Editor’s note: This is a guest post by Juan Pablo Cappello, an investor in more than twenty early stage companies. He will be discussing the issues raised in this article at The Next Web Conference Latin America later this month. Tickets are available now.

Having invested in some 20 Latin American focused companies since the dawn of the Web 2.0 in the late 2000’s, I am fairly certain that I am about to lose over $1 million, and perhaps more. And the truth is I probably deserve to lose this money.

I deserve to lose this money not because I am a bad guy, a reckless investor, an unhelpful mentor or inactive board member. I, like most active angels and early stage investors in Latin America, made a bet a few years ago that is turning out terribly wrong.

The bet we made

The bet we made was simple. We thought we could bring Silicon Valley to Latin America and the Silicon Valley playbook of funding companies built to need more and more capital to Latin America.

This seemed like a reasonable strategy since in LatAm over the past 100 years most of the fortunes have been made and remade using a simple formula. You build a company and sell it to international investors when your local market gets “hot”.

Whether as angel investors, accelerators or early stage VC funds, we each saw Playdom/Disney, Groupon and a couple of other multinationals acquiring early stage companies in Latin America. We assumed, we thought quite rationally, that these international companies were the first of many companies with global ambitions that would come to LatAm in search of companies to acquire.

We even “tropicalized” our expectations. In Silicon Valley the “sweet spot” for an exit is between $25-250 million. We figured that in LatAm that sweet spot for an acquisition might be more like $10-35 million, which is still pretty sweet if you are investing in early stage valuations below $2 million.

And thus the Web 2.0 revolution in Latin America started. Angel investors like me began opening up our wallets. Accelerators began springing up around the region. Government actors like Start-up Chile, City of Buenos Aires and Innpulsa (Colombia) began supporting start-ups with cash and office space. The more institutional venture capital money like Sequoia, Redpoint eVenture, Tiger Global, Kaszek Ventrues began to arrive to or to focus on Brazil, while looking for investments throughout the region. It was awesome. It was a great party.

We are waking up three or four years later with one dozy of a hangover. The early stage ecosystem in Latin America is sliding into a crisis.

Lack of exits

Simply put you cannot have an ecosystem where money keeps going in and no money is coming out. The steady stream of strategic exits needed to support the level of early stage investing simply has not happened. The reality is while big successes are great, it is the small to medium exits that are needed to encourage more and more investing.

We are seeing excellent accelerators that have invested in over 75 companies that have had one small exit. We seeing some the most active early stage investors with portfolios of 200+ companies, rethinking their early stage strategies. Some of the later stage VC funds are quietly “shifting their focus away from Latin America”. We are seeing a generation of Zombie companies.

Most discouraging for me, we are witnessing spectacular failures-for instance, I am an investor in a B2B company that recently failed having burned through its $350,000 of seed financing with exactly zero revenues and zero contracts signed. That is about as spectacular as a failure can be.

The honest reason that the exits haven’t happened is simple. We failed to build companies that are compelling enough to spark the interest of multinational companies.

In short, capitalism is working. We deserve to lose a lot of our money.

Why we went wrong: The artist vs. the baker

The reason we went wrong is that rather than focus on passion and creativity, we – the investors and the entrepreneurs alike –began to focus on the payday.

We lost sight that our goal needed to be to create great, sustainable companies that solve problems for our local consumers. Rather than focus on entrepreneurs bent on disruptive innovation, the reality is our focus has all too often been looking for a quick flip or finding an investor to fund more of company’s losses.

We forgot that a real entrepreneur is much more like an artist than a baker.

A baker gets up early in the morning, works hard, puts together the right ingredients and makes bread. Most bread is not art. A baker doesn’t need inspiration. A baker needs to put the right ingredients, together in the right way to bake his bread.

An artist is very different. An artist tries to see past how things are into how things could be. An artist is going to make his art at all costs, because he is consumed by his vision.

In Silicon Valley the whole community is interested in supporting the “artist’ and not the “baker”. We have been investing in too many bakers in Latin America. This is why our companies are not inspiring. That is why we are not seeing the exits.

Why Silicon Valley is not our answer

I admire Silicon Valley. Mainly because Silicon Valley is a whole ecosystem based on near total failure.

Before we set the goal to replicate Silicon Valley in Latin America (and start assigning cute names like “Chilicon Valley” or “Rio’s Silicon Beach”), let’s keep just two key statistics in mind. VC returns haven’t beaten the public market for most of the past decade, and the industry hasn’t as a whole had a positive year (returned the cash invested) since 1997. Not only the investors/experts aren’t showing good returns in Silicon Valley, the vast majority of the entrepreneurs that raise money there also end up failing. More than 75% of companies that raise Series A capital (generally raise over $1 million from an institutional investor) end up failing.

In the face of all this failure what makes Silicon Valley great? Why does Silicon Valley inspire us? Because the successes in Silicon Valley are tremendous. Because true innovation occurs in the Valley. And true innovation and disruption change all of our lives, much the way art changes our lives and inspires us.

It is hard to imagine that in Latin America we are going to be willing to accept a failure rate anywhere near the failure rate of Silicon Valley, particularly since we will never have the mega, tens of billions successes like Facebook, LikedIn, Twitter, Google, Microsoft to point to, and to skew the returns of some lucky (or insightful) early stage investors.

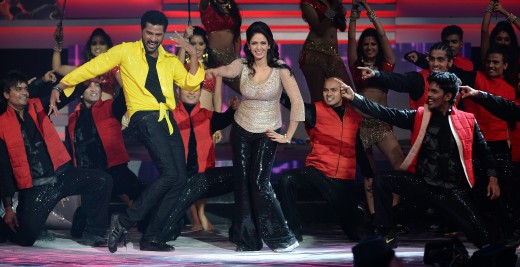

Bollywood as a model

Rather than try to replicate Silicon Valley, I suggest we try to create our own Bollywood. Bollywood, a synonym for the film industry in Mumbai (India), is a parallel film industry in India.

