Famed investor Warren Buffett sold at least $800 million worth of Apple stock last quarter, BusinessInsider reports citing SEC filings published last Friday.

The Buffett-led Berkshire Hathaway unloaded 3.7 million shares between October and December last year, when Apple’s share price rose by more than 30% (from $219 to $294).

Despite selling off 3.7 million shares, Apple persists as a Berkshire Hathaway favorite. It owns around $72 billion worth of Apple shares — 5.6% of the computing giant.

[READ: Apple, Facebook, and Warren Buffett: Here’s the top 25 stocks for millennials]

As Apple still represents more than 32% of Berkshire Hathaway’s overall portfolio, one simple explanation for the move is diversification.

The firm recently made notable investments in grocery chain Kroger and biotech firm Biogen, both US companies.

Apple shares have soared since Hathaway started buying

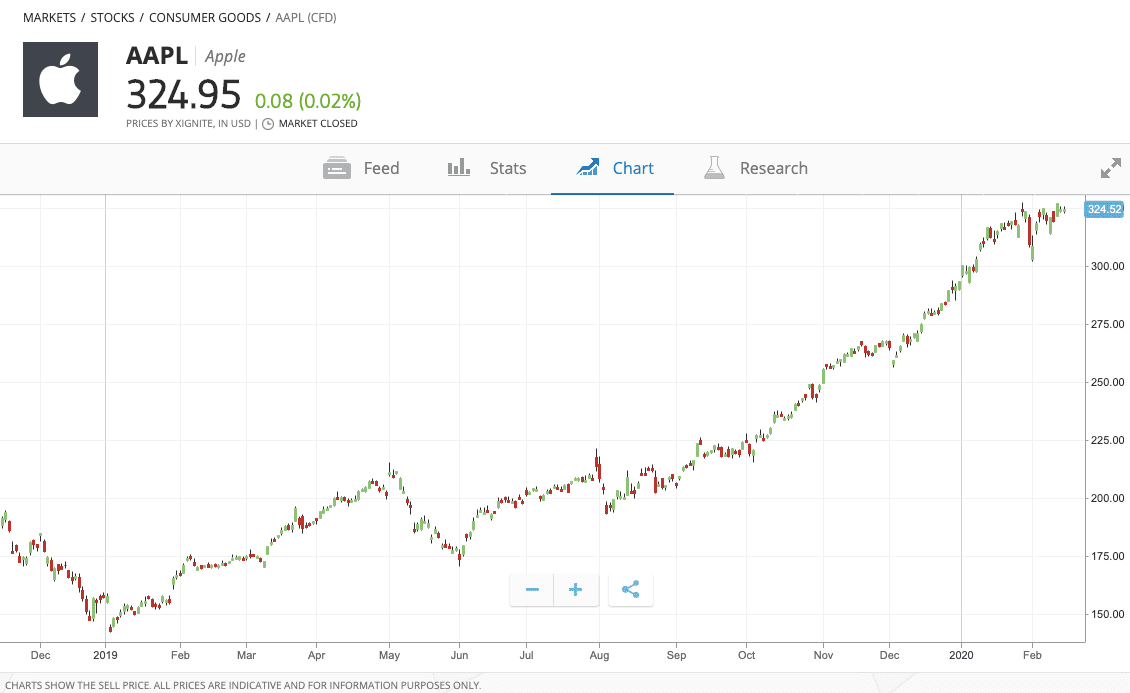

Berkshire Hathaway didn’t exactly get into Apple at the ground floor. Typically averse to tech stocks, Berkshire Hathaway only announced it had bought into the Cupertino-based company in 2016, when Buffett spent a cool $1 billion on 9.8 million Apple shares in the year’s first quarter. They were valued at around $100 at the time.

In fact, Apple was the second tech stock Berkshire Hathaway had ever purchased — the first was IBM. Buffett explained having shied away from the creator of the iPod in 2012, commenting “the chances of being way wrong in IBM are probably less, at least for us, than the chances of being way wrong in Google or Apple […] I just don’t know how to value them.”

Apple CEO Tim Cook later used Buffett’s change of heart to posit that Apple had transitioned from a tech company to a consumer products company.

By the end of 2018, Berkshire Hathaway had sold all of its IBM stock. Buffett would go on to purchase around $35 billion worth of Apple stock between 2016 and 2018, with Berkshire Hathaway sitting on more than 250 million shares in total. This represents Buffett’s largest investment in one company.

Bill Gates trusts Buffett to handle his charity’s investments

It’s a position that has undoubtedly paid off, with Apple’s share price rising more than 300% since 2016 to reach $324 at pixel time.

Holding Apple stock generates dividends; it’s estimated that Berkshire Hathaway’s dividend revenue from Apple is $784 million per year, and if Buffett sold all his holdings tomorrow he’d earn a cool $30 billion.

Ironically, Hard Fork reported last month that Microsoft founder and long-time Buffett buddy Bill Gates holds a significant chunk of Apple, too (kinda).

The Bill & Melinda Gates Foundation Trust actually controls $12.5 billion worth of Berkshire Hathaway stock, which technically means it owns 2.25% of the firm’s portfolio. So, in a way, Gates has $1.8 billion invested in Microsoft’s primary business rival, albeit indirectly.

Get the TNW newsletter

Get the most important tech news in your inbox each week.