A market sell-off triggered by Tesla’s dumping of $5 billion worth of stock continued on Tuesday, with the electric vehicle share price sinking by more than 15% in the early hours of trade.

Tesla stock opened the day at $356, and soon hit a low of $335.99 — down more than 32% since disclosing its “at-the-market” plan (a fancy term for fire sale) to the SEC on September 1.

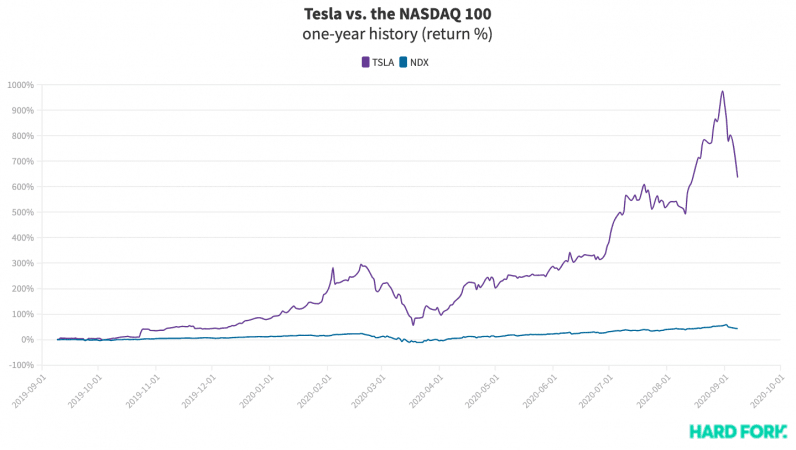

At the end of August, Tesla stock had returned 974% in one year, from $46.36 to $498.32.

Of course, those figures take the company’s recent five-for-one stock split into account, a dog whistle to retail investors concerned with low per-share prices also utilized by Apple in late August.

Tesla finished its $5 billion stock dump on September 4, and while falling 32% in a week reeks of big crypto energy, Tesla stock is still up 22% since its stock split announcement.

S&P steers clear of Tesla in its flagship index… for now

Some analysts connected Tesla’s September strife to its S&P snub, after Elon Musk’s wunderstock was noticeably left out of the flagship index of 500 top US companies, despite its technical eligibility.

[Read: These tech stocks still have a price above $1K — will they split?]

Speculators could’ve bought Tesla stock hoping it would rise further upon its eventual inclusion. The idea being that Wall Street’s biggest funds would be effectively forced into holding $TSLA, a reality anchored in the appeal of large index funds among institutional investors.

Throw in that supposed “Tesla rival” Nikola just signed a deal worth billions to have old world marquee General Motors build its first car, and Tesla’s volatility appears a little sharper.

In any case, the real question here is how readily Tesla can shake off its market slump, as speculators try to figure out where to flock to next.

None of this is investment advice. Don’t pretend it is, because it’s not. Always do your own research.

Get the TNW newsletter

Get the most important tech news in your inbox each week.