Cryptocurrencies are slowly taking over the world. If you haven’t heard about them, chances are you have been living under a rock. One of the most popular examples is Bitcoin, which has grown at an astronomical pace since its inception and is giving many folds return every year.

The era of using Bitcoin only in the deep web has long gone. Now, many big e-tailers are embracing cryptocurrencies. Mint, Bloomberg, Intuit, Zynga, Shopify, etc are some of the major sites which are accepting Bitcoin as payment method.

Many critics have suggested earlier that Bitcoins are not even capable of paying for a cup of Starbucks – particularly with such high transaction charges. However, with recent forks and the introduction of new cryptocurrencies like Ethereum, Monero, Ripple etc, retailers have more options in terms of currencies.

Any business, which is bound to be futuristic and tailoring themselves for upcoming years, should start adapting to generation’s favorite payment instrument—cryptocurrencies.

Due to the ease of processing, cryptocurrencies are proving advantageous for international transactions. People all around the world are able to easily send each other large sums of money and then seamlessly convert it into their local currency.

How to add crypto to my store?

Here are some generic steps to accepting any cryptocurrency in your store. Some steps might differ a bit for each currency, but more or less, this is the process that you will follow.

- Get a receiving address for crypto-currency. You have two options here – either sign up for a custodial crypto wallet like that of CoinBase or manage a wallet yourself (where you will control the private keys). For anyone who is dealing with significant amount of crypto currencies, it’s suggested that you get a hardware wallet; Trezor/Ledgerwallet do a good job in providing them. They are almost impossible to hack if you follow the guidelines they provide.

- Print the QR code of your crypto-address in the wallet and paste it on or near your register. Post a sign on your store that you are accepting that currency. For instance, a sign can say “I use Bitcoin QR code, a free service to make QR codes for accepting payments.”A much easier way to get QR code is simply navigate to “receive” in your wallet. Most wallets will show QR code and address. Take a screenshot of that address and use it anywhere. Don’t forget to put a Bitcoin Accepted/Ethereum Accepted/etc on your front door. You will likely attract customers who will just come to try out their first crypto purchase.

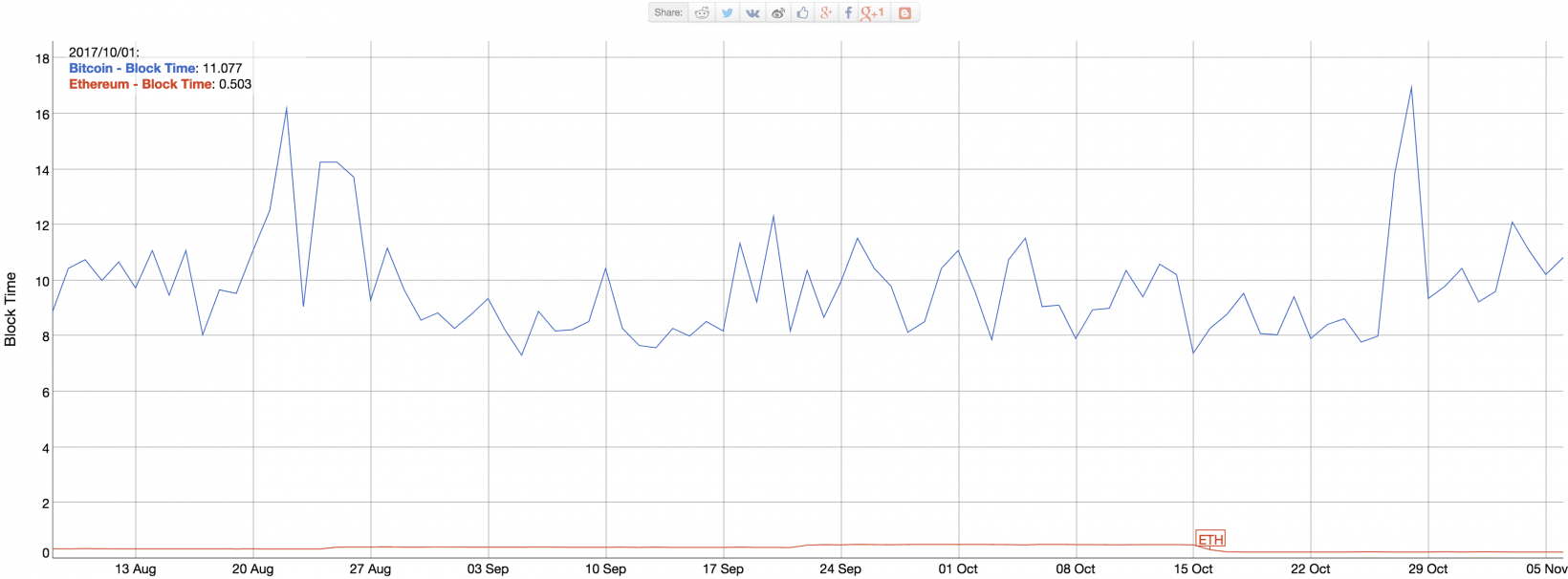

- Now, you are all set to deal with crypto currencies! Customers will do transactions and you will receive coins on your wallet. Be aware, though, that Bitcoin transactions certainly take much more time to receive confirmation. A good alternative to that would be Ethereum, which takes much less time to confirm than a Bitcoin transaction and will cost you fewer fees.

However, bitcoin transactions do show up immediately in the wallet once they are initiated. Transaction confirmation is a mathematically challenging process and requires heavy computation. For smaller transactions, you can take the risk and assume no would have time and dedication to try reverse an unconfirmed transaction. However, for bigger value transactions, it’s advised that you wait for at least some confirmations.

Which currency?

Once you have decided to incorporate crypto currencies in your business, your next question will be which crypto currency should I support? Bitcoin is an obvious choice because it’s the current leader of crypto currencies and dominates the cryptosphere.

However, Bitcoin has its own set of limitations, such as high transaction fees and longer waits for confirmations. Such problems are not faced in other alternatives like Ethereum or Ripple.

In contrast, the block time of Ethereum is much smaller than that of Bitcoin. If you look closely in the graph, you’ll realize it’s almost 40 times faster than that of Bitcoin. I have personally tried Ethereum transactions and they are blazingly faster than Bitcoin.

Cashing out

As a business owner, you must know how to cash out your crypto-currencies to your local currency. You can sign up yourself on exchanges like CoinBase/Kraken/etc, sell your coins there and get currency deposits in your bank account. Another way of using Bitcoins is to sell your coins directly in a p2p marketplace like localbitcoins, which supports almost all countries.

Such options do not exist for Ethereum, though. An upcoming startup called Dether is poised to lead the way for mass adaptation of Ethereum. Dether will allow users to create and manage wallets, build a decentralized marketplace where buyers and sellers can trade and integrate all the information to a map so users can easily go to nearest traders. Another added advantage of such eco-system is that people who don’t even have bank accounts can still trade Ethereum.

The future

Be optimistic about the future, because it belongs to crypto. These currencies are here to stay and will change the fate of banking and transactions. However, which one will eventually take over the world can’t be said just yet.

Get the TNW newsletter

Get the most important tech news in your inbox each week.