In a symbolic move, Nasdaq will phase out United Airlines from its popular tech stock indexes and will instead use DocuSign — the electronic signature firm whose stock price has near-doubled in 2020.

As of next Monday, the San Francisco-based DocuSign will sit alongside the likes of Tesla and Zoom in the NASDAQ 100 (NDX) index, which tracks the top non-financial companies listed on US stock exchanges. NDX is widely regarded as a solid benchmark for the tech industry.

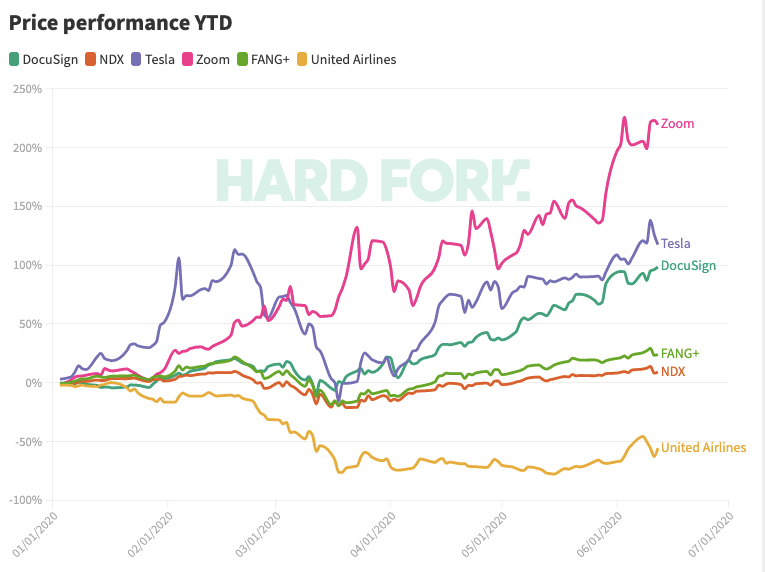

After comparing the market performance of the two companies, it’s easy to see why Nasdaq is replacing United Airlines with a ‘stay-at-home’ stock like DocuSign.

United Airlines stock collapsed after COVID-19 brought the tourism industry to a halt, down more than 55% for the year as of Friday’s market close.

DocuSign, on the other hand, is up an eye-twitching 98%, propelled by soaring revenues. Apparently, businesses worldwide have had to figure out how to sign important documents digitally — and DocuSign has positioned itself to help bridge the gap.

But COVID-19 hasn’t just been a boon to DocuSign. The tech industry, in general, has rebounded since the coronavirus pandemic laid waste to global stock markets.

The NYSE’s FANG+ index (which tracks Facebook, Amazon, Apple, Google, and Netflix) is up 24% in 2020, while the wider NDX has risen 8.9% and broken record highs.

DocuSign might be boring, but its subscriptions are hot

DocuSign’s market resilience is still impressive considering how little hype it generates. After all, its stock has performed somewhat similarly to Tesla — and while DocuSign CEO Dan Springer seems like a nice guy, he hasn’t exactly attracted a cult of personality on the same level as the enigmatic billionaire Elon Musk.

DocuSign has posted some healthy results this year. Back in March, the company revealed it had generated nearly $1 billion in revenue last fiscal year, up 40% year-on-year.

[Read: Bankrupt Hertz targets Robinhood traders in plot to dump $1 billion in stock]

Investors are also likely to appreciate DocuSign’s strong subscription base. The company billed clients $366.9 million last quarter — an increase of 40% based on the same quarter in 2019.

But whether you’re DocuSign or Tesla, it’s hard to beat Zoom in 2020: $ZM has more-than tripled from $69 to $228; which means if you invested $1,000 in the free video calling app on January 1, you’d now sit on a cool $3,300.

Get the TNW newsletter

Get the most important tech news in your inbox each week.