GameStop. It’s everywhere: your family members have messaged you about this, the world’s richest man has tweeted memes about this, and there’s also a sea shanty about it.

I don’t blame you if you feel left out of the conversation. However, this piece is not a long-form explainer to explain every character arc in this story. But it’s a collection of well-written articles that can educate you about the issue in a better way.

Before we begin the GameStop saga, however, it’s important to learn one concept that’s central to the whole story: shorting.

Shorting

A vague definition of shorting is betting against a company in the share market. Shorters borrow a company’s stock from someone, sell it to another investor, and wait for that stock’s price to go down. Then the shorter will buy them back for a lesser amount, return these stocks to borrowers, and keep the difference.

For example, a Shorter might borrow 50 shares of XYZ and sell them for $300. Now, they’ll wait for the company to fail and share prices to go down. Once the prices are around $200, they’ll buy it back, and keep the $100 per share difference. The video below explains it well.

Now that short selling is out of the way, let’s see what happened with GameStop.

GameStop history

GameStop was known — and probably still is — as a troubled company. Its share prices hovered around $3-$4 last year. In August, pet ecommerce company Chewy.com’s co-founder Ryan Cohen bought 10% shares of GameStop, and brought two colleagues on the board. Later in the year, Cohen said that the firm is going to have a more digital approach and shut down a lot of its physical locations.

This new strategy excited investors and some new retail investors also bought shares on apps like Robinhood, cause the price to shoot up. This meant people who shorted GameStop had to act quickly. Instead of selling these stocks, some of them borrowed more. And the frenzy started. You can read this in detail on Ars Technica.

Then there was Reddit

r/WallStreetBets is a wild place. Stocks are memes there and it might be a misleading place for someone who doesn’t have a lot of know-how of the market. As Vice notes, it’s “a subreddit filled with chaotic investment advice and surreal memes.”

Members of that subreddit, started to buy and hype the stock up saying that it’s undervalued. One of the motives was to cause losses to short selling investment firms.

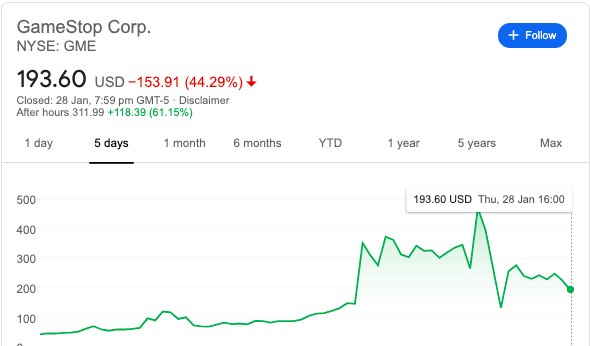

Then other investors from YouTube and TikTok joined in and created a “short squeeze” to increase the GameStop stock price. It’s been a roller coaster ride for this stock, which has gone as high as $469 and as low as $132 in one week.

The Verge has a video on this topic explaining how trading became a favorite activity of many people during the pandemic, and how we arrived at GameStock.

What is happening right now?

- Short-selling firms lost billions of dollars in trading GameStop shares.

- Discord banned r/WallStreetBets, but now it’s back and the company is helping it with moderation.

- The subreddit briefly went private to sort out the moderation issue.

- Trading app Robinhood stopped trading of GameStop stocks briefly, and after outrage, it resumed it in a limited capacity.

- Facebook shuts down Robinhood traders group.

- Politicians including Alexandria Ocasio-Cortez and Ted Cruz criticized the trading app’s freeze. Some of them are demanding a regulation check on the market.

- The Securities and Exchange Commission (SEC) said that it’s monitoring the situation.

- A debate of power balance between retail investors from Reddit etc. v financial institutions is brewing.

- There’s an ugly side to all this as internet users are harassing and doxxing executives of short selling investment firms.

- Quartz has a list of the 10 most shorted stocks that could be next GameStop.

This story is continuously developing and we’ll try and update this piece with more information as we unfold more stuff. I’ll leave you with this.

— it's me kathy ? (@ursulaklesin) January 27, 2021

Get the TNW newsletter

Get the most important tech news in your inbox each week.