Microsoft’s fiscal third quarter 2013 earnings report today was difficult to parse: Was Windows division revenue up a firm 23%, or was it in fact completely flat on a year over year basis? Both, as it turns out. That’s just one of the oddities in Microsoft’s most recent quarter that is worth discussing in detail, now that the raw figures have been released.

We’ll focus on three areas of Microsoft’s recent financial performance to better doodle up a sketch of how the company is performing: Windows division revenue, Entertainment and Devices revenue, and losses over in the Online Services division.

Windows

The Windows division had reported revenues of $5.70 billion in the quarter. Without removing deferred revenue from that figure, it represents a 23% increase on top line from the corresponding year-ago quarter. However, that figure includes, as Microsoft noted in its release: “Adjusting for the recognition of revenue related to the Windows Upgrade Offer, Windows Division non-GAAP revenue was flat.”

What might that mean? In short, the company had a deal by which customers who bought Windows 7 PCs could cheaply upgrade to Windows 8. Revenue from that, due to accounting rules, had in some cases be set aside – deferred – until the end of the promotional period. This meant that some upgrade income had to be accounted for in a later quarter.

This quarter.

Using rough analysis, Microsoft had Windows revenues of more than a billion dollars that it deferred. However, once we strip that money away, we have an essentially flat quarter. Is that good, middling, or bad?

Frankly, I’d say that it’s a rather decent performance. The current narrative surrounding Windows 8 and the larger PC market is that they are in painful decline, with unit volume shrinking and consumer reaction negative to the latest Microsoft operating system.

To have revenue be flat – on a non-GAAP basis – is therefore in contradiction to that perspective. What’s going on? Two things, I think, primarily that Microsoft’s long term service contracts with enterprise customers provide strong recurring revenue, in the realm of $1 billion per quarter. This provides an anchor for the division’s revenue.

Also, I think that revenue from the Surface tablet line also lands in the Windows division’s revenue bucket. I have a query in with Microsoft to confirm that fact. Microsoft deeply discounted Windows 8, which may have depressed software revenues in the division. Surface revenue may have made up that slack. That said, flat revenue isn’t great; but it may be ‘fine’ for the moment.

Entertainment and Devices

This was the breakout success for Microsoft in the most recent quarter, with revenue of $2.53 billion, up 56% year over year. That said, deferments were at play. On a non-GAAP basis, the revenue figure was up a more modest, but still impressive 33%.

For a company as mature as Microsoft, and for a division with revenue in the billions, such percentages stand out. In conversation with Microsoft’s Lisa Nelson – the company’s director of investor relations – she informed TNW that roughly half of the now 46 million Xbox Live subscribers pay the company. Membership costs roughly $60 per year, if paid all at once.

Thus, back of the envelope, $1.4 billion in revenue is recorded per year by Microsoft from Live subscriptions. However, membership was up 18% in the most recent quarter. Also, the company sold 1.3 million Xbox consoles during the time period.

Finally, Nelson told TNW that transactional revenue generated by the Xbox ecosystem in fact is greater than subscription revenue. Thus, the Xbox platform’s content system now generates more top line for the company than the set, $60 per year subscription fee.

If you average the $60 fee across all Live users, you come to a figure of $30 per, annually. Thus, transactional revenue on the Xbox platform is more than $30 per year per Live user. That’s higher than I expected.

In short, leading console sales, rising subscription income, and high-monetization of active users are driving the Entertainment and Devices division forward. “It’s a great business,” Nelson told TNW with enthusiasm.

Losses, er, Online Services

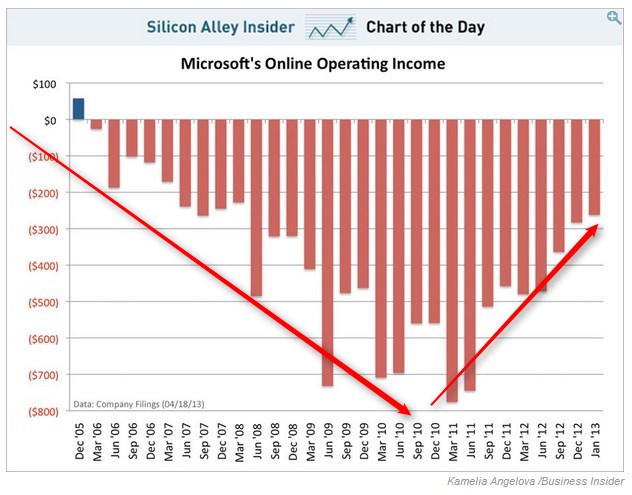

Finally, what is going on with the loss-leader, the creator-of-tax-help, the Online Servces division? Things in fact are improving, consistently. Revenue in the division landed at $832 million, an 18% increase. However, the group lost over $250 million dollars in the same period.

Is that bad? Certainly, it’s not ideal mathematically, but historically those are greatly improved figures for the division. Business Insider put together a great graph that illustrates the fact, which I have amended with arrows

There, you now know more than you ever cared to about Microsoft’s quarter. Please inform your friends over dinner, I am sure that they are dying to hear about it.

Top Image Credit: ERIC PIERMONT / AFP / Getty Images

Get the TNW newsletter

Get the most important tech news in your inbox each week.