Today Snapchat unveiled a partnership with payment processor Square to launch payments inside the Snapchat app.

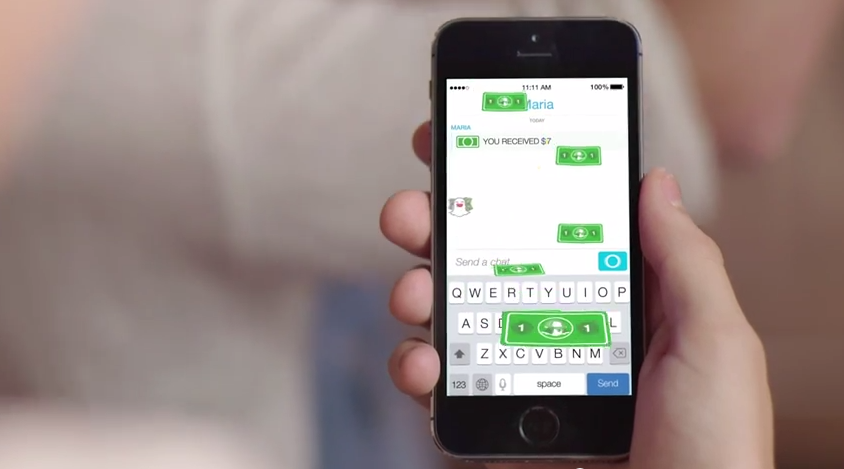

The feature, dubbed Snapcash, allows users to send money to friends on the network by simply typing the amount and hitting send. With Snapcash, we’re finally starting to get a glimpse of a promising future of mobile payments.

These types of frictionless payments aren’t exactly new. Square has allowed users to send money over email for some time now, while competitors like Venmo allow users to send payments with simply a mobile number. However, despite the choices before today, they’ve been going about it wrong.

Many of these payment companies have been focused on building out their own networks or messaging system in order to pay friends. Some of them have systems that are attached on top of social networks to send payments to others, but they still require the recipient to be registered on the payment service to actually receive the money.

Naturally, this barrier to entry along with the sheer amount of options in the payment space means that the act of actually getting money to a person is a total pain in the ass.

All of us have had at least one conversation along the lines of “I’ll transfer you the cash on Venmo” to which your friend replies “Sorry, I only use Square cash.”

The future of payments is simpler than this. These third-party payment platforms may well still exist, but partnerships like the one we’ve seen with Snapchat today will become more commonplace.

Instead of using a third-party app, payments will be baked into existing first-party social networks seamlessly, so that users never need to register for a new app or account, but instead can send payments instantly to anyone who’s already on the network. All the recipient will need to do to get paid is add their bank details.

Snapcash is the first to do this in a meaningful way. The company has removed all friction from mobile payments and makes it as simple as getting down to the act of actually sending cash. By launching this feature, the company has turned on payments for over 100 Million users.

But the company may have a perception problem; Snapchat is not a place you go to deal with money. Users don’t exactly associate Snapchat with safety, or security. I don’t doubt that some will use Snapcash, but I doubt it’ll ever catch on like the company expects.

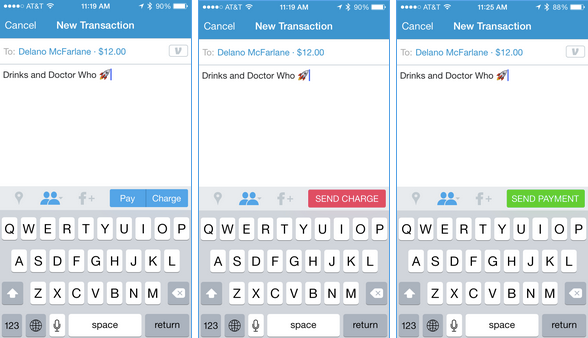

The elephant in the room, however, is Facebook. The company has been rumored again and again to be entering the payments space by making it simple to send money to users via its Messenger app. The feature is already hidden in the app’s code, so the launch is likely imminent.

When Facebook launches payments in Messenger, it’ll be tapping into a whopping 500 million monthly active users. It has the social graph that a payments service needs to succeed, because almost everyone you know already uses it. You’ll be able to pay almost everyone you know instantly, without friction.

Others could throw their hat in the ring too; with Apple’s new foray into payments, one could expect the company to enable payments via iMessage in the future. By combining Touch ID and seamless payments using the on-file credit card from iTunes, Apple could enable peer-to-peer payments for anyone with an iPhone.

No more disparate apps; just a single app you can use to pay anyone you know without needing to set up a new account. Social networks may be the payment haven we’ve been waiting for.

Payments are going to be easier, very soon. Snapcash is just a glimpse of how powerful a combination of payments and social can be. It just needs to be frictionless.

Get the TNW newsletter

Get the most important tech news in your inbox each week.