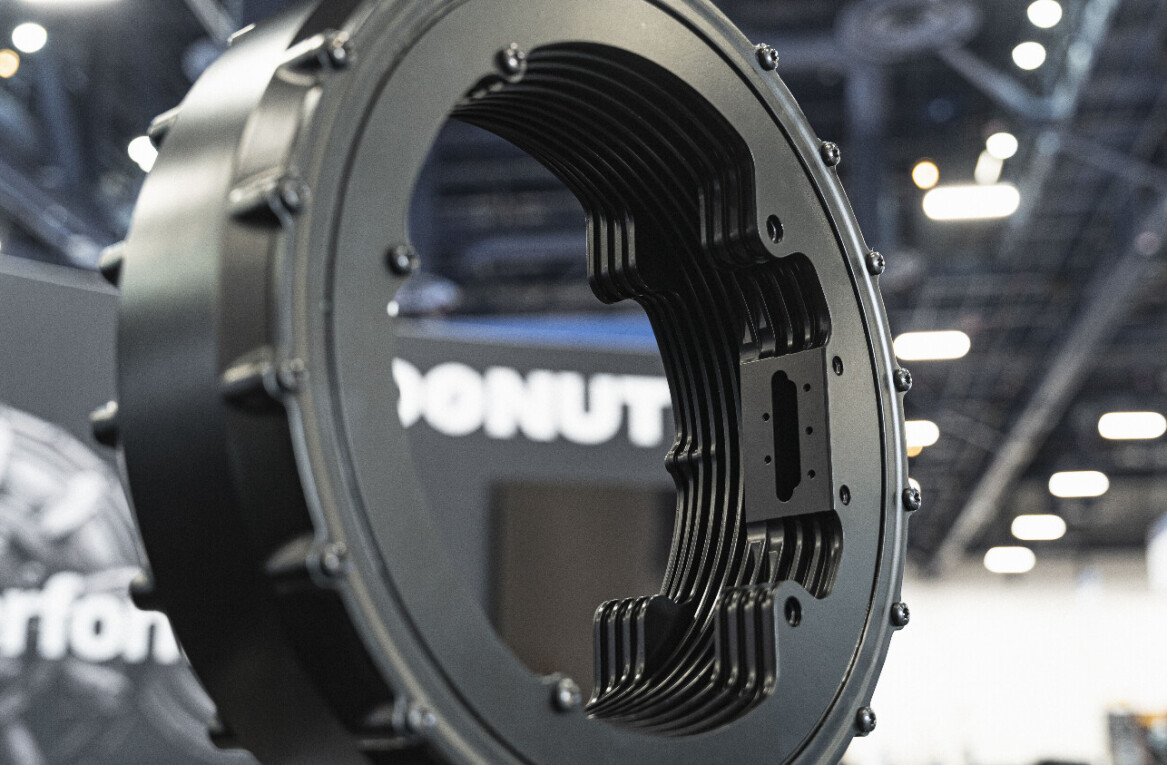

Up Catalyst has closed a €2.36mn seed extension round to accelerate the development of an industrial pilot reactor that turns CO2 emissions into carbon materials.

According to the Tallinn-based startup, the reactor will be able to produce 100 tonnes of CO2 per year. These can deliver 27 tonnes of advanced carbon materials, such as carbon nanotubes and graphite — a key component of EV batteries.

