Thomas Clayton is the CEO of Bubbly, a social media startup backed by Sequoia Capital, SingTel Innov8, and JAFCO.

It’s clear that the Messaging Age is among us. As Facebook becomes more of a place for parents, potential employers and schools, coaches, etc. to check up on people, young users no longer want to use it as a place to have uninhibited social interactions with their friends, and they’re increasingly choosing to log out.

Furthermore, users are getting sick of the lengthy text updates and exhaustive photo albums clogging up Facebook newsfeeds. It’s becoming obvious that we’re entering an era of brief, impactful, fun sharing with our closest circles.

Noticing its potential fall from grace, Facebook made the smart move of purchasing WhatsApp for $19 billion. A lot of people are calling this price tag outrageous, but messaging services like WhatsApp are putting up staggeringly high numbers of active users, which is so extremely valuable in the social space today.

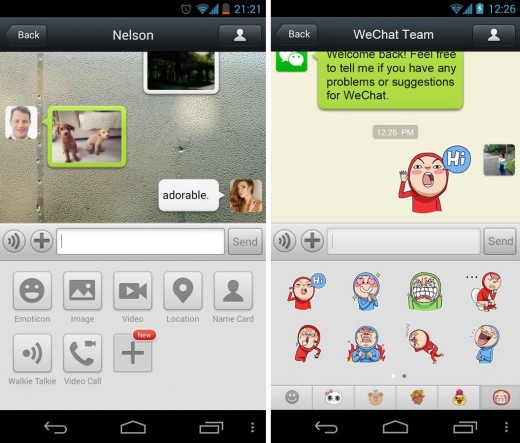

The three messaging services that have what it takes to follow WhatsApp in receiving a hefty acquisition deal all hail from Asia: KakaoTalk, WeChat, and LINE. These services have a lot of similar features, such as the ability to share photos, videos, audio messages, location, and stickers with friends, access to celebrity accounts, discover unknown users by shaking the device, and robust gaming platforms.

The business models of these services take a different approach than that of WhatsApp. Instead of one year of free service and charging $.99 per year after that, these Asian services offer a free app download with no subscription fee and have all sorts of virtual goods available for purchase within the app. This model works very well in Asia.

Each one is very capable of being the next big messaging service to sell for a ridiculously hefty sum, but which one will win global market share? Here’s a breakdown of what could contribute to the outcome of this matchup:

KakaoTalk

Advantages:

KakaoTalk has a lot going for it with more than 130 million registered users and over 95 percent penetration among smartphone owners in its native Korea. No one is quite sure what their MAU numbers are though, as they don’t break them out.

The company’s gaming division led the way in monetization a couple of years ago with the mass popularity of games like Anipang and Dragonflight, and to this day it remains a key source of revenue for Kakao. Cracking the code to gaming success isn’t always easy, but Kakao achieved it and is reaping the rewards.

From its launch in 2010, KakaoTalk has always led the market in terms of coming out with features and innovations first. This includes its very first creative way of growing virally: it was free to download, and it automatically registered friends through users’ stored phone numbers instead of requiring individuals to register.

Of course, that gave the service a nice head start on the other two, which launched later and mostly spent the first year duplicating features from Kakao.

Kakao is currently prepping for its own IPO at a rumored $5 billion valuation.

Potential Pitfalls:

Unfortunately, recent signs show the service is losing its influence. Its once skyrocketing gaming success is dwindling, as none of its new game releases is getting the kind of downloads that Anipang and Dragonflight received. The company quickly needs to find a new source of revenue, as it relies too heavily on this arm of its business.

Also, WeChat and LINE seem to have an advantage on KakaoTalk in terms of global presence. This is partially due to its lack of sufficient funding. Compared to its deep-pocketed rivals backed by much larger Internet stalwarts, Kakao has fairly shallow pockets, making it even more important to keep its innovation and creative edge over the others.

Advantages:

WeChat, spawned from Internet giant Tencent, has surpassed an impressive 355 million monthly active users. The service has also expanded much faster and broader into so many more areas than its competitors with mobile payments, a taxicab booking service, and even extensive financial services.

When you’ve got a company like Tencent behind you, you’ve got some serious monetary resources. This has helped WeChat accelerate its growth overseas, which is easily apparent just from walking down the street anywhere from Mumbai to Jakarta, where you see WeChat advertising with famous local celebrities plastered everywhere. The service has even brought on very big-named ambassadors like Lionel Messi and LeBron James.

