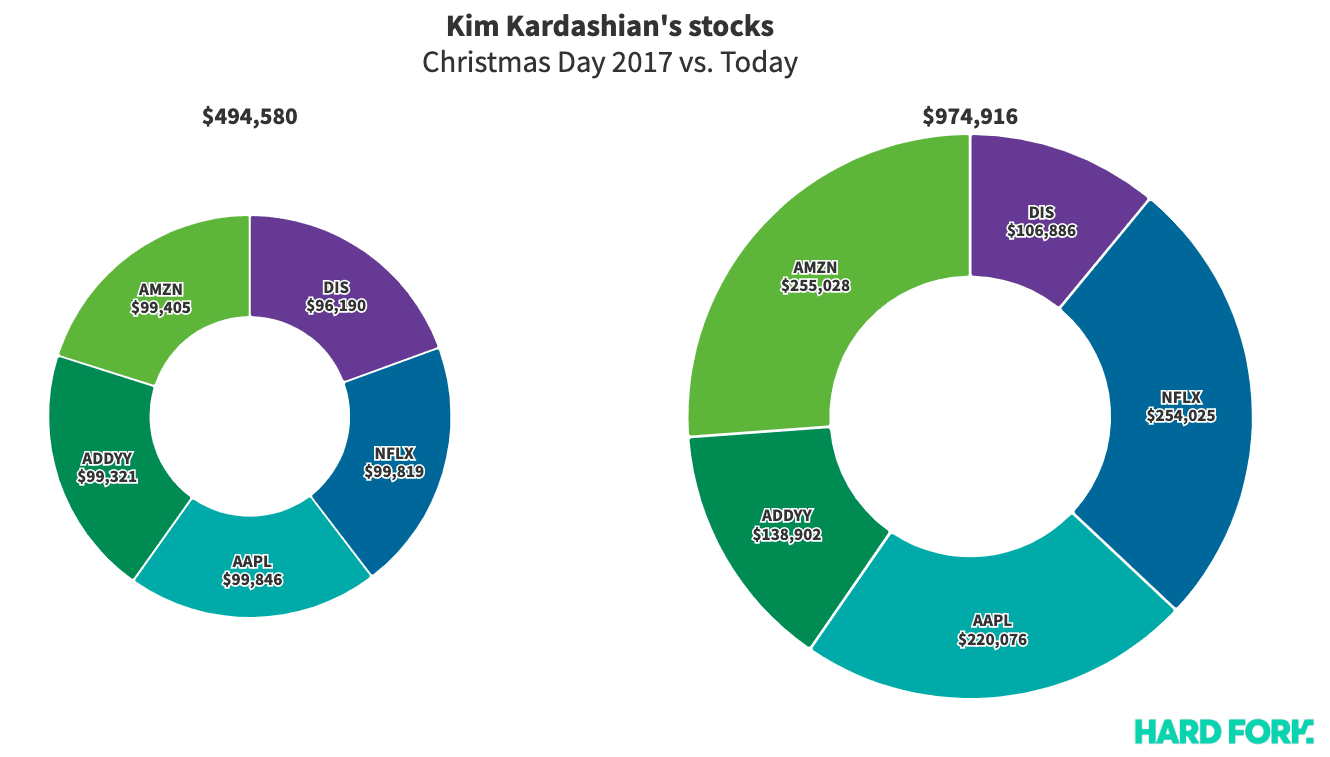

Two and a half years ago, Kim Kardashian received an extremely thoughtful gift from her rap icon husband Kanye West: a collection of five stocks apparently worth $500,000.

Turns out Kardashian’s bundle of shares, which included Disney, Netflix, Apple, Adidas, and Amazon, is now worth nearly $1 million, performance that puts Warren Buffett’s flagship firm Berkshire Hathaway to absolute shame.

