Nokia just announced its Q1 2012 financials which saw global sales of its Lumia range increase by approaching one-third (27 percent) on the previous quarter, with 5.6 million units sold.

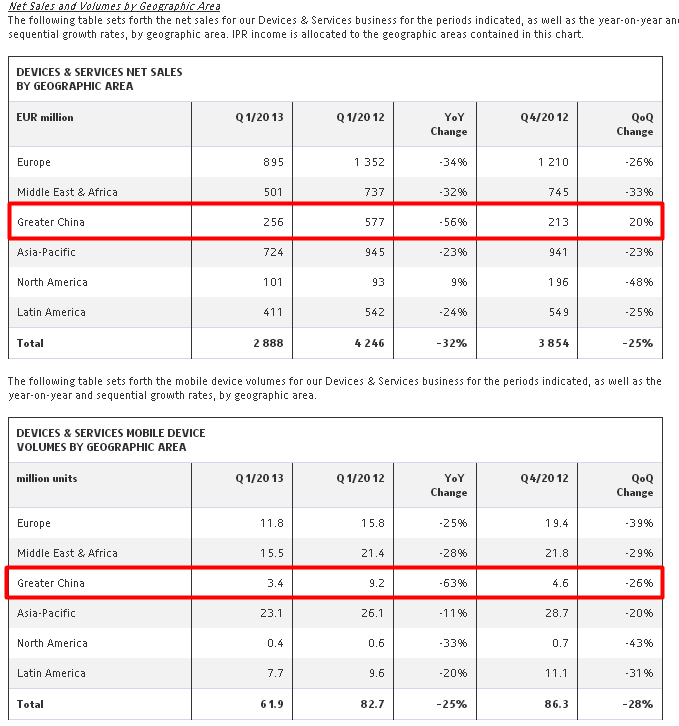

Despite that growth, the figures mask a real problem. Nokia’s raw sales figures show a decline in sales across all markets bar North America, with China a particular stand out. Device sales across the Greater China region hit 3.4 million units, that’s down 26 percent on the previous quarter and a massive 63 percent lower than Q1 2012.

(See bottom of post for global sales and revenue charts.)

No new year retail boost

This is concerning for a number of reasons. The quarter covered Chinese New Year, a boom time for retailers — especially mobile, tablet and other electronics firms — since millions of Chinese exchange presents to celebrate the Lunar New Year. Plus, added to that, Nokia has struck a number of promising deals that had been expected to boost its flagging presence in China.

The most notable deal saw the Lumia 920T launch with China Mobile in late 2012. With a full quarter of business behind it, the device was full of promise given that the operator — which has the world’s largest customer base: more than 700 million — does not sell Apple’s iPhone, which makes the Lumia 920T one of (if not THE) premier 3G smartphones on its network.

Nokia doesn’t break out its Lumia sales figures by geography, nor does it break out regional sales by device type, so it is possible that its Lumia sales might have grown in China. But, against a backdrop of lowering figures across nearly every international market, that seems unlikely.

A quote from Nokia suggests that its smartphones grew in China and revenue in the country grew 20 percent on the notoriously quiet Q4 2012 in China. Yet, Greater China sales were down 26 percent quarter-on-quarter and revenue came in 63 percent lower year-on-year, showing that the company has much still to do in China:

On a sequential basis, net sales decreased in all regions except Greater China where the increase was primarily due to our Smart Devices business unit.

Struggling amidst tough competition

Nokia says that its overall sales were “negatively affected by competitive industry dynamics”, and the competition in China is arguably more intense than most markets. A bevvy of local manufacturers sell forked Android devices at prices that are far lower than those of Nokia, Samsung and Apple’s flagship devices.

Xiaomi, which is one of the best examples of the bunch, expects to sell 15 million of its Mi smartphone range this year — according to AllThingsD — which is more than double its 7.19 million sales in 2012. Those projected China-only sales numbers may come in higher than Nokia’s global Lumia sales in 2013 — indicating the potential of China for those that can get it right.

Apple releases its Q2 2013 figures — covering the same period as Nokia’s Q1 2013 — on April 23, and its figures are likely to include a pronounced spike in sales across Greater China, and to a lesser extend Asia generally (parts of which celebrate Chinese New Year), and that’s exactly what Nokia will have been hoping for.

The fact that it fell well short indicates that the company is still to figure out the Chinese market. Given that it is the world’s largest smartphone space, with the potential to grow further, and that Samsung (which recently became the top smartphone seller there) and others are performing well there, China is rapidly becoming a big problem for Nokia.

It’s hard to know what Nokia can do differently in China, aside from dropping its prices — which is unlikely given that Xiaomi’s phones alone retail at around half of its high-end Lumia range.

Certainly things don’t look good at all. Nokia quietly closed its flagship Shanghai store last month. Strategy Analytics ranked it a lowly seventh on smartphone sales in China, behind a range of competitors, including Lenovo, Huawei and even local manufacturer Coolpad.

Headline image via Shutterstock

Get the TNW newsletter

Get the most important tech news in your inbox each week.