Rivian today showed that people “will come” even before you build it. Today, the electric truck manufacturer raised a massive $11.9 billion in its initial public offering (IPO). This is the biggest so far this year and the sixth-largest ever on a US exchange. It trumps Uber which raised $8.1 billion in 2019.

The company, founded in 2009, is now valued at more than $77 billion — nearly as much as traditional companies Ford and General Motors. It was briefly valued at $104 billion after trading began.

Shares were offered at $78 each — above the previously estimated price between $57 and $62, showing there’s a keen commitment to buy. Pretty good for a company with almost no revenue from actual vehicle sales.

I spoke to Maxim Manturov, Head of Investment Research at Freedom Finance Europe, just before the IPO, who explained:

Rivian’s two consumer products, the Rivian R1T and Rivian R1S received over 48,390 pre-orders as of the end of September, while its commercial vehicle, Rivian EDV, received substantial orders and investments from Amazon.

By 2025, Amazon will own 100,000 EDV’s, with 10,000 to be purchased by the end of 2022.

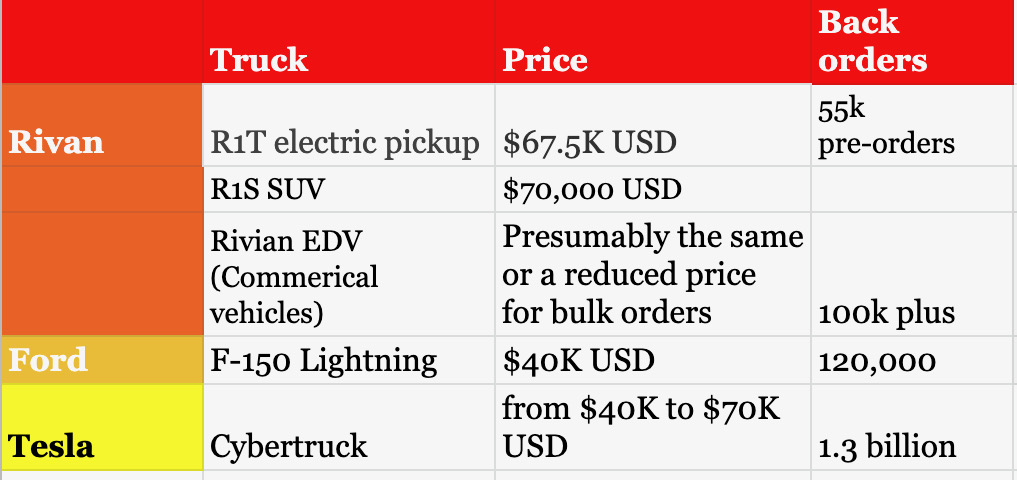

Entering a dominant market: How does Rivian stack up against its two main rivals?

Ford will be releasing its F-150 Lightning truck in 2022, and like the Rivian R1T, it also has a 480km driving range. But the F-150 is over $20k cheaper than Rivian. So far, the F-150 has secured 120,000 reservations.

Further, Tesla’s cybertruck has a reported reservation backlog of a massive 1.3 million and will cost consumers between $40,000 and $78,000 — the latter with all the bells and whistles.

