Hydrogen is being hailed as, if not a silver bullet, then at least a crucial component to decarbonising the world’s energy sources. And no wonder — when burned, hydrogen produces zero greenhouse gas emissions. However, the transition to a renewable hydrogen economy must first overcome a non-insignificant list of challenges.

So-called green hydrogen, produced through electrolysis of water using renewable energy, currently accounts for only about 1% of global production. It is also about three times as expensive as its grey counterpart, produced from fossil fuel sources.

One of the major pieces of the puzzle to scaling green hydrogen is access to vast amounts of renewable energy and water. Enter fully offshore wind-to-hydrogen, where high capacity factor floating wind turbines are connected to electrolysers that utilise seawater.

“What is complex and costly in deploying an offshore [wind farm] site is actually converting the energy at sea and bringing it in a cable to shore,” Stéphane Le Berre, offshore project manager at renewable hydrogen producer Lhyfe tells TNW, adding that for the latest large-scale projects, this part alone amounts to billions of euros.

“One solution for offshore wind park developers to suppress the need for expensive electric substations and cables is to replace them with a hydrogen production plant, which converts the electricity to hydrogen,” Le Berre states. The hydrogen can then be transported through a pipeline — already in plenty of supply in the North Sea, courtesy of the oil and gas industry.

Aiming for green (hydrogen) unicorn status

Founded with six people in 2017 by Matthieu Guesné, today Nantes-based Lhyfe employs 200 people and is present in 16 countries. It has attracted around €80mn in funding, and says its mission is to become a “green unicorn.” Rather than measuring its status in valuation, it hopes to reach a billion tonnes of avoided CO2 emissions. Lhyfe’s onshore site in Bouin, running since H2 2021, currently produces 300kg of green hydrogen per day. One kilogram of hydrogen is the energy equivalent of one gallon (3.78 litres) of petrol, which produces a little over 9kg of CO2 when burned.

That Lhyfe became a hydrogen producer at all is almost something of a side effect. In fact, it came about partly motivated by addressing another aspect of global warming — the oxygen depletion of the oceans.

When producing one kilogram of hydrogen through electrolysis, you also release eight kilograms of oxygen as a by-product. Lhyfe has the intention of pumping it back into the sea, to potentially help restore the balance of marine ecosystems disrupted by climate change.

“When we started Lhyfe, we wanted to make offshore hydrogen so that we would have economic viability to bring oxygen to the ocean,” Le Berre says.

World’s first offshore wind-to-hydrogen pilot

In September last year, Lhyfe inaugurated the world’s first offshore renewable hydrogen production pilot site. In June, the company announced that the 1MW demonstrator project, called Sealhyfe, had produced its first kilograms of green hydrogen. (Chinese state-owned Donfang Electric may have beaten Lhyfe to the actual production by a couple of weeks.)

Sealhyfe is located approximately 20km off the coast of Le Croisic, France. Today it produces half a tonne of hydrogen per day. It is plugged into the SEM-REV powerhub — the first European floating wind farm and site for multi-technology offshore testing.

SEM-REV has an underwater hub, which is like a giant block with four sockets. One of them is used to connect the SEM-REV wind turbine, and another the cable connecting the site to the grid onshore. This leaves two highly coveted sockets available for demonstration projects, one of which now allows the Sealhyfe platform to draw electricity directly from the wind turbine.