Bollywood is not an attempt to copy “Hollywood” in India. Bollywood is a film industry inspired by Hollywood, that takes many cues from Hollywood, but that is totally adapted to the 1+ billion Indian market. Films cost less to make (on average $1.5 million vs. $47.7 million in Hollywood). The studio system, where actors are on contract, is the norm. The films often are musicals with fanciful plots that appeal to the Indian audience, but would never appeal to a wide Western audience.

The results speak for themselves. Bollywood movies sell more 3.6 billion movie theater tickets a year. Hollywood movies sell 2.6 billion tickets a year worldwide. While Hollywood movies generate about 35 times the revenues as Bollywood movies, Bollywood is a thriving and a profitable film industry on its own terms.

In Latin America we can create our own “Bollywood” for venture capital. We need to forget about how things are done in Silicon Valley and create our own “TechnoLatino”. Our TechnoLatino should have an “air” of Silicon Valley while being uniquely Latin American.

First, the accelerators and government start up programs need to stop funding “clones”. A clone is any project whose elevators pitch begins with “We are the XXXX for Latin America” (for XXXX you can fill in whatever successful Silicon Valley company you like be it Opentable, Uber, Groupon, Twitter, Amazon, Kickstarter, whoever.

Clones that appropriately tropicalize proven tech business models and bring them to Latin America are great. Clones require great execution, rather than great inspiration. Clones require “bakers”, rather then an “artist”. Clones are best created by “company builders” – funds that specialize in the “industrial production” of companies.

There are company builders that have literally built 200+ companies who are experts in executing or cloning business models. In Latin America we are seeing the emergence of some interesting company builders. The development of “clones” is best left to those specialists (disclosure: I an an investor in a company builder that operated in Latin America).

Accelerators and other start-up programs need to focus on real innovation–focus on finding the artists. It is only real innovation that will support that big returns/valuation that will justify their efforts.

Second, we have to start creating companies that could be attractive acquisition targets for the local economic groups that dominate our economies.

Throughout Latin America there are very few truly public companies. Virtually every company is dominated or controlled by a family/economic group. Many of these groups have stood on sidelines, watching with bewilderment as money has been thrown at startups in the past few years. We need to start to realize that the best and most likely alternatives for exits of our companies are those local economic groups. We need to engage those economic actors. Our companies need to begin to solve the problems and offer solutions to those groups.

Third, the angel investors have to change the funding model. We cannot try to apply the Silicon Valley playbook for funding-which often is “spray and pray”. Angel investors like myself in the Latin America regularly supported seed capital rounds of between $250-750,000 for start-ups and near start-ups. This was really, really stupid.

We need to start offering entrepreneurs much smaller amounts of initial capital. Less is sometimes more. Less initial capital imposes disciple and promotes a lean launch. Too much money often encourages building too much infrastructure, too soon before you know your customer and what he wants. For instance I co founded a company where we raised $750,000+ in initial seed capital. We launched on day one in three countries. It has taken us two (2) years and three (3) CEOs to really learn what our customers’ needs are. We would have been better offer having much less money, starting small, while we figured out our business.

Also, have you ever seen a start-up raise $500,000 and not end up with a $30,000 a monthly burn?

An initial seed round of $100,000 should be enough for most companies. $100,000 is a lot of money–almost an unimaginable amount of money in LatAm where middle class people live on $1,000 a month. The reality is most of our tech-based companies should be able to reach breakeven with $100,000, if they have a business model that makes sense.

As part of our initial $100,000 financing, we, the angel investors, can offer a commitment to inject an additional $150,000 of more growth capital, if the company proves its business model (or modifies its business model enough times until it stumbles into the right formula).

My last suggestion is simple. Can we please stop organizing the demo days/start up tours to Silicon Valley? In Spanish we say “delirio de grandeza” (“delusions of grandeur”). While a start-up day that brings together a selection of the best companies from the whole region will attract interest, investors in Silicon Valley are not waiting to receive an email that yet another group early stage companies from any one Latin American country or city is coming to town.

If the goal of these trips is entrepre-tourism, then these trips are a great success. The Latin entrepreneurs get a perfunctory tour of Facebook’s office and to meet a recent hire from Google’s meet and greet squad. All too often on these start-up tours, Silicon Valley becomes like an Epcot for visiting entrepreneurs.

However, if the goal of these trips is to stir interest from investors, they are generally abject failures. Even in Miami, which is much more interested and connected with Latin America, demo days showcasing companies from one country or one city fail to generate much interest.

————–

When I first rode the subway in New York City by myself, my mother only gave my one piece of advice. “If you realize you are heading in the wrong direction, you need to get off that train and get on a train that is heading in the direction towards where you want to go.” It is time that we in the VC ecosystem in Latin America get on a different train and head in a different direction.

Old timers like me waited almost 10 years from the year 2000’s tech debacle for there to be a reasonable flow of venture capital activity in the LatAm region. We have a unique, once in a generation opportunity to create some incredible companies and create a sustainable tech/innovation ecosystem.

In Latin America we need to forget about trying to copy or depend on Silicon Valley. We need to create our own TechnoLatino ecosystem, inspired by Silicon Valley, but uniquely our own.

Now, would someone please pass me the “Salsa”?

Tickets for The Next Web Conference Latin America are available now.

Image credits: Thinkstock, INDRANIL MUKHERJEE/AFP/Getty Images

Get the TNW newsletter

Get the most important tech news in your inbox each week.