Bookkeepers and accountants have a lot on their plate. Unfortunately, their ability to dedicate their time and efforts to their most important responsibilities is often hindered when they are forced to spend a significant part of their day answering recurring client questions or dealing with mundane tasks like sending invoices or paying bills.

When this occurs, your bookkeepers aren’t left with much time for other vital tasks related to managing your business’s finances — like analyzing your company’s financial data to help you make smarter business decisions. As a result, their productivity is limited, and your company’s profitability and growth suffer.

Thankfully, it doesn’t have to be this way any longer. The rise of automation — and bookkeeping chatbots, in particular — have made it easier than ever to streamline much of the financially-oriented client communications and other tasks that can sometimes divert your accounting team’s resources.

The rise of chatbots

So how exactly do chatbots work? As Matt Schlicht of Chatbots Magazine explains, artificial intelligence and machine learning are what allow chatbots to be truly effective: “You don’t have to be ridiculously specific when you are talking to it. It understands language, not just commands. This bot continuously gets smarter as it learns from conversations it has with people.”

This enables bookkeeping chatbots to respond to a wide range of requests and questions, regardless of how they are phrased. While older “rule-based” systems could only respond to specific commands, the machine learning models don’t face these limitations. With more interactions, the more useful the chatbot becomes. As Chatbots Life explains, this ultimately allows a chatbot to work “in much the same way as a human manning a help desk.”

While chatbots can be programmed to fulfill a wide range of functions, it should hardly be surprising that they have taken root in the world of business accounting. PC Magazine notes that chatbots have proven to be especially valuable for the end user in part because of their ability to put “accounting jargon in natural language. Ask ‘who owes me money?’ and the bot will quickly pull the data … and tell you how much the invoice is, when it’s due, and the quickest way to contact the person.”

This is just the tip of the iceberg in terms of how an accounting chatbot can help. The latest chatbots are able to handle tasks such as analyzing receipts uploaded for expense tracking, helping clients stay on top of purchase ledgers, and even providing information regarding tax returns. When the chatbot encounters a question or request that it can’t resolve, the issue can then be passed on to a living, breathing accountant who has the ability to handle more complex problems.

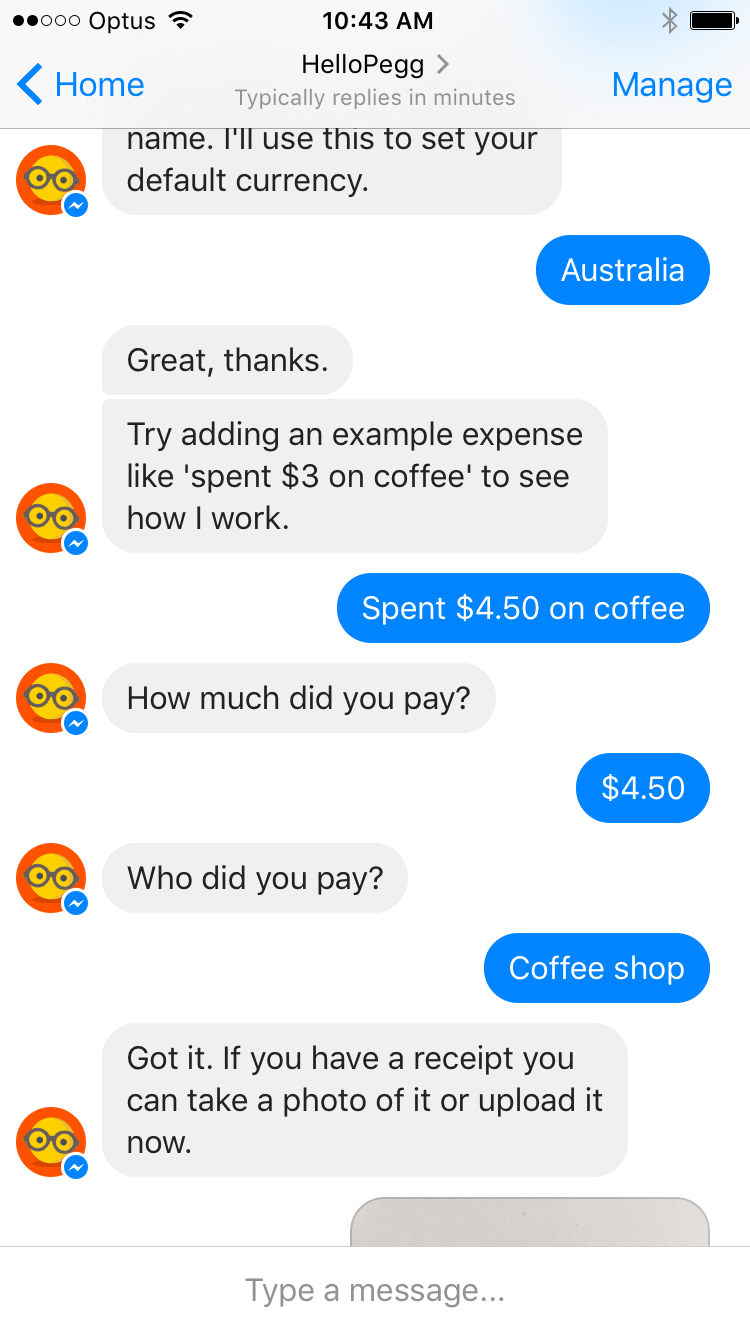

In other words, implementing accounting chatbots like Pegg or botkeeper allows many of the most commonly asked questions to be handled without the need for any human interaction. As the chatbots continue to learn from real-life interactions, their responsiveness and usefulness will only increase.

What this means for you

While the increased use of accounting chatbots may cause some bookkeepers to worry that their jobs will disappear entirely, industry consensus is that these tools will only increase the value accountants bring to the workplace. After all, while a chatbot can let clients know how soon they need to file taxes or how to contact someone who owes them money, it can’t replace human knowledge and intuition.

This actually allows accountants and bookkeepers to become more valuable than ever by giving them an increased capacity to focus on their clients’ financial strategy. These advances in technology make it possible for accountants and bookkeepers to spend less time answering simple questions and more time focused on the things that matter most.

Coco d’Hont, a financial writer for The Association of Accounting Technicians, puts it this way: “Because chatbots can only perform simple tasks, the ability to give complex and tailored advice is more relevant now than ever before. Think of chatbots as helpful assistants which can take over time-consuming and tedious tasks, freeing you up to help your clients with more complicated jobs.”

Essentially, by effectively responding to the obvious questions accountants get asked on a daily basis, chatbots help clients keep better track of their financial records. Thanks to their integration with messaging tools like Facebook Messenger and Slack, this also makes it easier for clients to stay connected with their accounting team.

This ultimately increases an accountant’s ability to serve in an advisory role — in which they can add greater value by helping clients better understand how to manage their money. With more time available to fulfill these roles, accountants are better equipped to make a lasting difference.

As d’Hont explains, the use of chatbots ensures that “accountants can use more of their expertise to add value for clients. In fact, for those who engage, chatbots may even help attract new clients and impress old ones.” As you implement these helpful technology tools into your workplace, you’ll be able to achieve better results from your accounting team than ever before.

Get the TNW newsletter

Get the most important tech news in your inbox each week.