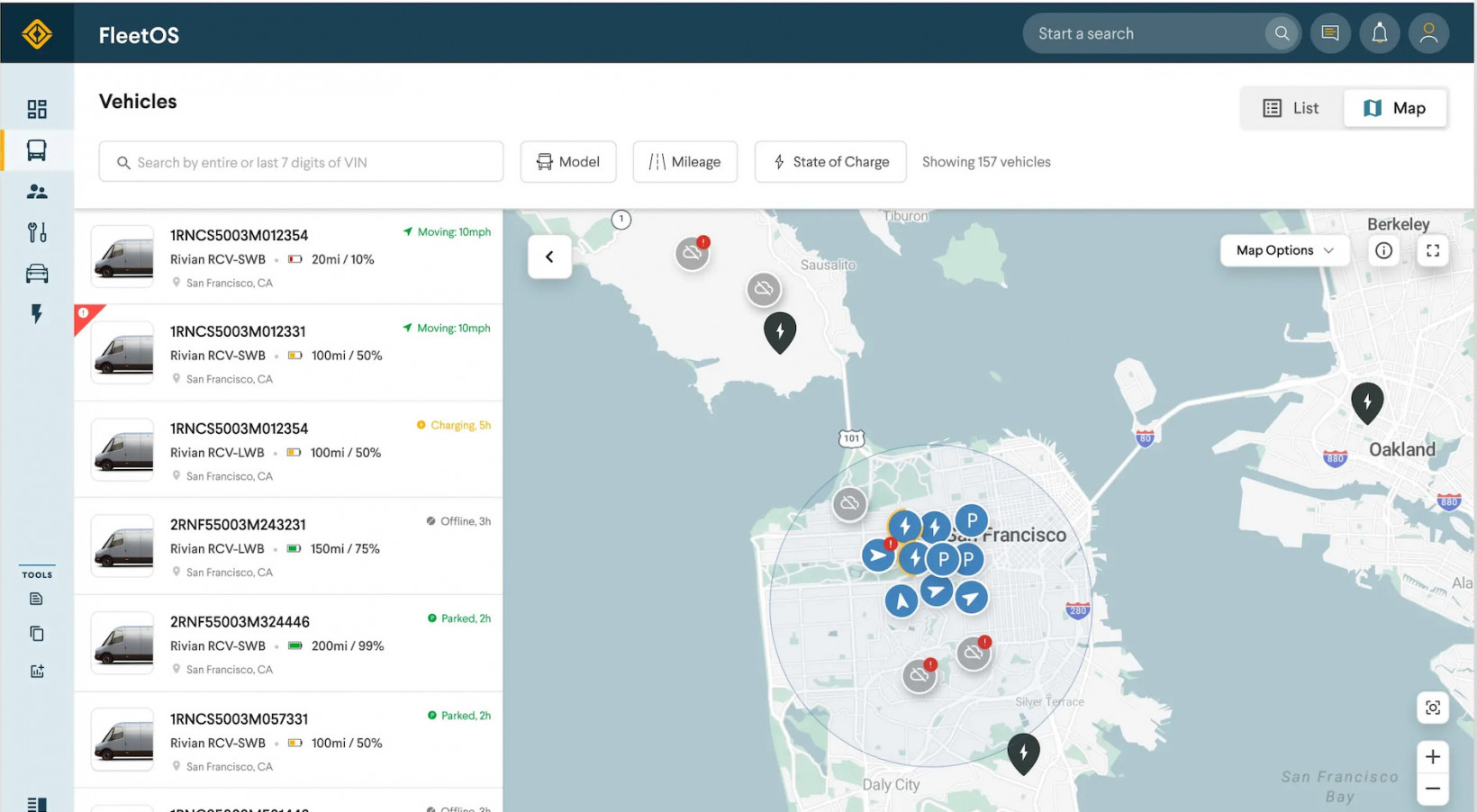

Rivan Fleet is no longer exclusive to vans for Amazon

Besides news of a sexual discrimination lawsuit against Rivian last week, the company launched the Fleet section of its website on Friday. This is despite a previously exclusive deal with Amazon for van manufacturing.

It also plans to sell the R1T electric pickup truck and R1S electric SUV in fleets with a corresponding fleet management platform called FleetOS and a charging infrastructure solution.

Manufacturing is slow – can they keep up with demand?

Of course, the challenge will be if Rivian can keep manufacturing up with an influx of orders, especially given the supply chain problems and semiconductor shortage affecting the whole auto industry.

Rivian’s filing with the Security and Exchange Commission reveals worrying manufacturing numbers:

In the consumer market, we launched the R1 platform with our first-generation consumer vehicle, the R1T, a two-row five-passenger pickup truck, and began making customer deliveries in September 2021.

As of September 30, 2021, we produced 12 R1Ts and delivered 11 R1Ts, and as of October 22, 2021, we produced 56 R1Ts and delivered 42 R1Ts.

These numbers are woeful considering that Rivian plans to deliver an order of 100,000 electric delivery vans in the next three years, with only 10 delivered by the end of 2021.

Rivian only started delivering the R1T to primarily employees in September and plans to only make about 1,200 vehicles by the end of the year.

According to the IPO filing, its plant in Normal, Illinois, can produce up to 150,000 vehicles annually. The company plans to ramp up to 200,000 vehicles by 2023.

The securities filing also revealed that Amazon holds a 20% stake in Rivian Automotive. The behemoth has more than $1.3 billion in Rivian to date. It’s likely they’ll honor these orders first.

Can Rivian stand up against the brand that is Elon Musk?

Manturov also said that brand recognition might prove to be a challenge for Rivian against its rivals:

Tesla and Ford are both household names, with Tesla’s valuation skyrocketing from $73 billion in 2019 to three-quarters of a trillion today. As a result, they have a long line of loyal customers who trust their product.

While Rivian follows Tesla’s approach in terms of advertising by shunning traditional advertising methods, Tesla’s charismatic owner, Elon Musk, keeps the company in the news, which explains why he has 60 million Twitter followers compared to Rivian CEO and founder RJ Scaringe’s 46,000 followers.

Rivian hasn’t got a celebrity CEO. But today’s news shows a firm commitment to electric vehicle manufacturing. It’s a bonus for sustainable mobility.

Get the TNW newsletter

Get the most important tech news in your inbox each week.