Cryptocurrency has found support all over the world. It is popular as a solution for common business problems in many industries, but also allows people to invest and speculate as they would with stocks.

For both reasons, companies and individuals around the globe are motivated to participate in cryptocurrency, but when this adoption reaches a certain point, governments step in to have their say. This makes perfect sense, as there are no other entities with such a significant stake in the status quo.

Chinese citizens were on the leading edge of both Bitcoin mining and trading for years until China’s government and central bank made sweeping regulatory changes out of fear over the implications of cryptocurrency on its Yuan. Others like Sweden and Japan have worked to integrate it into their societies by making cryptocurrency legal tender, and allowing the creation of new financial instruments like bonds based on Bitcoin.

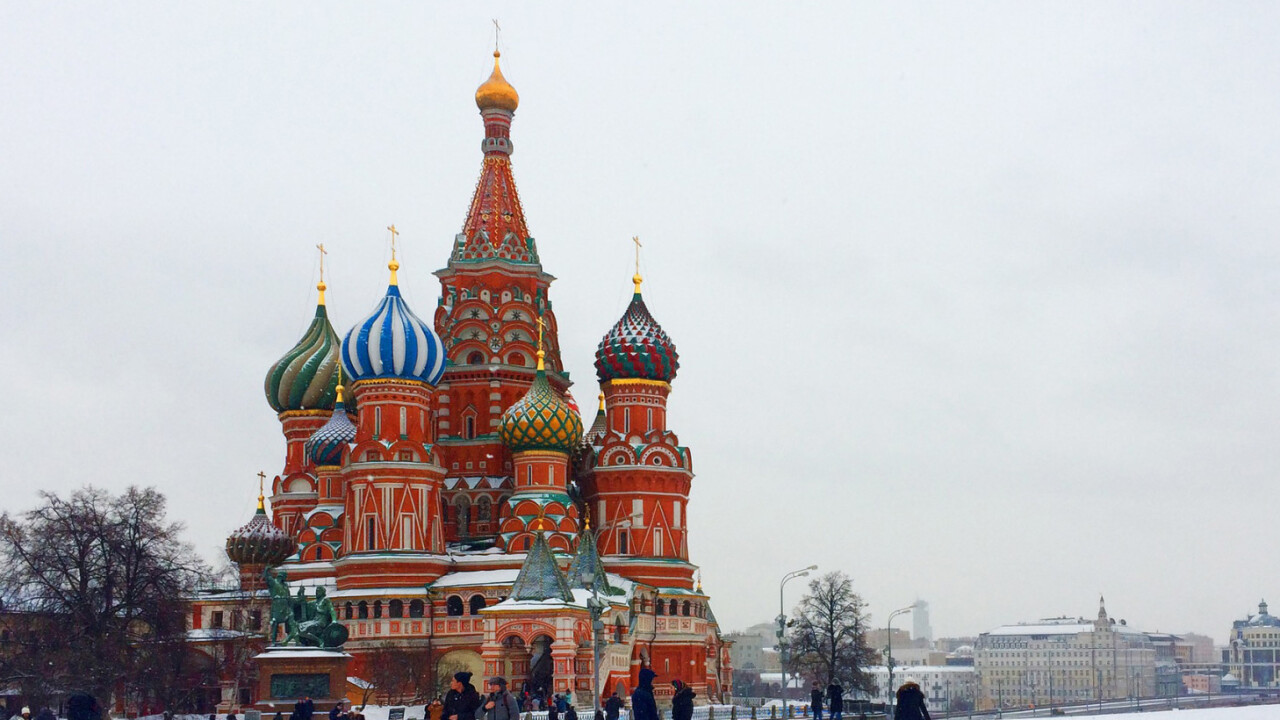

Some countries choose not to take a stance, much like America, which has largely elected to leave young cryptocurrency markets alone. Russia, on the other hand, has a different relationship with the technology altogether.

The big pivot

After the biggest year for cryptocurrency yet, wherein the total industry’s market cap flew past $200 billion and illustrated multiple new use cases, countries that haven’t addressed this trend are late to the game. Until recently this group included Russia: a country that is typically comfortable to wait for other major international entities to take a stance before acting in turn.

Before the boom in Bitcoin took the currency past the $7,000 mark (at the point of writing this article, Bitcoin price is at around $16,000), Russian politicians and bankers made their conflicting opinions and hesitancy known. Vladimir Putin called for tighter regulation of cryptocurrency just a month before his speech about nurturing the young technology, and influential central bankers likened cryptocurrency to a pyramid scheme. There was even a proposed punishment for owning Bitcoin that would have seen citizens jailed for up to seven years for being in violation.

These combative statements from the Kremlin and central bank have recently pivoted, with a string of announcements that solidify Russia as a potential epicenter for the inevitable cryptocurrency revolution. One of the greatest catalysts for this turnaround is demand from people all over the world for digital cash as instruments of investment, payment, and more. Russia has answered their call, but in a distinctly Russian way.

Russia comes out as pro crypto

In late October, President Putin announced his support for cryptocurrency in Russia and ordered legislation to create infrastructure for its national adoption. Five distinct legal structures were created: for taxing cryptocurrency miners, nurturing blockchain technology in business, regulating initial coin offerings (ICOs), and creating a comprehensive payment system for citizens. The most startling announcement was Putin’s intention to build a digital version of the ruble called ‘CryptoRuble’.

From what little we know currently, the CryptoRuble is intended to be exchangeable with the ruble on a 1:1 ratio. Unlike traditional cryptocurrencies, it cannot be mined, and will issued by the central bank exclusively. This approach is uniquely Russian, and is based on years of careful observation about how cryptocurrency is affecting other countries.

It sacrifices some economic freedoms for government control, while still including the technology’s greatest advantages. An immutable ledger will make citizen cash flows transparent to the government and help stem fraud and corruption, while also tearing down barriers between systems plagued with middlemen.

Interestingly, CryptoRuble income will be taxed at 13 percent for those who cannot provide a legitimate source for it, which is both an attempt at stemming corruption but also a way to profit from it.

A stake in the 21st century

As the world saw with last year’s Russian influence in the United States presidential election, it is important for Russia to have a finger in every pie, but also to protect their own borders fiercely. The country’s leadership is ever-vigilant of new ways to gain an edge in international politics, finance and trade. Cryptocurrency is one of the likeliest avenues for increased influence across borders, so Russia’s renewed interest is logical.

In the past, even Russia-based cryptocurrency projects weren’t significant enough to win explicit government support. Services like Russian Miner Coin (RMC), a platform supported by a Russia-based mining operation, operate in the same borderless way as other decentralized financial platforms, and don’t suit the country’s insular political temperament. These platforms are too democratic, and would allow outside influence to have a say in the value of an otherwise Russian currency.

Recent sanctions imposed on Russia by the United States give the country another reason to spur adoption of their own custom solutions. If Russia were to create a decentralized system for selling its petroleum anonymously, for example, they could skirt these sanctions and continue to operate without oversight (or consequences).

The Russian revolution

Regardless of sanctions, more efficient financial tools, or increased oversight, Russia wants cryptocurrency because the world wants it. In a country whose main export is quickly becoming obsolete, fostering a friendly environment for the globe’s newest source of demand is both politically smart and fiscally responsible.

Politics, finance, and the citizenry of Russia are slowly moving towards blockchain-based infrastructure. For Russia especially, blockchain must be a compromise between autonomy and control, and this reality will require a delicate hand, but it is already underway.

Get the TNW newsletter

Get the most important tech news in your inbox each week.