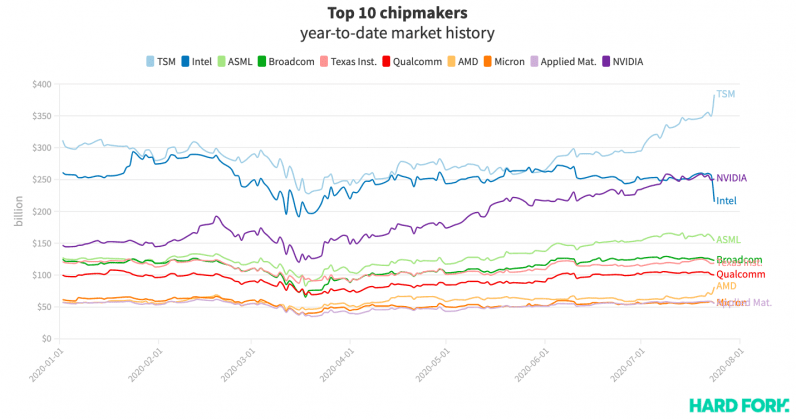

Intel stock plunged on Friday after the US computing giant revealed a third-party manufacturer might make its next generation chipsets — wiping $41.72 billion from its market value.

The announcement sent traders flocking to Intel’s rivals. Taiwan’s TSMC, the world’s largest chipmaker by market cap, grew by $33.8 billion on Friday, while AMD added $11.5 billion.

According to Bloomberg, TSMC’s 10% rally sent its stock to its highest point since 1990, ranking it the 12th most valuable stock in the world, tech or otherwise. TSMC produces chipsets for AMD, among others.

Remarkably, AMD’s stock surge mirrored Intel’s losses; $AMD closed the day up 16%, $INTC down 16%.

Wall Street insiders even took turns battering Intel stock as it fell. One analyst reportedly referred to Intel’s earnings call as the company’s worst over the 45 previous calls they’d covered. Swathes of others either downgraded $INTC or decreased their price targets.

Intel’s dramatic loss had another effect: it solidified competitor NVIDIA as the US’ most valuable chipmaker, after the Santa Clara firm eclipsed Intel for the first time earlier this month.

In fact, NVIDIA has grown faster any other US-listed chipmaker this year, having added a butt-clenching $104 billion to its market value this year (71% growth).

AMD is currently second with $23.8 billion (41.5%), and TSM is third with $72 billion (23%).

Get the TNW newsletter

Get the most important tech news in your inbox each week.