The disastrous failure of WeWork’s non-IPO provided not just a dramatic crash-and-burn spectacle, but also a valuable cautionary tale about how not to do an IPO.

Even if your company is not ready to go public at the moment, if there may be an IPO in your future, things go more smoothly for companies that begin the work well in advance.

As a financial manager who consults for public and soon-to-be-public companies, I’ve worked with organizations traveling along a well-planned path, and those with an IPO date looming and management panicking. Here’s what I’ve learned in the process.

Have a business plan that demonstrates a path to profitability

The first tech boom clearly demonstrated the folly of having an IPO with nothing more than “a good idea.”

Now, especially after several high-profile IPO failures, investor sentiment has swung to favor companies that demonstrate a solid growth history and a clear path to profitability.

Go disciplined or go home

Venture capitalists frequently advise startups to focus on five things: product, customer service, growth, market share, and complementary acquisitions.

But it’s important to add to the formula that each of these things must be done with a disciplined focus on the bottom line. In the long run, investors get nothing from “big” or even from “good.” They only reap their reward when your company makes a profit. Consequently, your decisions in each of these areas must be connected to profitability.

Have a management compensation structure that incentivizes future performance

Investors want to see that your financial rewards are linked to theirs, and that you are not in it for the quick buck. The investment community will examine executive compensation for assurance that management is incentivized to work toward a successful future.

Properly structuring compensation packages instills investor confidence, and few would argue with a compensation structure that is back-loaded and tied to stock performance.

Be prudent with related-party transactions

During an IPO, all significant financial transactions will be examined, and nearly every non-ordinary transaction connected to management will undergo thorough vetting for propriety and fairness.

The easiest way to avoid future conflicts is to act properly. Was the transaction approved by an independent board? Were there third-party independent valuations? Was the transaction ordinary and necessary for the company, or if not, was there a management consensus approval process?

It is best to ask these questions and follow an established protocol than to have to defend a transaction after the fact, especially if it’s one that does not meet expectations.

Avoid fickle and non-related acquisitions

Acquisition of a competitor or of synergistic technology is the fastest way to achieve growth and product improvement. Acquisitions should have product or market relevance, add technical expertise to existing endeavors (an “acqui-hire”) or supplement company growth. Anything else diverts management focus and has the effect of eroding investor confidence, while evoking complaints of “what were they thinking?”

At WeWork, for example, one of the company’s acquisitions included an element of related-party conflict, which was viewed as egregious management.

Form an independent, knowledgeable, and diverse board of directors

Is your college roommate sitting on your board? Proper board membership and governance practices are a sure way to avoid questions about your management judgment. Decisions vetted by the board are largely immune from being questioned by future investors, provided your board is demonstrably independent and includes members with subject-matter expertise.

Diversity is important because the best decisions are made with input from many different perspectives. Further, the makeup of your board can serve as an expression of the values of your company.

Plan a capital stock structure to which management must answer

It may go against a CEO’s impulse to retain maximum control over their company, and may not align with the motives of venture capital investors or your board, but shareholders need a say in your company.

A past trend in the IPO market was a stock structure that diluted ordinary shareholders’ input: management and other insiders would hold “Class A” shares, while the public was floated “Class B” shares with one-tenth of the voting rights. This multi-class structure prevented ordinary shareholders from having any real say in corporate governance.

More recently, groups representing shareholder interests have advocated against multi-class stock structures, and even “outed” specific IPOs in the press for using them — sometimes loudly and harshly. Consider the effect being a target of such criticism at a time when you need to generate good buzz about your impending IPO.

