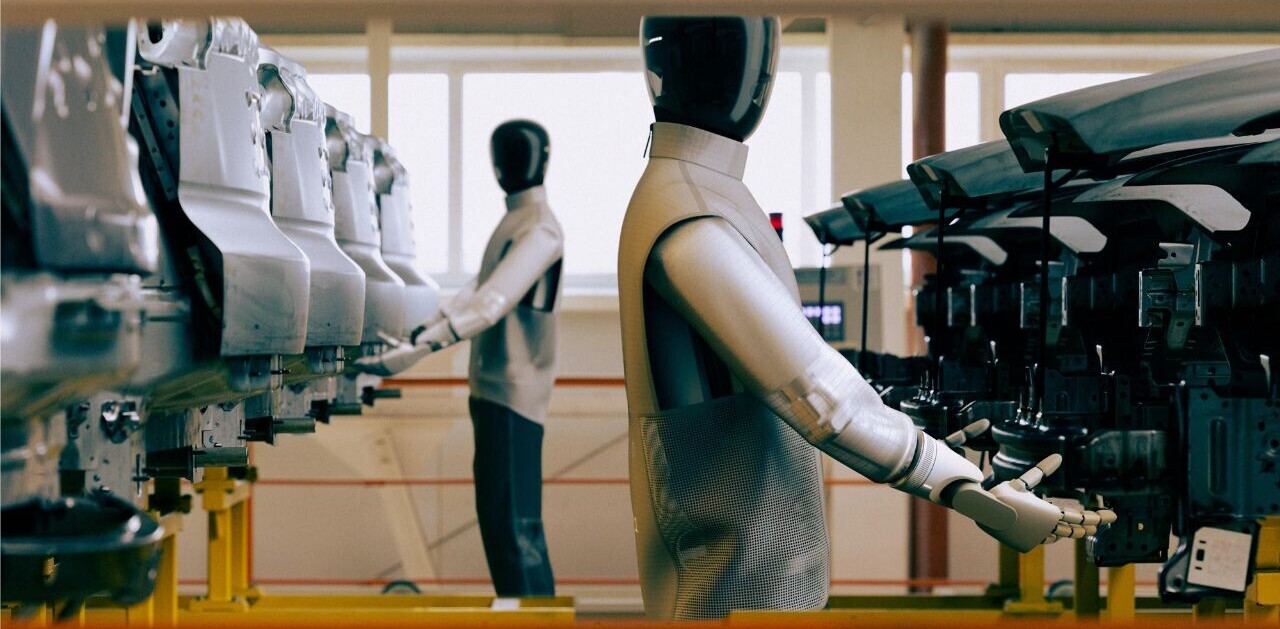

Robots

What kind of insurance policy do you need to let one of the robots from Boston Dynamics tow your car? What about one of the incredible autonomous warehouse robots produced by Gideon Brothers?

Ground robots are coming and hopefully with the right insurance for when things go wrong. Currently even finding a specialist robot insurance policy can be tough and if you can, it’s likely to be an expensive one-size-fits-all policy that isn’t economical for every use case.

Autonomous cars

I’m sure you’re all familiar with the classic trolley problem by now: if there’s a runaway train hurtling down the tracks about to hit five people, is it ethical to pull a lever to divert that train so it hits two people on another track? Who do you save?

This same thought experiment is often posed when we talk about a future where autonomous cars rule our roads. Or to be more specific, a future where humans and autonomous vehicles share the road.

It is this meeting of man and machine where the real risks lie. Our stupid, unpredictable, emotional humanity is very hard to preprogram against. So how can insurers truly calculate the risk of a collision in this brave new world we’ll soon be a part of?

Tesla has already started exploring the insurance space and I’d love to hear from Elon Musk on how he’s managed to make it 20% cheaper while still taking into account a whole host of new risks.

The sharing economy

This isn’t one piece of technology but a concept insurers never imagined. We’re now sharing cars, scooters, apartments, and even appliances with each other at the click of a button.

In the sharing economy, our insurance requirements are directly linked to the state of an asset. An unused Lime scooter isn’t exposed to the same level of risk as when it’s being used to zoom down a high street. In the same way, if an Uber driver is carrying a passenger, his car insurance needs are different to when he’s driving to the supermarket or, if you’re renting out your guitar on Fat Llama, you’re a lot more likely to want it insured when it’s in a stranger’s possession than when it’s just sat in your room.

The changing states of our assets pose a whole new challenge for insurers of the past.

Insurance connected

So how is the world of actuarial science keeping up with all these new risks? With the help of even more technology of course!

Instead of relying on historical data, insurers have to tap into the vast quantities of data that each of these technologies is producing every minute of every day. As an example, Flock’s risk intelligence engine uses a ton of different data sources like real-time weather, building density, and operating temperatures to truly understand the risk associated with drone flights. It’s this data-driven approach that allows us to fairly price everything our customers do, from crop spraying agricultural drones to flying taxi services.

You only need to look at some of the other companies that have gone through the Lloyd’s Lab program to see data is a common theme. From finding new ways to tackle old risks, like Floodflash using IoT sensors to detect flooding, to helping others understand risks that haven’t even happened, like Oasis’ open-source catastrophe modeling software.

This is part of a bigger trend in the insurance industry, and one I’m really excited about. Imagine if your insurance company could prevent you from having any accidents in the first place?

2020: The decade of the risk partner

In the future, we won’t be looking for an insurance broker to cover our equipment, we’ll want a risk partner to help us protect it. A risk partner that understands how we operate and helps us make better decisions to minimize risk.

If you think about it, it’s in everybody’s best interest to reduce incidents — companies pay less in premiums and insurers receive fewer claims. There’s so much data and computing power out there that it’s entirely possible. But as usual, it’s fear that holds us back — fear of what rummaging through our digital footprint might tell our insurer about us. Data security must always be taken seriously, but as long as we stay in control of our data, we shouldn’t always be afraid to share it. Responsible data usage is the way of the future.

Instead of being scared of what insurers might make of our data, transparency will open the door for huge innovation, just as we’ve seen through the Open Banking initiative in the fintech space where companies like Monzo, Transferwise, and GoCardless have managed to do incredible things.

These changes won’t happen overnight but the sooner we accept our insurer can help us not hinder us, the sooner the industry can transform itself from a boring afterthought into an essential part of our everyday lives.

Get the TNW newsletter

Get the most important tech news in your inbox each week.