Almost one year after Intel first confirmed it was building an Internet TV service, telecommunications giant Verizon announced it had purchased the assets of Intel Media, the arm responsible for developing cloud TV products and services.

The long and short of the deal was that Verizon was taking on board Intel’s yet-to-be-launched OnCue Internet-based TV platform. Erik Huggers headed up the Intel Media brand up until its acquisition by Verizon earlier this year, and now Huggers claims the title of senior vice president of Verizon, while heading up OnCue for the company.

Huggers, who was Director of BBC Future Media & Technology (where he was chiefly responsible for building out iPlayer) before leaving for Intel in 2011, was at the Guardian Changing Media Summit in London yesterday to give a little more detail on the happenings behind the scenes at OnCue – how it all came about in the first place, and the reasons for the change of ownership.

At the time of the deal in January, Verizon said that it would help accelerate “the availability of next-generation video services, both integrated with Verizon FiOS fiber-optic networks and delivered ‘over the top’ to any device.” When this will actually happen, however, very much remains to be seen.

In the beginning

“Originally I was hired as corporate vice president to run a group called ‘Digital Home Group,” explained Huggers on stage. “Not many people know that – because three months into the job, I talked to the board, and said ‘this silicon business that we’re in, I think it’s pretty shit; this was a group that was to sell chips to TVs and set-top boxes and such like. I very quickly came to the conclusion that that was not a great business.”

Three months in, Huggers and a small group of people came up with a plan to “reinvent television”, which they presented to the Intel board – it was greenlighted, it got funding, and the rest – as they say – is history.

This was of course a very bold move from Intel. The initiative was going to steer Intel away from its siliconized semiconductor roots, and into the software-centric media realm. The plan? To disrupt the home-entertainment market, and create a more direct connection with the consumer.

“The previous CEO had recruited me out of the BBC,” said Huggers. “And his vision was that in order to stay relevant in other businesses than the PC and silicon business, i.e. mobile devices, tablets and anything portable, you needed to go into digital media, you needed to have a direct relationship with the consumer.”

This gave birth to the ‘Intel Media’ brand, which grew from a handful of people into an-almost-400 strong team in around 18 months. “We built a complete, modern, end-to-end IP-delivered, over-the-top delivered, live, linear, catch-up TV platform,” added Huggers.

Subscription TV in the States

For those not in-tune with the TV landscape in the US, it’s a very different beast to that of, say, Europe. Indeed, of the 115 million TV households, around 100 million of them subscribe to a pay-TV service. And it’s not cheap either.

“The average revenue-per-user there (US) is in the $80-$100 a month range, but for that you don’t get very much,” said Huggers. Indeed, if you’re looking for more bang, you cold be paying much more than that – Huggers said his own pay-TV bill (in Silicon Valley) is around $170 per month.

But whichever numbers you use, it all amounts to a lot of money. “The upshot of this pay-TV market, is that the total value comes to around $160 billion per year,” added Huggers. “$100 billion of that is subscriptions, and $60 billion from advertising. It is absolutely enormous, and it’s built by a few companies.”

If you look across the board, there’s the distributors and cable companies, big-name brands such as Comcast, Time Warner and so on, and then there’s the broadcasters too.

“Between those groups, there’s probably about nine broadcasters that matter, and about five or six big distributors that matter,” said Huggers. “It’s a very concentrated market, and there’s not a lot of competition there,” said Huggers.

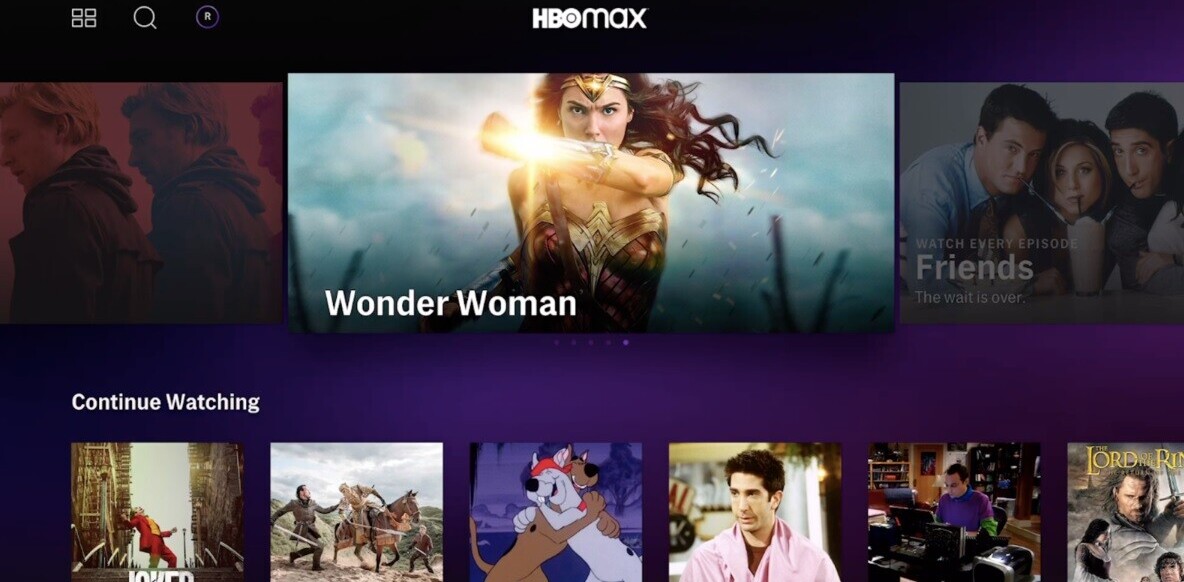

“The idea was, instead of being forced to choose the one cable company that happens to be in your neighborhood, you can now just buy broadband, buy a little device from us, hook it up to your power, HDMI, put in your WiFI access key, and boom…you have beautiful HD quality, live, linear TV, an incredible user experience, and all integrated with the Web services from the variety of providers,” he added.

