Technology has lent itself well to changing and revolutionizing the world around us. Over time, technology has changed the way we communicate with each other, travel from place to place, conduct business, and how we maintain and organize our lives.

As more technology has developed over the years and more industries are tapping into ways they can make new technology work for them, it will soon become a requirement to work with new technology and adapt for the changing world around us.

While there are many industries of which have taken to new technology with open arms, soon every industry will need to do the same in order to survive and thrive.

Tech trends

The banking industry — with a long history of being a viable part of our society — is no different.

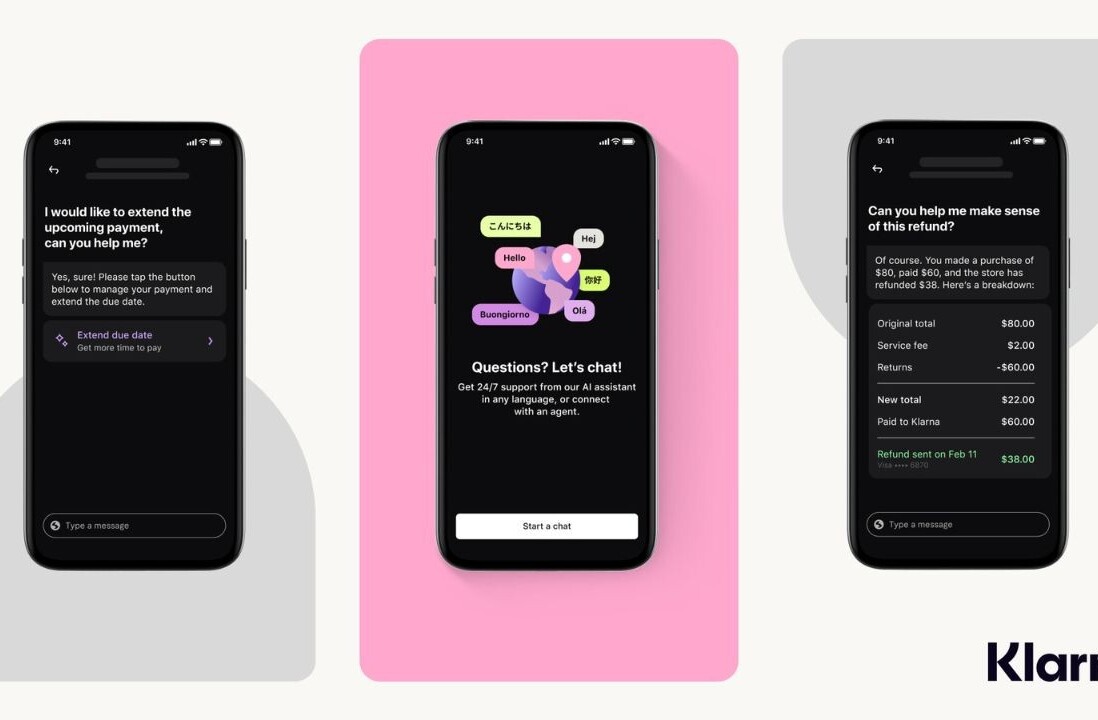

Technology has allowed us to expand who we sell to, how we manage our finances, even how we can apply for loans.

With new technology comes new challenges to adapt in order to stay a viable part of an industry and as part of the economy as well. The banking industry sees this, and is taking the challenges and opportunities head on.

This law and the possibilities new technologies bring, means the role of banking is changing and emphasizes the trend towards ‘open banking’. Financial services and banks such as Dutch bank ABN AMRO see new technologies on the horizon and are working to find the trends in which they can gravitate toward and adapt to.

