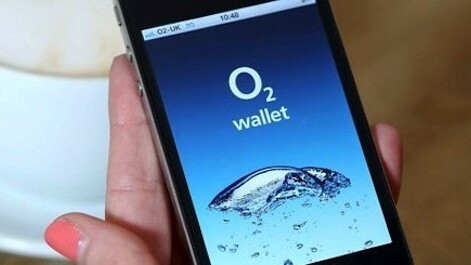

Back in February we reported that UK mobile network O2 was looking to launch a wireless payment service this year. It was rumoured that it was set to apply to the Financial Services Authority for a license that will allow the company to roll out its own payment system without needing a bank partner to do so.

Today the mobile network has finally announced the launch of O2 Wallet, in what it’s calling a “seamless and secure digital wallet service that will deliver the benefits of mobile money to more UK consumers than any other product or service currently available.”

Bold words for sure, but what exactly does it do? Well, the Wallet will let users send and receive money, compare prices and shop via their mobile phone. And crucially, it will work whether they’re an O2 customer or not, as it works via a separate mobile app.

We recently looked at what the future of online banking could look like, reeling in examples such as Barclays Bank’s Pingit which launched earlier this year, noting that it had one eye on usurping PayPal with its money transfer service that uses mobile phone numbers. As with O2’s new system, Pingit doesn’t require the user to be a customer with Barclay’s, and it’s placing its focus in the first instance on getting as many people as possible using the service. A good move, you’ll no doubt agree.

As for O2 Wallet, here’s an over of the key features:

Money Message

O2 Wallet lets consumers transfer money using any UK mobile phone number, and it’s as easy as sending a text message. The so-called ‘Money Messages’ allow users to make daily transfers of between £1 and £500, and is designed to make lending, borrowing and repaying money easier.

Those temporary standing orders and one-off payments requiring you to dig out your dusty card reader? No more.

Mobile shopping

O2 Wallet constitutes a barcode and search engine function to help shoppers compare prices across millions of goods covering around 100 online retailers. They will also be able to tap daily discounts and deals via the ‘My Offers’ icon.

When it launches, these will include discounts and money-off promotions from the likes of Debenhams, Comet, Sainsbury’s Direct, and Tesco Direct.

Your phone IS your wallet….

How do you get money on your mobile phone? Well, you can load money onto your O2 Wallet account using your debit card, by receiving a Money Message from someone you know, or by using cash at more than 30,000 participating outlets, including O2 stores, PayPoint and epay outlets.

The O2 Wallet’s ‘transaction history’ helps you keep tabs on your spending, and you’ll receive texts alerts when your account balance changes – you’ll have access to a 30-day payment history within the app, and a 12-month history online.

Flexible friend: O2 Money Account Card

O2 Wallet will also come with a physical and a virtual O2 Money Account Card. Both cards are based on a Visa prepaid account aimed at consumers wanting to manage their finances, as they can only spend what they put in. Whilst the ‘virtual’ card will work fine for online shopping, you can also apply for the physical card to pay for things in-store and withdraw cash from ATMs. This also doubles as a contactless card, enabling tap-and-go payments at compatible payment points across the UK.

“We welcome the launch of O2 Wallet and are delighted to be enabling the m-commerce experience with a Visa prepaid card,” says Sandra Alzetta, Senior Vice President of Mobile at Visa Europe. “The new service creates an easy and efficient online payment experience for mobile device users, supporting the continued growth of m-commerce in the UK, as well as encouraging contactless payments among those users who choose to take a physical card. This announcement is another step towards an integrated future where the way we pay reflects the full potential of these new technologies.”

Compatibility

O2 Wallet will be compatible with iPhones, Android and BlackBerry smartphones, as well as iPads. Even many without a newfangled smartphone can still use some of the features of O2 Wallet – such as Money Messages, as long as their handset has Web-browsing functionality.

Just to give you a little background on the development of O2 Wallet, it took a team of 250 from a variety of specialist fields including financial payments and m-commerce to produce the technology. In addition, O2 has worked with a number of partners such as global e-payments company Wave Crest; global banking and payment technology provider FIS; digital banking solutions provider Intelligent Environments; G&D for its contactless payment cards; IDT Financial Services Limited which is providing an interim e-money licence and BIN sponsorship whilst O2’s own e-money licence is being approved.

Implications

This is a big move for O2, and it’s one that it’s hoping will firmly ingrain itself in the mobile payments space. The proportion of people using mobile banking increased from 9.7% in 2010 to 20.4% last year, whilst shopping on mobile devices is on course to grow by more than half over the next 12 months. It’s also worth noting that Barclays Bank’s Pingit notched up 200,000 downloads in two days, and we can perhaps expect to see a similar uptake for O2 Wallet.

“O2 Wallet delivers the benefits of mobile money to more UK consumers than any other product or service currently available,” says James Le Brocq, Managing Director at O2 Money. “With O2 Wallet, it’s easier to transfer money, track expenditure and pay swiftly and securely, all using your mobile. We believe it will transform the way people manage their finances and spend money.

“We recognise that security is absolutely key,” he continues. “O2 Wallet has been trialled internally for months and has undergone extensive ‘stress-testing’ with security experts. In addition to PINs and passwords, all personal details and financial data are held on remote central servers rather than on the mobile device itself. This, we believe, is the safest and most secure way to deliver mobile payment services.”

Looking to the future, O2 says that the Wallet will evolve to include near field communications (NFC) technology and enable contactless payments direct from mobile phones. You will also soon be able to use O2 Wallet to top-up mobile airtime and buy train tickets.

➤ O2 Wallet: Android

Get the TNW newsletter

Get the most important tech news in your inbox each week.