And while there has been a lot of fuss made over WhatsApp’s acquisition price, it is rumored that Tencent may be considering spinning off WeChat with its own IPO later this year at a $30 billion valuation.

Moreover, WhatsApp’s valuation is based mainly on its massive user base, whereas WeChat’s valuation is based on its phenomenal revenue growth. WeChat just turned on their monetization levers late last year and is already projecting $1.1 billion in revenue this year.

Potential Pitfalls:

WeChat’s main concern is building a large active user base outside of its native China. While it has become the de facto platform in China, it has yet to become the number one messaging app in any other country.

It has certainly spent a significant amount of money on acquiring new users, but it remains to be seen if these efforts will result in an active, sticky user base that grows larger than the other dominant players in various key countries.

LINE

Advantages:

LINE recently announced it has over 360 million registered users using its service – a number that is even more impressive given less than a quarter of those users are in its native country of Japan. Although, just like Kakao, LINE doesn’t break out its monthly active users so we can’t quite achieve an apples-to-apples comparison in this regard.

One thing LINE has proven is that it knows how to monetize, and monetize well, as it is leading all messaging apps with $338 million in revenue last year and $156 million in revenue last quarter.

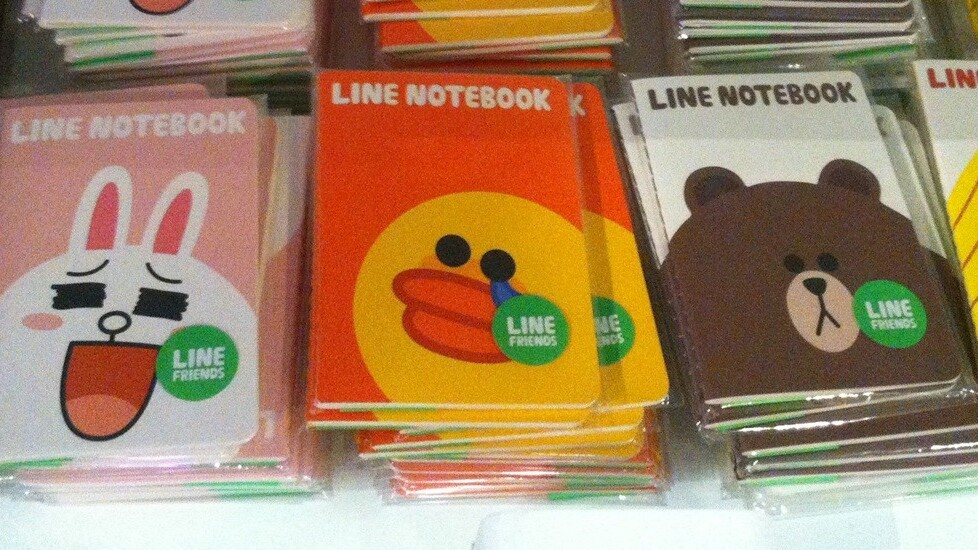

LINE’s stickers (known as “stamps” in Japan) have developed a cult-like following with hundreds of packs being added via third parties. These grew to a sizable revenue scale in just a year, earning the company nearly $70 million in sticker revenue last year alone, which represents roughly 20 percent of LINE’s overall revenue last year. This subset of LINE’s earnings is probably more than WhatsApp’s total revenue last year.

The company is also rumored to be considering an IPO with a valuation of $28 billion. And that price was estimated last year – long before WhatsApp’s acquisition.

Potential Pitfalls:

One major issue for the service is that it is struggling to appeal to Western users. The user experience is a bit too cluttered and overwhelming for U.S. users, who are used to super simple apps that do a few things very well rather than apps with many buttons and options.

Each of these services has done extremely well at capitalizing on trends at the right time and accumulating a significant user base, but which one will break away from the pack to be the next big messaging acquisition? Or will they all dominate particular countries and none actually grow to dominate all of the countries across Asia?

Only time will tell if some of the above factors will eventually knock any out of the running or if they’re merely speed bumps on one’s rise to the top.

Get the TNW newsletter

Get the most important tech news in your inbox each week.

![[Graph] KakaoTalk Passes 100M Users](https://cdn0.tnwcdn.com/wp-content/blogs.dir/1/files/2013/07/Graph-KakaoTalk-Passes-100M-Users-520x641.jpeg)