Update 04/2019: Dwolla reached out to TNW to let us know they still get a lot of visitors from this page looking for this particular service, which they do not offer anymore, unfortunately. Just so you know.

Dwolla has made a name for itself in the payments space by doing exactly the opposite of everyone else. While PayPal is charging transaction fees and then sticking a debit card fee on top of that, Dwolla avoided the card entirely, and any transaction under $10 is completely free.

So how do you make that even more appealing for your users? According to CEO Ben Milne (check out our interview with Milne), you give them instant access to cash, any time that they have an Internet connection. With that in mind, Dwolla Instant was born.

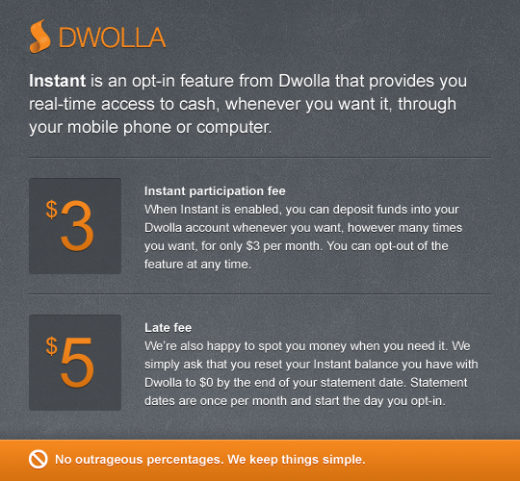

Instant is a new feature from Dwolla that gives you instant access to cash. So instead of having to wait for funds to hit your account Dwolla will front you up to $500 instantly, and all it costs is $3 per month.

Milne says that there is a $5 late fee if you choose to let the borrowed money float past the end of your statement date, but that’s more akin to a late charge on a rented movie than a punishment method by which Dwolla wants to make money.

Milne says that there is a $5 late fee if you choose to let the borrowed money float past the end of your statement date, but that’s more akin to a late charge on a rented movie than a punishment method by which Dwolla wants to make money.

“We don’t want to charge you the fee. Please, just return the movie.”

In order to activate Instant, you’ll need to log in to your Dwolla account via the Webpage. I’m told, however, that the feature is going to be coming to both the Android and iOS apps in the near future. Once you deposit or send cash with Instant, you’ll see that you now have an Instant Balance section, handled separately from your normal Dwolla funds.

You have two options with Instant – Pay it back immediately via a linked bank account, or pay it back later. As long as you complete the repayment before the end of your statement date, there’s no late fee. Miss the date and it will cost you $5. Please, just return the movie.

While the feature is obviously more powerful for those who have Dwolla-accepting merchants around them, it’s still handy even if you don’t. Say you’re on the road and need quick access to cash, but you don’t have the funds in your account just yet. Instant can act in a “payday loan” capacity, giving you the money that you need for a short time, until you can afford to pay it back. This is especially handy, for instance, if you need to split a check with a friend but don’t have the cash on hand in your Dwolla account.

Dwolla isn’t without company in the mobile payments space, but the approach of avoiding cards and being the man-in-the-middle provider is working out well for the Iowa company. By way of comparison, Clover Pay (another recently-released addition to the space) holds a lot of the same function as Dwolla, but it has absolutely nothing like the Instant feature. If you’re out of funds in your Clover account, you’re simply out of luck until you add to it, which can take days.

Dwolla is once again taking an idea, running with it and completely changing the way that it has happened in the past. It’s a powerful move from the company, and Milne expects to see many people taking advantage of it quickly. As such, you might see a queue for a short time but Instant is now available so you can turn it on and have a better option for immediate cash.

➤ Dwolla

Get the TNW newsletter

Get the most important tech news in your inbox each week.