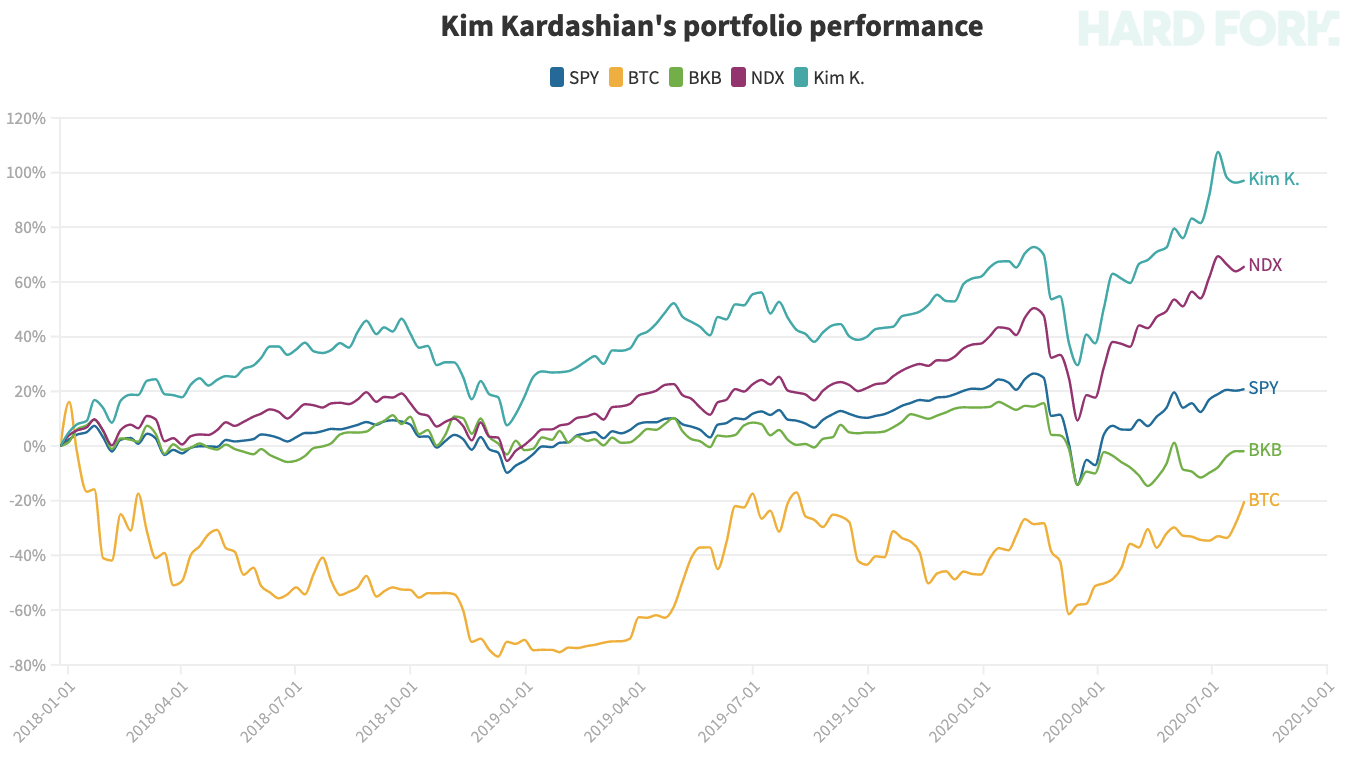

Kardashian’s portfolio eclipsed major indexes like the S&P 500 (SPY) and the NASDAQ 100 (NDX) in a big way — despite the latter setting new price records in 2020.

[Read: 84K Robinhood traders at risk of ‘bagholding’ after Kanye threatens GAP]

Even Bitcoin (which would’ve been extremely popular at the time) underwhelms compared to Kardashian’s stocks. BTC has fallen 20% since December 26, 2017, while Kardashian is up 97%.

