Tablet adoption soared in India during the third and fourth quarter of 2012, with 3.11 million units shipped during the full calendar year, according to new data published today by CyberMedia Research.

During the final three months, 1.09 million tablets were shipped throughout the country. That’s a slight dip from the previous quarter, which clocked 1.1 million units, but it far outstrips the 904,000 tablets that were shipped for Q1 and Q2 combined.

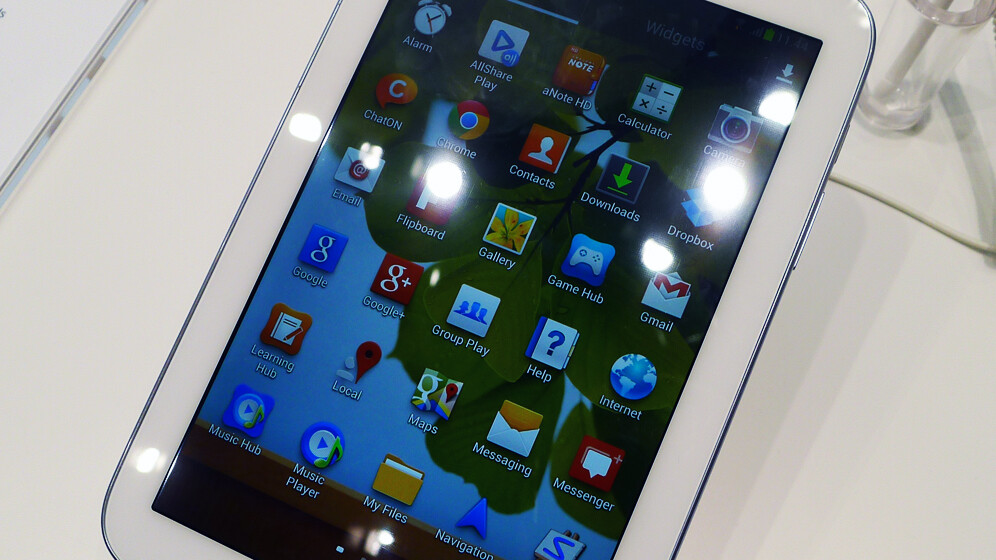

It’s worth noting, however, that CyberMedia Research has defined a tablet as any mobile device with a 5-inch screen or higher. That means the data could be skewed significantly by larger smartphones such as the Samsung Galaxy Note II or Huawei Ascend Mate.

Faisal Kawoosa, lead telecoms analyst at CyberMedia Research, has recognised the emergence of these devices, often referred to as ‘Phablets’, and promised that they will be counted and analyzed separately in future reports.

For now, we’ll have to make do with the two categories combined. The data showed that for the full calendar year, Samsung was the market leader attributed to 25.1 percent of total shipments. Micromax, an Indian OEM known for its Funbook range of tablets, took second place with 14.3 percent, leaving Apple to trail with 9.1 percent.

That state of affairs doesn’t really differ when you dig into numbers for the fourth quarter of 2012. Samsung still leads with 20 percent of device shipments, with Micromax chasing in second with 15.7 percent.

Apple has been pushed out, however, by Karbonn, which also produces a number of its own tablets running Android.

The Samsung Galaxy Note and Note II has probably had a large influence on these figures though. A separate dataset, looking only at devices with a 7-inch screen or higher, shows that Samsung slips to third place for the full calendar year with a marketshare of 10.39 percent.

Apple snags second with 10.88 percent, allowing Micromax to leap out in front with 17.07 percent.

Digging down into the fourth quarter, Micromax retains its lead with 19.04 percent of tablet shipments, while Karbonn trails in second with 9.85 percent. Datawind, manufacturer of the Ubislate tablets, follows in third with 9.64 percent.

“Samsung has been able to maintain the lead in the market only because of the first-mover advantage with the Galaxy Note and the Galaxy Note II,” Tarun Pathak, Telecoms Analyst at CyberMedia Research said.

“But this is not a sustainable strategy in the long-term, as it has resulted in the creation of the new ‘Phablet’ form factor, attracting competitors at both ends of the price spectrum to follow suit. With the entrance of Apple at the top end and multiple Chinese and Indian players at the entry-level, the Phablet segment is only going to see increased competition in the foreseeable future.”

The current trend in smartphone design is to produce handsets with larger screens. Nevertheless, these ‘phablets’ are different to tablets and shouldn’t be treated the same. While these figures provide a crucial glimpse into the desire and adoption of such devices in India, the next data for 2013 should be much more valuable, given its separation of the two categories.

Get the TNW newsletter

Get the most important tech news in your inbox each week.