We know that tech’s biggest are stronger than before the coronavirus pandemic — but when it comes to stock market debutants, tech companies have been completely overshadowed by a new wave of public biotech and pharmaceutical firms.

The only exception is ZoomInfo, the Massachusetts data software and marketing startup that raised nearly $1 billion with its stock offering last week.

As of Friday’s market close, ZoomInfo stock was up a tongue-swelling 85% on its initial offer price, making it the most profitable US listing for a tech company so far this year.

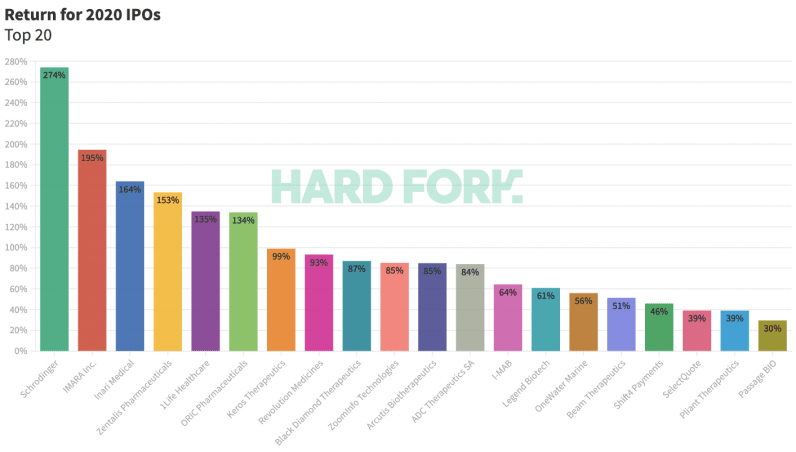

Still, that’s nothing compared to Schrodinger, a pharma-fused simulation software firm that counts Bill Gates as an investor. Since offering company shares for $17 in early February, Schrodinger stock has skyrocketed to hit $63.59 — returns of 274%.

In fact, 15 of the 20 best-performing IPOs we studied this year are in some way related to the pharmaceutical industry, while just one is considered a tech stock: ZoomInfo.

Fresh tech stocks just can’t beat that vaccine hype

Hard Fork analyzed the market performance of the 41 public offerings conducted so far in 2020, as reviewed by investment portal IPOScoop.

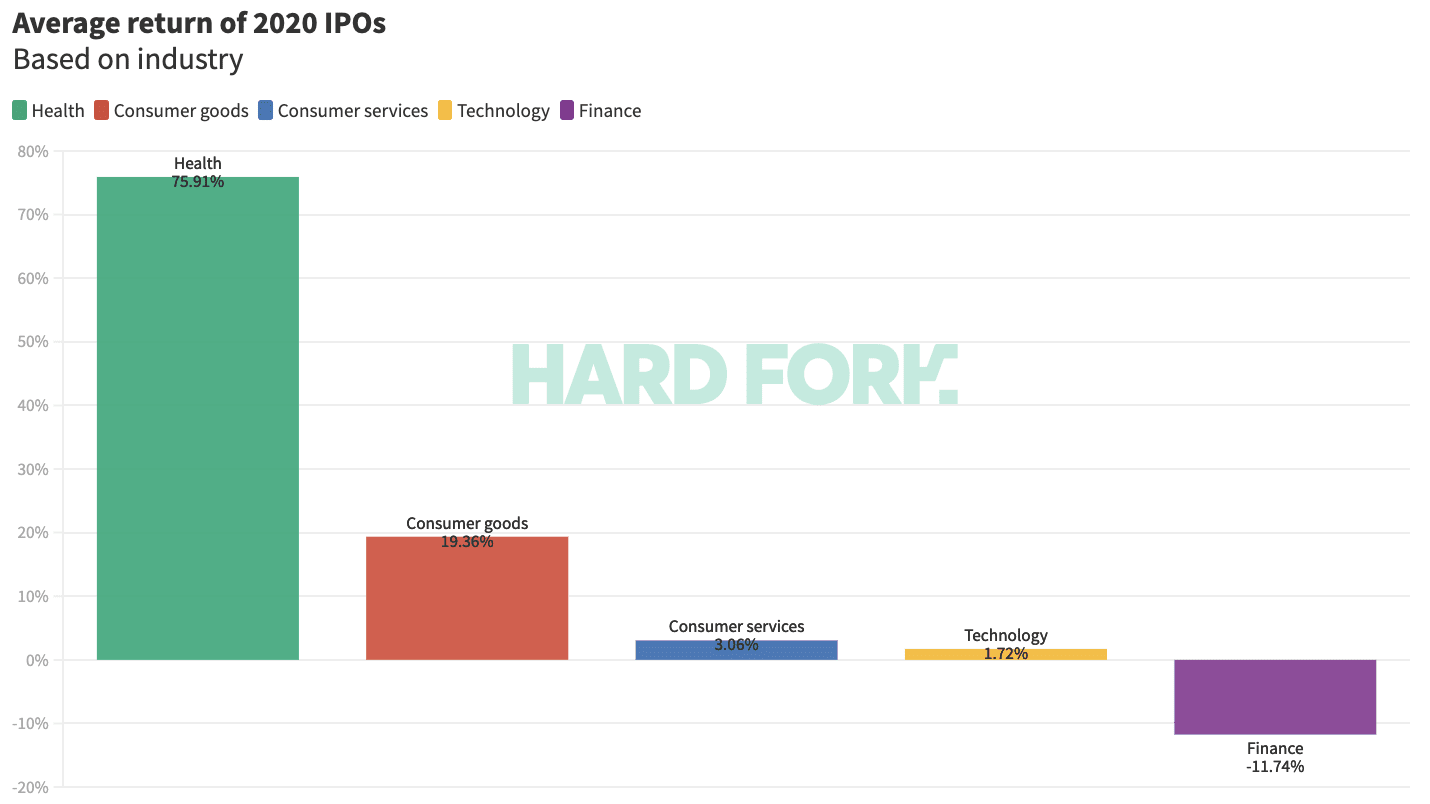

They can be grouped into five categories: health (21), consumer services (7), technology (5), consumer goods (4), and finance (4),

Generally, investors have shown the most enthusiasm for fresh pharmaceutical stock like Schrodinger. As of June 5’s market close, new listings IMARA, Inari, Zentalis, and ORIC had all increased by more than double, raising the average return for this year’s healthcare-related IPOs to nearly 76%.

For scale, freshly-minted tech stocks we looked at have barely broken even on average. Besides ZoomInfo, the only tech IPO to have enjoyed any kind of market growth is China’s Kingsoft Cloud Holdings, which says it’s the country’s “largest independent cloud service provider.”

Indeed, Kingsoft stock is up 19% while the other tech hopefuls — Dada Nexus, WiMi Hologram, and Lizhi — are all in the red, down 0.06%, 37%, and 58% respectively.

This brings the average rate of return for analyzed tech IPOs in 2020 to just 1.72%. (NB: Lizhi is the worst performing IPO this year, tech or otherwise).

[Read: These 5 tech companies are swimming in cash]

After pharmaceuticals, IPO stock in companies that provide consumers with goods in some way — like Warner Music — are returning the most profits for investors.

Warner Music stock is up almost 20% since its $1.9 billion IPO last week, while shares in household mainstay Reynolds have jumped 27% since its January listing.

Get the TNW newsletter

Get the most important tech news in your inbox each week.