Kim Kardashian’s stocks, ranked for performance

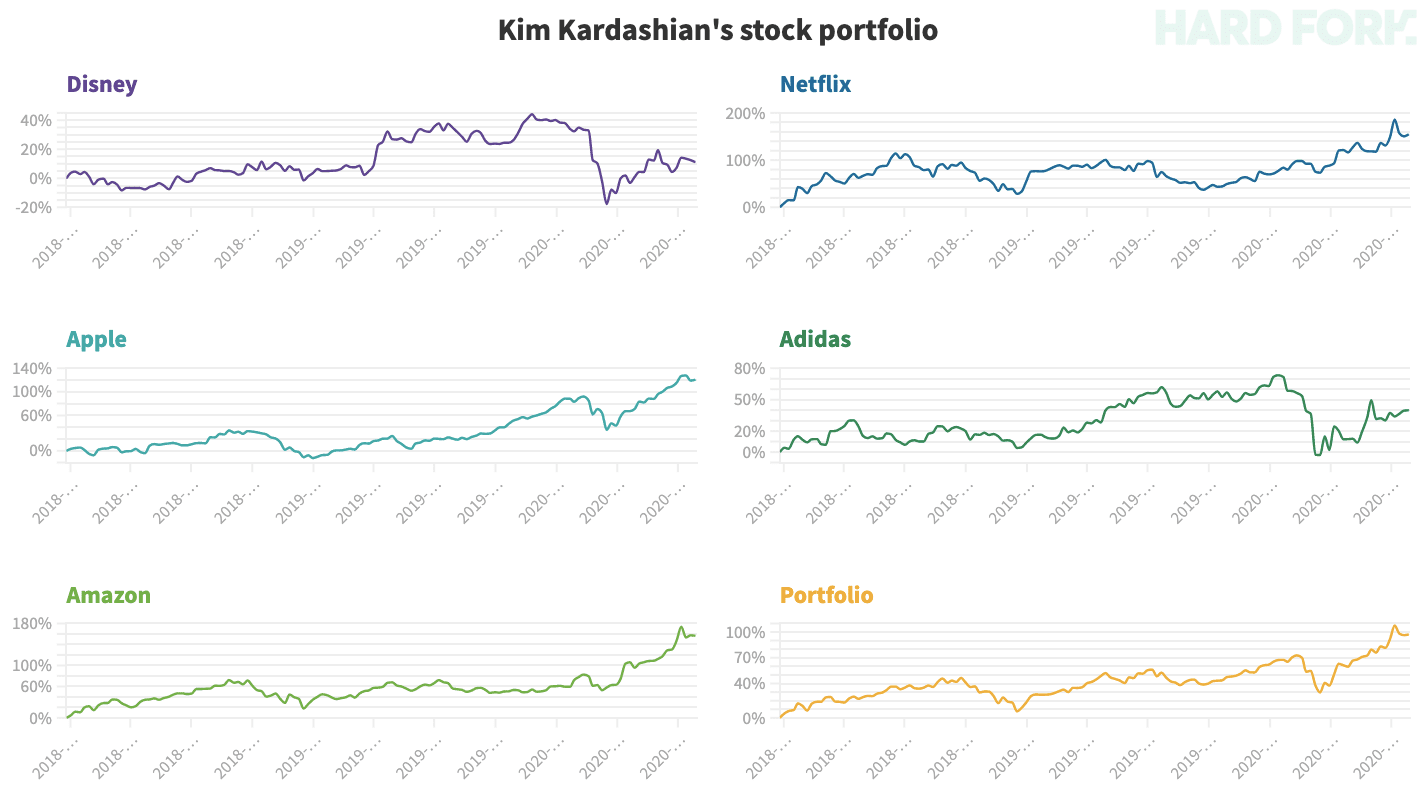

Kardashian can thank stellar performances from streaming giant Netflix (+154%), iPhone peddlers Apple (+120%), and ecommerce lord Amazon (+157%) for most of her gains.

That isn’t to say Disney and Adidas were bad calls. Both $DIS and $ADDYY are still in the green since 2017’s Christmas, up 11% and 40% respectively.

On the other hand, Buffett’s Berkshire is down 1.91% over the same period. Berkshire’s portfolio mostly consisted of old school bank stocks leading into the coronavirus pandemic, dragging down its returns.

[Read: The ‘average’ Robinhood trader is no match for the S&P 500, just like Buffett]

But let me reiterate: Kardashian’s portfolio of stocks — while admittedly under-diversified — constantly outperformed Berkshire over the past two and a half years, and recovered far quicker in the wake of global financial meltdown.

Queen.

[H/T Market Realist]

Get the TNW newsletter

Get the most important tech news in your inbox each week.