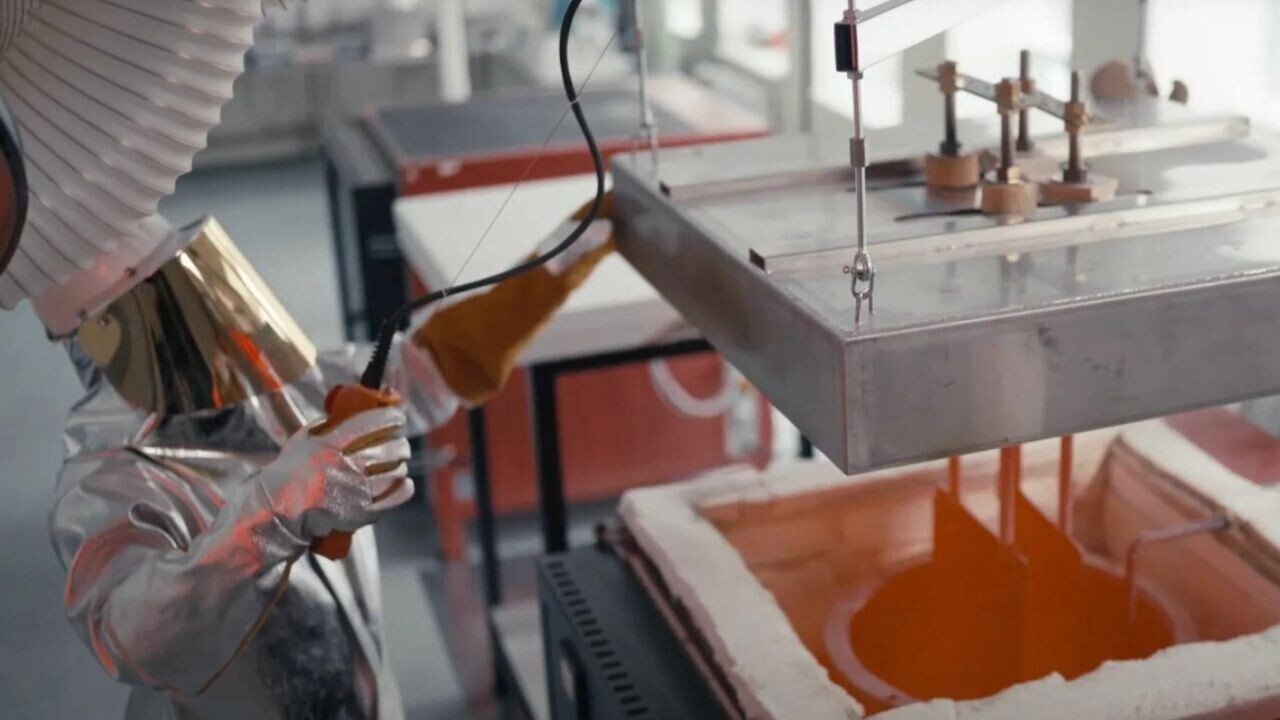

The company’s technology isolates CO2 from flue gasses from heavy industry emitters. It then uses a process called molten salt electrolysis to turn it into green carbon.

“We’re essentially electro-transforming carbon dioxide gasses into carbon nanomaterials,” Apostolos Segkos, senior chemical engineer at the startup, told TNW in an interview earlier this year.

With this process, Up Catalyst’s first aim is to achieve price parity with traditional carbon sources. Its second aim is to reduce reliance on fossil fuel-based carbon, while lowering the carbon footprint associated with raw material production.

EV batteries present an illuminating example, typically containing 50 to 100kg of graphite. According to the startup, the shift from fossil fuel-based to green graphite could prevent 118.7 megatons of CO2 emissions per year.

Creating green graphite

Up Catalyst’s mission is well aligned with EU goals on the energy transition and the respective need for stronger supply of critical raw materials, Segkos said.

“Graphite, among other key carbon products, is considered a critical material by the EU, especially as we import about 99% of it, which mostly comes from China.”

“With our technology we can help localise production,” he added.

At the same time, the startup’s process promises a significantly lower carbon footprint compared to conventional graphite production.

The funding round saw equal participation from VC firm Warsaw Equity Group and Estonia’s state fund SmartCap. It follows an initial seed round of €4mn, bringing the total seed investment to €6.36mn.

Get the TNW newsletter

Get the most important tech news in your inbox each week.