From a very young age, we are taught the importance putting money away for our retirement. But a Fintech startup believes that we have been getting it all wrong by investing more time and money on accumulation, rather than decumulation.

The problem with a lifetime of saving is that many many retirees then encounter problems transitioning to their new world of responsible spending. This was enough for Hello Wallet founder Matt Fellowes to tackle the problem by launching United Income to transform retirement income.

The Startup is using a combination of tech, data, and financial advice in a new money management approach extend the life of cash. When I spoke to Fellowes on my podcast, he highlighted that although we have made significant advances in medicine, our diet and medical technology, when it comes to managing money, very little has changed.

Thanks to advancements in healthcare, people are living longer and are retired longer. But, the market has struggled to find a way to extend the life of money as effectively – Matt Fellowes

Many retirees have spoken openly about the frustration of not knowing how much they can safely spend. Fellowes also highlighted that a 70-year-old with a modest lifestyle might have almost all their essentials covered by a guaranteed pension. But this also provides an opportunity invest aggressively and build up a fund for late-in-life health care or a luxury purchase.

Armed with $200M in assets, the startup clearly has disruption in its sites. The service examines millions of potential future market and life outcomes to create personalized projections of future changes in spending on health and other items.

United Income’s financial planning methodology and investment recommendations, estimates that the average 64-year-old could increase their chances of having enough money in retirement by 55.7%. But, will those who have been conditioned to a life of playing it safe, think it’s worth the risk?

By harnessing powerful new technology and a growing body of data and academic work, we have been able to invent a new approach to money management that aims to extend the life of money.

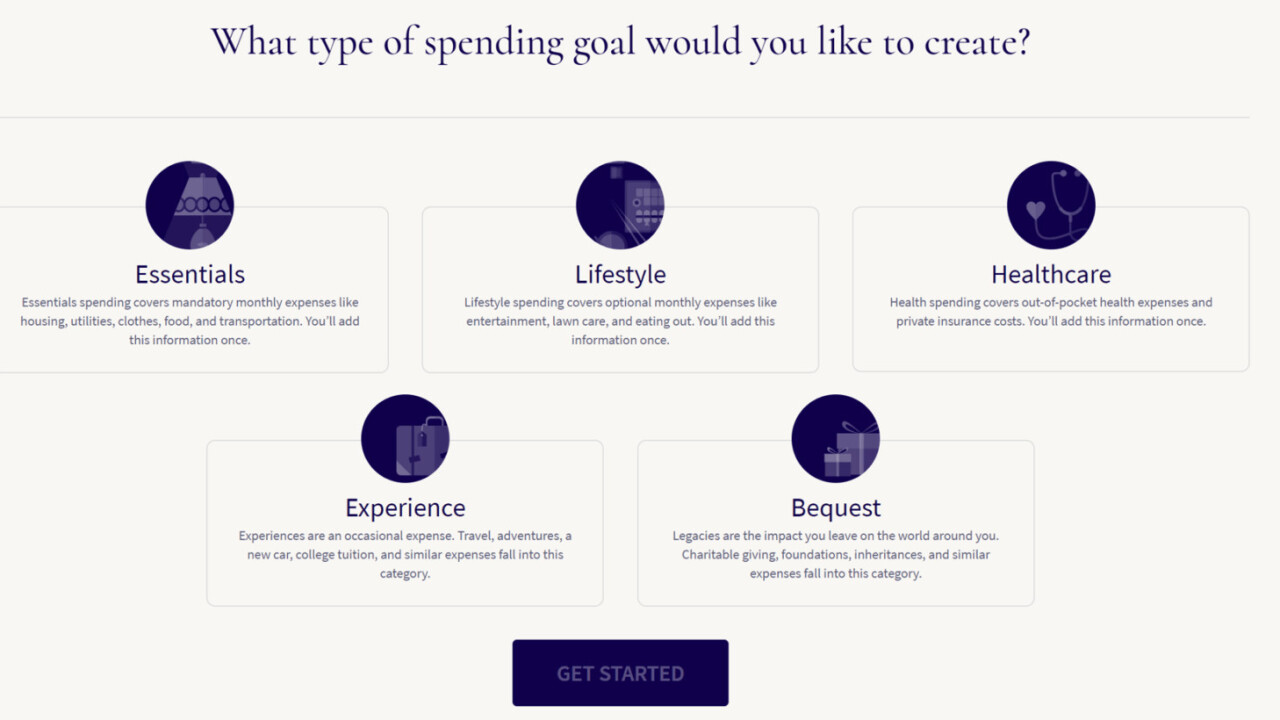

United Income is doing their best to provide peace of mind by offering clients with the ability to monitor their plan’s risk of failing in real time. A user-friendly online meter that displays a confidence level if the plan will succeed and a high-level overview of their spending goals are a nice touch.

Considering Fellowes, previously sold a financial tech startup for $52.5 million, I shouldn’t have been too surprised that he knows what he is talking about. But, it’s fresh approach and a new way of tackling an old problem that fits perfectly with the current.

The introduction of a retirement paycheck service that makes it easier for retirees to manage their budget as they did in the working lives sounds like a welcome addition. But the value of an annual fee of 0.5 to 0.8 percent of assets is still up for debate.

However, a one size fits all approach to retirement is starting to look a little dated. Especially, in a world that is increasingly becoming dominated by AI, and algorithms aimed at simplifying even the most complex of pain points.

Considering that everybody’s spending curve is different, it should be no surprise to learn that startups such as United Income are hovering around an industry ripe for disruption. A personalized plan to maximize the probability of achieving as many of an individual’s retirement goals as possible feels like a step in the right direction.

Get the TNW newsletter

Get the most important tech news in your inbox each week.