LearnVest‘s mission is to make financial planning more accessible for everyone, and now it is taking a major step towards realizing that goal with four important announcements. Today, the company is updating its financial planning subscriptions and releasing a redesigned free money management tool, while announcing its newfound status as a Registered Investment Advisor and teasing its first iPhone app.

Diving deeper, LearnVest’s 3-tier financial plan is receiving a new Portfolio Builder option, which brings in investment advice that’s coupled with the five-year financial plan. The plans now run as follows: Budget Starter ($89/yr), 5-Year Planner ($349/yr) and Portfolio Builder ($599/yr).

LearnVest’s updated Money Center, a free money management tool (like Mint), brings in a number of improvements, all of which make it significantly easier to see where your money’s going and how much of your budget has been spent.

From LearnVest CEO Alexa von Tobel:

LearnVest is committed to helping people make the most of their money, by offering unbiased advice that is easy to consume and take action on. Financial advice is our first, most important touch point with people, and now we’re excited to introduce investment guidance to help our members really make the most of their money.

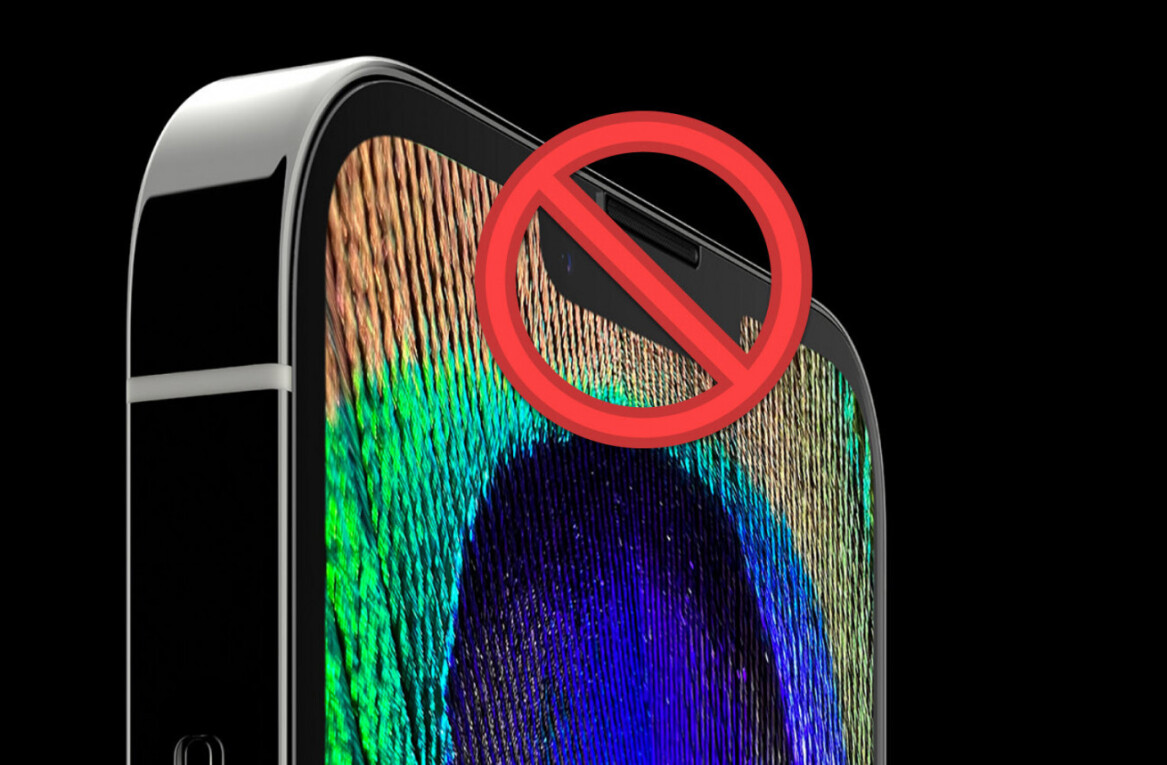

As for the tease of the company’s upcoming iPhone app, it will arrive this October and allows users do things like monitor their spending budgets on the go. The upcoming app also reflects a subtle shift that LearnVest is taking as it moves from a female-focused service to something for everyone. We talked with Alexa von Tobel to learn more:

We believe that financial planning is essential for everyone. As our users have brought their partners and spouses to the brand, we have continued to evolve to meet their needs. Additionally, with our new paid products and free tools, we’re attracting a wider audience in general. Making personalized financial planning easy to access and easy to understand is what all our users love about our service.

With 50 full-time employees in its new NY office, LearnVest is growing quickly in a space that doesn’t seem too sexy at first. Managing your money doesn’t always sound like much fun, especially when you know loans or other debts are bound to be involved.

As we said above, LearnVest’s goal is to make real financial planning, a service that traditionally costs thousands, available to everyone. Judging from how customers have responded to the service, it’s clear that LearnVest is changing the lives of people who never realized how helpful (and healthy) a financial plan can be.

Featured image: Les Chatfield

Get the TNW newsletter

Get the most important tech news in your inbox each week.