Tesla, the electronic car company of the Valley has filed paperwork signaling intent to go public, selling stock in an initial public offering (IPO).

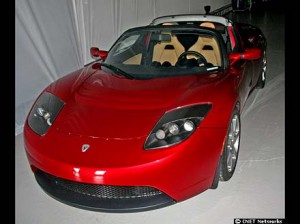

The company has not yet set a date for their offering. The Palo Alto company filed on Friday for this offering. The company is famous for making high powered electronic sports cars that cost more than $100,000, and are on the very cutting edge of electronic car technology.

According to filed documents, the IPO will be for $100 million dollars. The company recorded sales of some $93.4 million in the first three quarters of 2009. As of this moment, we are not sure what the post-IPO valuation will be of the company. Our bean counters are sifting through the documents as we speak.

On those sales they lost some $31.5 million. However, this was an improvement over the year prior, when they lost $57.3 million in the same time period.

The offering has extremely powerful underwriters, with huge investment banks JP Morgan, Goldman Sachs, and Morgan Stanley taking part. According to SAI, the company will be setting aside some $50 million of their IPO for the DOE.

With the $50 million in proceeds from the sale of stock, Tesla could perhaps handle another year of losses at its current levels.

Get the TNW newsletter

Get the most important tech news in your inbox each week.