Huggers also pointed to the fact that annual surveys frequently indicate that the big players in this space are often the most-hated brands, according to the American Customer Satisfaction Index, at least.

“Consumers were ready for change because the product that was offered by these companies for very high price-points, felt like they were from the 1990s,” said Huggers. “Very, very old technology, terrible user interfaces, terrible customer service.”

But the technology side of things was only one facet of this drive. Content is every bit as important as the delivery mechanism.

“The content plan was to go after the existing programmers, so these are the big broadcasters – ABC, CBS, Fox, Viacoms of the world – and license from them the rights to deliver live linear TV over the open Internet,” said Huggers. “The consumer only needs a broadband connection, the OnCue device or mobile app, and they get whatever they want.”

Playing catch-up

From his stint working with the BBC’s iPlayer development division in London, Huggers said he realized how powerful catch-up was – but this is a relatively novel concept in the US.

“This product in this country (iPlayer in the UK) continues to go from strength to strength,” he said. “In the US, catch-up television actually, believe it or not, does not really exist in the way it exists here in the UK. Our plan was to deliver a consistent catch-up experience, not just across one broadcaster, but across all broadcasters.”

What Huggers is talking about, of course, is something just like iPlayer…but for everything. One platform that lets consumers choose what they want, without being shoehorned into paying for a tonne of content they may not desire.

“In the US, one of the big, big problems that consumers have is that they get forced hundreds and hundreds of channels down their throats…[ones] that they don’t want,” he said. “And the only way that it’s currently offered, is that you can buy small, medium or large – bronze, silver, gold. There’s no differentiation, and you have to buy all this stuff that you don’t want. We were going to create a world with smaller, more genre-based packages that allowed consumers to switch on the fly – a modern, cloud-based TV platform, delivered via the Internet.”

TV…if it was invented today

As you already know, things didn’t quite go according to plan at Intel. But that doesn’t mean the project is doomed of course – why else would Verizon have agreed to pay what was rumored to be around $200 million for the business?

The whole premise behind OnCue, quite clearly, was to build a TV platform as though TV itself was just invented. In other words, ignore antennas and satellites, and focus entirely on this wonderful thing called the Internet. But the main reason Intel ditched the OnCue dream, said Huggers, was that CEO Paul Otellini retired and made way for a new guy – Brian Krzanich.

“Paul Otellini is the man who hired me into Intel, he was there for 39 years…straight out of university, rose all the way up to become CEO,” said Huggers. “Paul Retired though, and a new CEO was elected, who had a different set of priorities. And those priorities did not include having a subscription service for media. Those priorities were rightfully so, in hindsight…[but it] still hurts to say it. The [new] priorities were, ‘let’s go make sure Intel becomes a power to reckon with in mobile semi-conductors.”

Huggers added that Intel recognized that what they had built was something “very special”, and instead of just pulling the plug, they told him to …”go find a new home for the team and for the product.”

That sounds all very heart-warming on the surface, but of course there’s also the many millions of dollars that will have changed hands to see this deal completed. Intel had invested considerable resources in the project, so it wasn’t just going to give it away.

But why Verizon, exactly?

“It [Verizon] operates the best and fastest 4G LTE network in the country, with 105 million customers nationwide,” said Huggers. “It operates a very successful pay-TV service too – it’s not as big as your Comcasts, but it has proven itself over the past seven years, with over five million subscribers.”

Throw into the mix its fiber-optic network, and it’s clear that Verizon ticks many of the boxes required when looking for potential suitors to take on all your hard work. But there’s more too.

“[They] own and operate thousands of their own retail stores,” added Huggers. “So direct connections with consumers, which Intel didn’t have at all. If you add all that together, where you already have all the content relationships, where you have the distribution, where you have both the fiber-optic network and the most advanced LTE network, that’s a powerful mix.”

Alrighty…so when can I use OnCue?

There’s still one giant gargantuan question here though. OnCue doesn’t yet exist for consumers to, well, consume. It all seems very much like a pipe-dream, one that has been tarred by the ‘failure’ brush across the media realm. So is it going to happen?

“Let me put it this way – Verizon and its leadership team would not have gone through all this trouble to acquire Intel Media, or the product that we call OnCue, if they weren’t serious about using these technologies to deliver phenomenal consumer experiences, that have the potential to change the media landscape,” said Huggers, somewhat vehemently. “And so my bet, is ‘yes’. I wouldn’t be there if I didn’t think something was going to happen.”

The fact that Huggers referred to it as a ‘bet’ may have been perfectly innocent, or it could be quite telling about the state-of-play with OnCue. Either way, it’s still early days, with the ink on the Intel-Verizon deal still drying – it was only announced in January, while it was finalized just a few weeks back.

It will be interesting to see whether OnCue makes it to market any time soon. But it’s clear that Verizon wouldn’t have taken on Huggers & Co. if they weren’t serious about doing something with it. What that something ultimately is, and when it will happen, is still anyone’s guess.

Feature Image Credit – Shutterstock | Image 1 – Shutterstock

Get the TNW newsletter

Get the most important tech news in your inbox each week.