Money matters

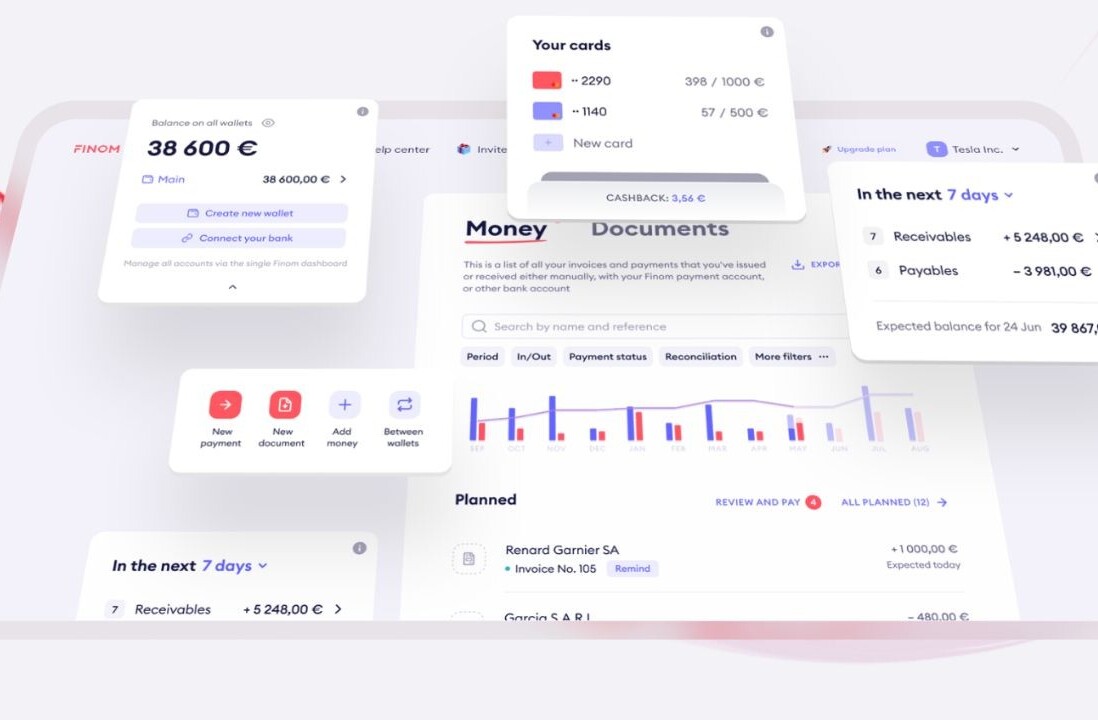

PSD2 works to provide a foundation for the creation of a single-wide market for payments. It allows consumers the ability to connect their bank accounts with third party services, allowing the services through an API to access data generated by their bank accounts.

This new law will change the way banking and payments are done in and around Europe, mainly due to the fact that now there will be a new industry of providers who want to help consumers with their banking needs. These providers can use banks APIs to provide a service to banking customers.

In other words, with PSD2, banks will essentially become a platform for banking with providing APIs to access data. Consumers will always remain the owner and control of their accounts, but they can now give permission to different apps, services, and companies who want to help them in their financial lives, such as with budgeting, retirement planning, or bill pay.

Another example is the ability to easily connect to any and all banks to provide payment options such as through paying with a cell phone, pay through an app, or auto pay through a service.

Disrupting dinero

Should banks be concerned about losing customers or their business with entrepreneurs creating apps and services using the bank’s API as a platform? Laurens Hamerlinck in the Focus Team Innovation Centre at Dutch bank ABN AMRO actually sees entrepreneurs creating these services and apps as partners instead of competition:

For a bank these apps are an extension to the bank-as-a-platform and therefore a partner in both customer experience and distribution. They can help us offering new services to our clients and help us distribute products like for example a consumer loan or credit facility. It is also a great opportunity for these apps to make use of banks’ risk management-, security- and compliancy capabilities.

For instance, ABN AMRO works closely together with startups and scale-ups to bring customers simple and user-friendly apps. Recently, the financial institution worked with Swedish startup Tink to develop a new app allowing customers to easily overview their earnings and expenditures.

With new innovations, the PSD2 law, and technology advancing every day, the banking industry is looking for ways to move away from the manual and time consuming activities and move toward automatic, seamless, and faster activities.

Customers still hold the control over how their data is used and must give permission for services and apps to connect to their accounts, but with new innovations and new laws, this is becoming much more commonplace and those consumers who want to take advantage of it now can regardless of their bank.

Fintech future

Perhaps the most important thing to come away from banks becoming more of a platform with the use of API is not the initial innovation, but the innovation that comes from the initial innovation. PSD2 is enabling innovators and entrepreneurs to tap into markets that are currently underserved. Once those innovations take hold, more opportunities will come about that will stir innovation and possibly change the way banking is done all together.

PSD2 and banking as a platform may just be about the ability to access account data right now, but as time goes on, we will see even more ways in which banking as a platform can serve as the foundation to much bigger innovations in our daily lives. That future is yet undetermined, and lays at the feet of PSD2 and the innovation it creates.

Banks that transition to be a platform more than a service provider stand the greater chance of staying viable and successful as they see technology changing all around them and changing how they gain customers and work with partnering companies to better serve their customers.

Banking as a platform is a beginning step toward driving innovation to make banking, financial services, and payments much more fluid, faster, safer, and more in control of the consumers.

Get the TNW newsletter

Get the most important tech news in your inbox each week.

Whatever your specialism, with ABN AMRO your talent and creativity will help build the bank of the future. Find out what it’s like to work for ABN AMRO and learn more about their exciting job opportunities.