Since the dawn of time – or at least since Chris Skinner, Chair of the European networking forum The Financial Services Club and Nordic Finance Innovation, says farmers traded goods for coins and coins for sex (more on that later) – banks have always been leery of innovation.

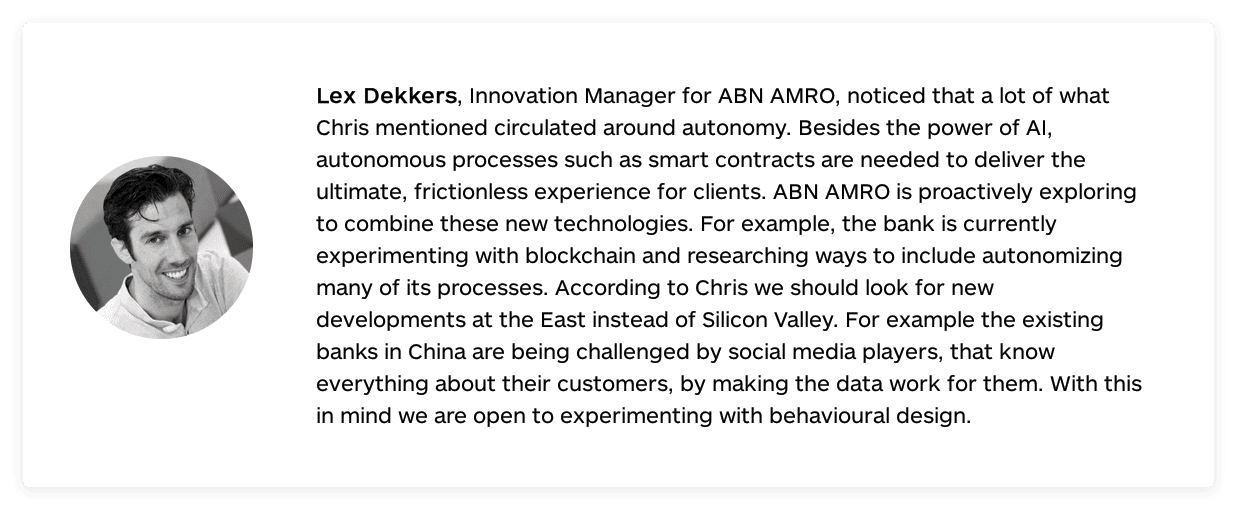

However tech is moving quickly, and as antiquated banking system are slow to innovate, they will get left behind. And as the Semantic Web begins to gain steam, financial systems that must also integrate itself into the internet.

At present, artificial Intelligence (AI) technologies are increasingly being applied in the banking industry, mainly toward knowledge management, identity authentication, market analysis, customer relationship management, anti-money laundering, and risk control.

But this is only the beginning.

It’s just a matter of semantics

In reality, Semantic Web technologies are as much about the data as they are about reasoning and logic. When the internet has this full cognizance, instead of an Internet of Things, it becomes an internet of me. What I’m doing, what I need.

As Skinner explains, life becomes simple and easy. You no longer have to book a trip, just think about going somewhere and it’s done. Hungry? Think about that hotdog and it’s taken care of.

Invisible banking

As Skinner notes on his blog, the issue with current banking systems is that “they were developed in multiple proprietary servers that don’t easily lend themselves to AI and machine learning”. So how can a machine learn anything about me if my data is stored in multiple systems, based upon whether I’m using a bank’s deposit services, loans, mortgages, cards or savings? That’s the challenge today for the analog bank.

But as the Semantic Web grows, so too does the Semantic Bank.

Like bitcoin, Semantic Banks will be “based upon data at the core of transactions and both systems recognize that decentralization will create more security, as there is no single point of failure.” In the growing digital age, the Semantic Web and intelligent machines will interact automatically with one another and trade with each other.

The Semantic Bank will know more about you than you do. A bank that deep dives data to proactively and predictively can offer customers direct intelligence in all financial activities. As such, Semantic Banks won’t be actual banks, but an advisor to customers. We will move from people who advise, to systems that do.

Just as you think of that hotdog or vacation and it’s taken care of, you can begin to apply the same to your finances. Interested in a new car? Can you afford it? Sure, but this is what you’ll be forfeiting to do so. Walk by a house that’s for sale down the street. Can you buy it? Yes, but at the risk of giving up something else.

Additionally, banking will be invisible – in fact, it already is. When was the last time you reached into your wallet to pay for something? With apps like Uber, it’s becoming common practice to simply just connect to your account and then no longer have to physically pay. This frictionless form of payment is the basis of the Semantic Bank.

The financial future is now

The country – with financial services such as Tencent, Baidu and Ant Financial – is consolidating social, commercial, and financial lives and experiences of their users into a single ecosystem.

Chinese banks are leading the charge in a myriad of ways. One of which is the use of virtual reality.

Ant Financial specifically, who expects to reach two billion users by 2025, currently allows customers to shop in virtual reality. The company understands the main point of interest of their customers… sex. Which, according to Skinner, is the reason for innovation and new forms of financial systems. Consequently, Ant Financial has used this knowledge to build VR shopping malls that fully immerse consumers with more explicit images to exploit this weakness.

But China isn’t merely conforming to the old adage that ‘sex sells’, the country is also a leader when it comes to open banking and circular economies. While traditional banking institutions are systematically rather linear – where you open a checking account or take out a loan or apply for a credit card – Chinese financial systems are creating economies. Their leading companies are young, having only begun in the early 2000s and are the pioneers for some of the new commerce and payment systems. All the while, US is clinging to an antiquated system where 43 percent of American banks are written in COBOL.

Rejoice! Don’t run.

With the growing popularity of chatbots and apps, banks are seeing a flattening of services as these new technologies replace customer services.

According to Skinner, one in three bank jobs will be automated by 2025. Skinner also believes that by 2029, networks and systems will know more than humans do and will subsequently support them.

But he advises people to not be scared, but rather, be excited. Technological advancements will make you feel as though you’re dealing with a human, when in fact, you are not. You may not even notice the difference.

At the end of the day, nobody likes to deal with suits – especially not those that judge us based on our bank accounts. Working with chatbots gives you that freedom to live; to enjoy life without administration and bureaucracy.

Get the TNW newsletter

Get the most important tech news in your inbox each week.