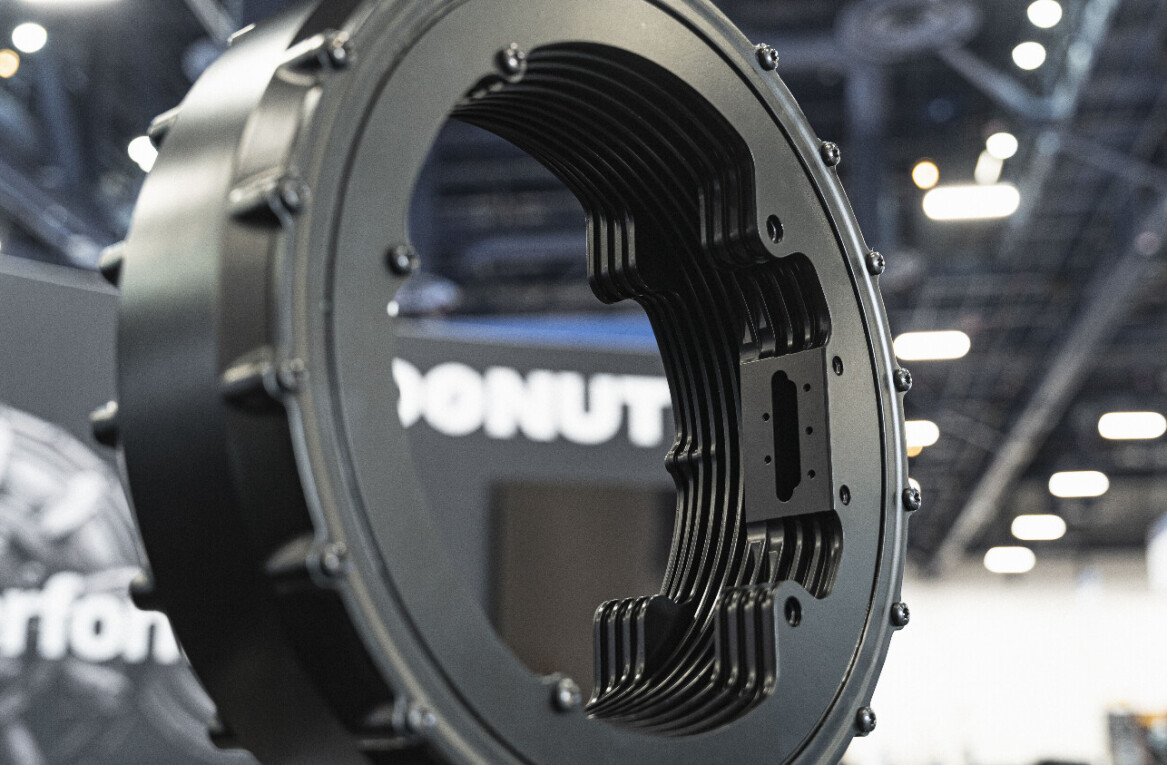

The Sealhyfe electrolyser sits on a floating platform, engineered to stabilise the production unit at sea, and uses desalinated water for the electrolysis. One kilogram of green hydrogen requires nine litres of water, and with potable water scarcity projected to increase significantly over the coming decades, this is one of the main arguments for locating production sites by or on the sea.

Lhyfe has until May next year before it needs to disconnect from the SEM-REV hub. Until then, it hopes to prove not only that the technology works, but that it can withstand even the harsh conditions of the Atlantic Ocean in winter.

Hydrogen HOPE

Lessons from Sealhyfe will inform future offshore projects. This includes the unprecedentedly large-scale 10MW HOPE, which Lhyfe is coordinating with another eight partners. The European Clean HydrogenPartnership program has selected the project for a €20mn grant.

HOPE will produce up to four tonnes of green hydrogen a day. Intentions are to have it up and running outside the coast of Belgium in 2026. By 2030, Lhyfe means to have multiplied several 10MW projects for a total capacity of 100MW.

Across Europe, several other offshore wind-to-hydrogen production projects are beginning to take shape. One is H2Mare, run by a group of industry and academic partners led by Siemens Energy and Siemens Gamesa, the energy giant’s wind turbine division.

“Offshore sites could make it possible for densely populated regions like Europe and Japan to generate at least part of their hydrogen close to coastal demand centres, thereby cutting transportation costs,” says H2Mare’s project coordinator and program manager for offshore hydrogen at Siemens Energy, Mathias Mueller. “Also, wind speeds are generally higher and steadier out at sea, permitting consistently greater output.”

Siemens has invested €120mn into the project, which will not set up a full-scale offshore system, but rather a test platform on a barge on the open sea, along with an onshore test setup of the electrolysis system. It will attempt to prove the financial viability and best configuration for offshore wind-to-hydrogen.

Wise from falling behind on batteries, Europe not sleeping on hydrogen

The German Federal Ministry of Education and Research has chosen H2Mare as one of three flagship hydrogen projects awarded €700mn in total. As part of Germany’s plans of generating 30MW of offshore wind power in 2030, the government has set aside an area in the North Sea for green hydrogen production with a capacity of up to 1GW.

However, the industry is not satisfied with the ambitions. In May, a group including BP, Siemens Gamesa, RWE, and Lhyfe, signed an appeal to the German government, asking it add a target of an additional 10GW of offshore hydrogen production by 2035 to the national strategy and area development plan.

The Dutch government is also pushing the offshore hydrogen agenda. In March this year, it designated an area located in the North of the country, near the Wadden Islands, for a 500MW wind-to-hydrogen project. As a stepping stone, it will develop a smaller pilot project with an electrolysis capacity of between 50MW and 100MW.

“I think Europe was smart enough to bet on hydrogen and to support hydrogen early enough. Because they learned from what happened with the batteries in China, and, of course, anything that Europe has tried to do with batteries was years behind schedule compared to China,” Le Berre says. “Now, Europe has put things in place so that we are on time, and we can actually compete efficiently, economically, and technologically versus China.”

With RePowerEU, the European Commission has set targets to produce 10 million tonnes of green hydrogen by 2030, and predicts that hydrogen — domestic and imported — could make up 14% of its energy mix by 2050.

To support this aim, it intends to mobilise €372bn through the InvestEU program by 2027. For the European startups building electrolysers or creating demand by developing hydrogen-powered planes and cars, this type of industry support might just propel them off the ground — and us toward a cleaner-burning future.

Get the TNW newsletter

Get the most important tech news in your inbox each week.