If you criticize them, you must be jealous. That’s the common attack levelled at people – like me – who find the veneration of Silicon Valley investors and the ‘disruptive’ tech companies they champion less worthy of hero status than some.

I don’t like the idea of being a ‘tech writer.’ The journalists who write about technology that I most admire are not ‘tech writers,’ but people with an interest in what the future will be like and how the present is shaping up.

Don't ever doubt the magic that @jason brings to the game. pic.twitter.com/p51CB9Icmj

— Chris Sacca (@sacca) August 6, 2015

Writers who crave the pseudo-glamor of being an investor or want some of the shine that clings to successful entrepreneurs to rub off on them are to be pitied. You should also watch them carefully with a wary eye, scanning for who they don’t want to criticize and who they choose to lionise.

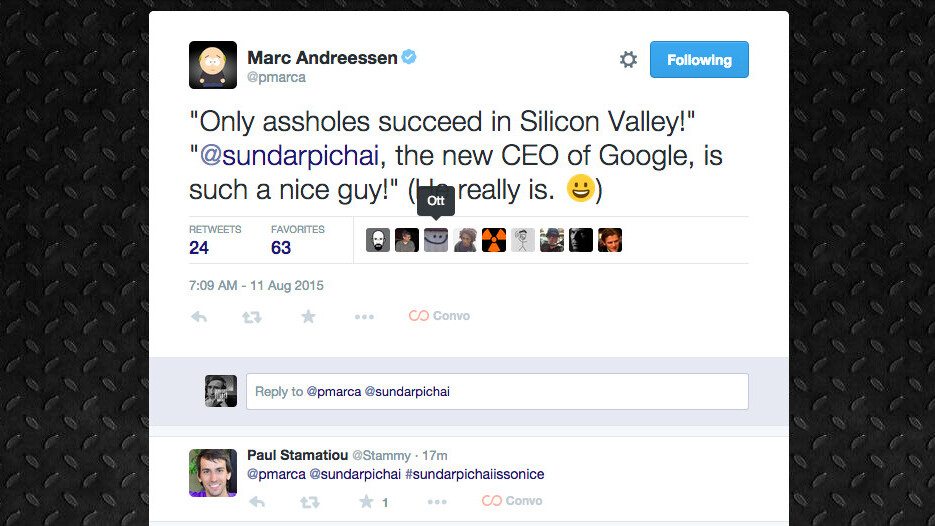

On Twitter, there is almost a cargo cult around the pronouncements of famous and infamous investors like Marc Andreessen, Chris Sacca and Jason Calacanis. Similarly, interesting thinkers lower down the pole, like the undoubtedly smart Benedict Evans, distribute their thoughts like commandments carved in stone and flung down from Mount Sinai.

@pmarca Twitter. You met me when we were 13 employees. You probably don't remember that. :)

— John Adams (@netik) July 27, 2014

There is no doubt that Andreessen, Evans, Sacca and the rest all have interesting things to say about the culture and business of technology, but their views are also highly skewed.

The same can be said for me. I have so many chips on my shoulder that I could set up a small concession selling them to passersby. I went to Cambridge – but was the first person in my family to do so – I have imposter syndrome in the most obvious way. I know even mentioning my alma mater will prompt hate on Twitter. It comes with the territory.

But there’s a difference between these op-eds I write – which are liked by some and derided by others – and the love bombing that greets the most well-known names in the ‘disruption’ industry. From behind blue ticks – The Who should write that update – it’s easy to start believing you vomit pure gold.

I find Trump and Corbyn essentially comforting: they have no chance of getting into power. Other countries are less lucky with their idiots.

— Benedict Evans (@BenedictEvans) August 8, 2015

To many of these ‘golden god’ investors, there is no problem that cannot be solved by white men in the Valley, no industry that should benefit from state protection, no notion of a natural monopoly that cannot be monetized for private gain.

I recently noticed Andreessen writing on – you guessed it – Twitter about the British left-winger Jeremy Corbyn, who has surprisingly surged forward in the contest to be the new leader of Britain’s Labour Party.

https://twitter.com/pmarca/status/629944457786294273

To Andreessen, the notion of a left wing candidate, one who advocates the renationalization of Britain’s railways and strongly opposes the marketisation of the National Health Service (NHS), is unthinkable.

He blithely concludes – like most British political commentators – that a Corbyn win would result in a nuclear winter for British politics with all but the Tories wiped out as a plausible party of government.

I have some news for you, my American friends: Despite the spread of the American implication that ‘left wing’ is an insult, it’s not quite yet totally taken hold in the UK.

I’m less right wing or left wing than broken wing – spreading my distrust for most politicians with the same generosity as a farmer spreads manure – but the notion of someone being unelectable because they don’t immediately buy into the Silicon Valley-endorsed notion of a tiny state and predatory capitalism makes me feel more a little bit sick.

https://twitter.com/pmarca/status/471757876780728320

Take unions. They are one of the finest inventions of human society – the ability to collectively bargain as a worker and be able to, at least partially match the power of the employer. They are much maligned but in an economy where workers’ rights are under attack like never before they’re arguably more important than ever.

But under the cult of disruption there’s no need for unions. It is Margaret Thatcher’s “there’s no such thing as society” credo amped up by the push button convenience of the on-demand world. To many of the vaunted VCs and their disciples, destablizing current regulation is almost always good and the rights of the individual trump the rights of the many.

Another tendency among the purveyors of pithy investor insight on Twitter, led by Andreessen, is to be deliberately, comically obtuse. Take this on a recent Economist article critiquing the now ubiquitous idea of the ‘unicorn’:

https://twitter.com/pmarca/status/630489119458619392

He knows that The Economist, one of the world’s most level-headed and rational publications, is not suggesting that all of the high-valued players are without value. Rather, it is suggesting that there might be, just might be, some over-valuation at work in a world where Uber has raised $6 billion.

There is no doubt that Andreessen knows his stuff. His record bears that out. But he and the other Twitter-happy VCs and angels, with their abiding love of the tweetstorm – a sudden flurry of thoughts spread across numerous messages – inject every tweet with an underlying arrogance. In the cult of disruption, there is no business they don’t understand, no ‘legacy-model’ of thinking they can’t sweep away.

Time to ‘disrupt’ the cult of personality on Twitter. We don’t have to concede to a world view built by predominantly white male futurists. They may storm loudly, but there are other voices we can choose to amplify. It’s possible to build an alternate future, whatever the VC consensus.

Read next: Twitter– a Google/Alphabet company: How and why it would work

Get the TNW newsletter

Get the most important tech news in your inbox each week.