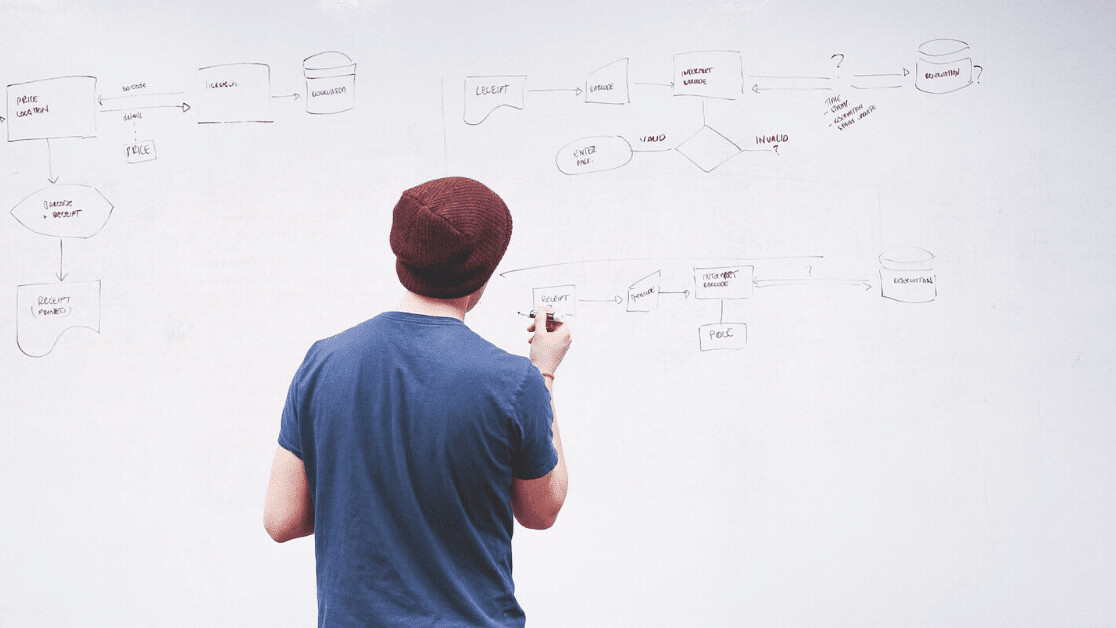

Now is the time to think about an S-1

Even if you’re not yet thinking about going public, now is the time to begin thinking about your S-1 Registration Statement if you’re based in the US. An S-1 is a technical document that provides a comprehensive explanation of your business, its legal and capital structure, and its financial condition. The document also explains how capital will be raised in your IPO and how those funds will be put to use.

During my career, I’ve been brought in to prepare S-1’s for a company planning for an IPO more than two years in the future, and for another company that was just a few months out from a public offering. It’s not difficult to guess which of those two companies spent more money and suffered more angst.

In the first company, the experienced CFO was aware that the task of preparing financial statements to meet SEC filing requirements would need to be done — it was only a matter of when. So doing the work internally, under normal operating conditions, kept things relatively simple and cost-efficient.

In the second company, whose well-publicized IPO was anticipated by investors, auditors were still working on past financial statements just three weeks before the anticipated offering date. Aside from the deadline pressure, performing this task at the last minute was extraordinarily costly, but management had no choice.

It’s important to note the SEC generally requires three years of audited financial statements to be presented in an S-1, but investors often like to see revenue and expense statements going back as far as five years. Even if you feel your company does not require full audits at this point, compiling organized and well-documented financial statements well in advance of your specific plan for an IPO will serve the process well, making an audit easier and less costly.

Prepare for serious scrutiny

Leading up to your IPO, issues that play out in the press or presented in disclosures are what the public sees. But like a duck crossing a pond, the calm appearance on the surface might contrast with the frenzy below.

Marc Benioff, co-CEO and Chairman of Salesforce has said for CEOs, a public offering “cleanses their company of all the bad stuff. It forces them to apply the regulations necessary to have a clean company.”

Applying the regulations means you will have accountants and lawyers looking over every aspect of your company’s past and present, and they in turn will be watched closely by your board, your VCs and your underwriters. One cannot overstate the organizational disruption this process creates.

Mistakes during the IPO process provide an excellent opportunity for a shareholder lawsuit, so these professionals must exercise due caution in everything they are required to examine.

It’s hubris to believe that past indiscretions will not surface. So if any exist, deal with them early rather than waiting until the months just prior to your IPO, when the focus should be on creating positive buzz.

Make a timeline — then throw it out

Even to the extent planning a timeline is possible, there are factors outside your control: the economy, competition, unanticipated financial performance, or changing IPO market conditions.

All of the steps necessary to take a company public, even if carefully planned, create an organizational disruption. That means it’s wise to build in more time than you think you’ll need. In other words, during the IPO process, you can always expect the unexpected. But you can also be prepared.

Get the TNW newsletter

Get the most important tech news in your inbox each week.