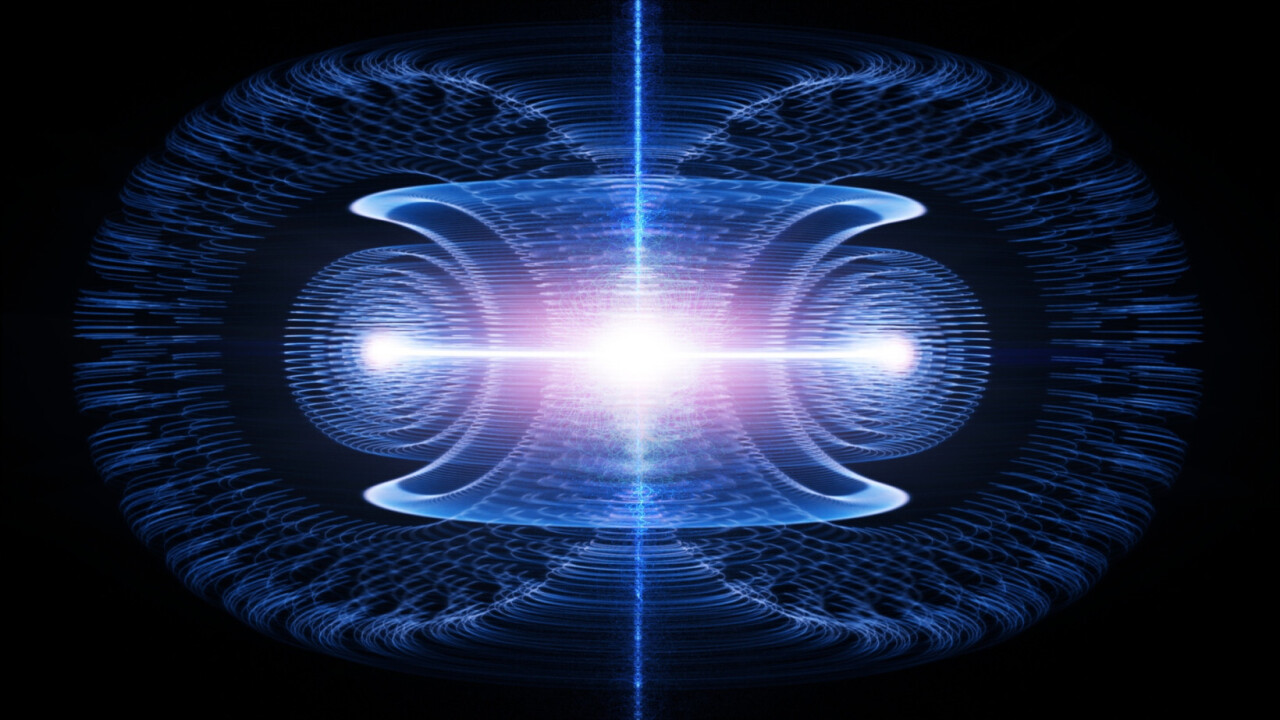

ITER, set to be the world’s largest experimental fusion reactor, has been delayed yet again. The €25bn megaproject will only switch on in 2034, and start producing energy in 2039. That’s almost a decade later than originally planned.

Thirty-five nations including the UK, US, China, and Russia launched ITER in 2006 to demonstrate the scientific and technological feasibility of fusion power. But startups may end up beating them to it.

As private companies race to commercialise fusion energy, it’s increasingly clear that ITER will take on a more supporting role. But that doesn’t mean it’s obsolete.

We chatted to some of Europe’s biggest fusion energy startups to find out more about what the latest ITER delays mean for the industry going forward. For some, the challenges exemplify the need for better collaboration between private companies and governments — both of whom want the same thing: to unlock a virtually limitless, safe, and clean energy source for humanity.

Leading the charge

“Delays in the public sector mean ITER is unlikely to arrive in time to have a meaningful impact on the energy transition and the clean energy baseload required by 2050,” Ryan Ramsey, COO at First Light Fusion, told TNW.

“The private fusion sector is developing viable fusion schemes at a rate of progress that is much faster.”

First Light is developing a reactor based on the science of inertial confinement fusion that it believes is “going to be faster and cheaper” than the tokamak machine ITER is building.

When it comes to harnessing fusion energy, there are many ways to skin a cat. The most well-researched is magnetic confinement, used in devices like tokamaks and stellarators, which use powerful magnetic fields to contain hot plasma. Then there’s inertial confinement fusion (ICF), where intense laser beams compress fuel pellets to achieve fusion conditions, as seen in the US National Ignition Facility. Many variations exist between these two paradigms.

First Light is pursuing a form of ICF called projectile fusion, which shoots something akin to a copper coin at tremendous speed into a target containing fusion fuel.

“While ITER has produced critical scientific learnings, including for us, it is simply not relevant to what we are doing,” said Ramsey. “We are a nimble, fast-growing company that is developing our technology at a rapid pace. The news on ITER simply reinforces our strategy to keep going.”

For First Light, ITER is not as useful as it might once have been. But that doesn’t necessarily mean it’s useless.

Joint effort?

“Private fusion industries benefit from the research and development done by ITER in several ways,” Peter Roos, CEO at Stockholm-based Novatron, told TNW.

ITER is one of history’s biggest science experiments, and has already achieved a number of engineering breakthroughs in its almost 20 years of development. These include advancing the science of magnets, heat-resistant materials and tritium-breeding — a process critical to a self-sustaining fusion reactor.

Nevertheless, Roos still believes that a “private initiative” will be the first to deliver a commercially viable power plant.

Ross’ company, Novatron, is pursuing a novel type of magnetic confinement fusion known as a “mirror machine.” The startup claims its design solves one of fusion’s biggest conundrums — keeping plasma stable.

“For me, the delays at ITER are not a surprise,” said Roos. “But it does emphasise that ITER should start prioritising the development of common technologies that are of value to the private industry.”

This sentiment is echoed by Tokamak Energy, Europe’s best-funded fusion startup, headquartered in Oxford, UK. Company spokesperson Stuart White told us that the company would like to see more knowledge exchange between ITER and private companies.

ITER launched its first-ever public-private workshop in May, as it looks to foster a “cross-sector approach to fusion innovation” in response to the “changing fusion R&D landscape.”

“We are encouraged by ITER’s willingness to share information and be more open and collaborative,” said White.

When ITER was launched, there were five fusion startups, now there are almost 50. As these companies race to commercialise fusion energy, it’s increasingly clear that ITER will take a back seat.

However, these companies still face huge challenges. All are still in the R&D phase and have yet to demonstrate net energy gain — the point at which more energy is produced in a fusion reaction than is used to create it — let alone build a reactor that produces electricity at a competitive price.

Faced with these hurdles, tapping the expertise of ITER simply makes sense. With climate change worsening, and the need for clean energy greater than ever, both the public and private sides of the industry would do well to fuse together, not apart.

Get the TNW newsletter

Get the most important tech news in your inbox each week.