In an age when everything is going virtual and digital, we could be looking at a future where wallets may be as uncommon as Filofax organizers and paper address books.

Sure, there are traditionalists who prefer the feel of pen against paper, a physical item to hold on to, but there is something to be said for the convenience of storing thousands of contacts on your tiny mobile phone. So wouldn’t it be just as convenient to be able to put nearly everything that’s in your wallet into a virtual space, accessible via your phone?

So what do we take with us in our wallets? Credit cards, loyalty and membership cards, photos, cash, and possibly a business card or two. For the most part, particularly for US residents, there are online or virtual alternatives that make it easy to ditch your physical wallet in favour for the smartphone that you take with you everywhere you go.

Needless to say, you can store your wallet photos of loved ones directly on your phone. In our digital age, there’s nothing easier than taking or transferring a photo onto your phone and having it with you everywhere you go. But what about the rest of the personal things you’ve got stuffed in your wallet? Here, we’ve put together a guide to apps that are currently available, as well as what’s still to come.

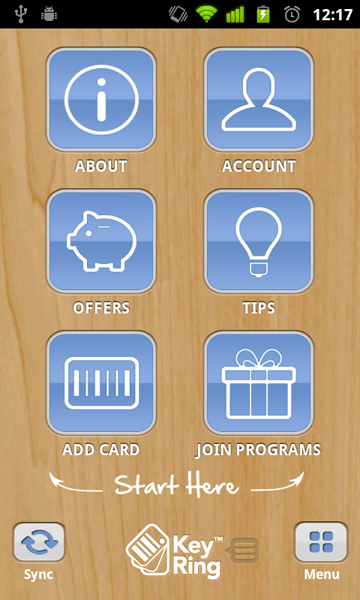

Loyalty and membership cards

While loyalty cards should be baked right into Google Wallet, the chances are not every single retailer will be included in the equation. The cross platform app Key Ring is the perfect solution to get rid of all those loyalty cards crowding your wallet (or key chain) and put them all on your phone. Available for Android, iOS, Windows Mobile and Blackberry, the app allows you to scan and save the barcode of your loyalty cards and store them on your phone. Moreover, Key Ring also locates special offers in your area, so that you don’t miss out on anything.

There are other options for loyalty cards, such as Punchd, which we’ve reviewed in the past, and the trend is making its way around the world as we’re seeing localized versions of the concept, such as the Middle East’s Cashbury, which has yet to launch. It’s worth checking to see if your favourite stores have their own apps, or if there’s a localized version of Key Ring for your region.

Key Ring is of course only useful if it includes businesses and retailers that you frequent. So for those of you who want an app that doesn’t limit you, which is particularly handy for those of us living east of the Atlantic, the app CardMobili has a limited selection of international cards, but more importantly it allows you to add cards manually on the website. The site and app aren’t as user-friendly and attractive as Key Ring, but at the end of the day it gets the job done. CardMobili should also allow you to store any card with a barcode, regardless of whether or not you use it for loyalty points, for example gym and library membership cards should work with the app. The cross platform app is available for Android, iOS, Windows Mobile, and Blackberry, and anyone else can also use the service, with limited access, from their mobile browsers.

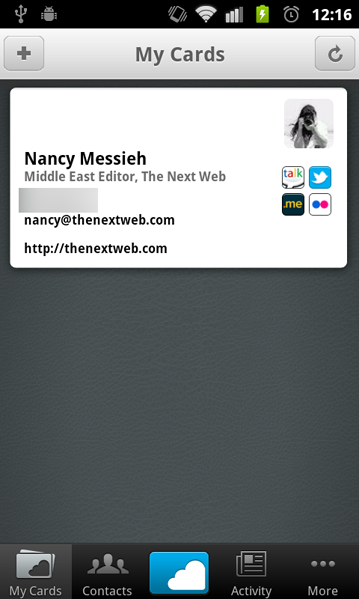

Business cards

Rather than use traditional business cards, there are several virtual options that can replace the need to print out a stack of cards. It’s more environmentally friendly and you won’t have to worry about forgetting your cards. CardCloud, which we’ve written about in the past, is available for both iOS and Android and allows you to email your business card to users who don’t use the app, and record the location where you exchanged business cards – making it the most well-rounded app of its kind.

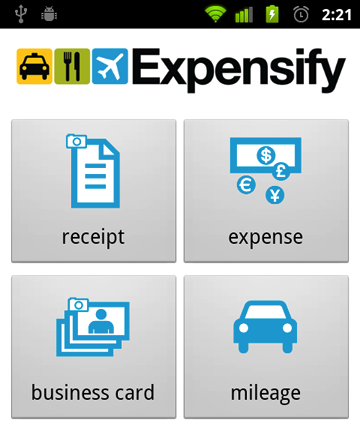

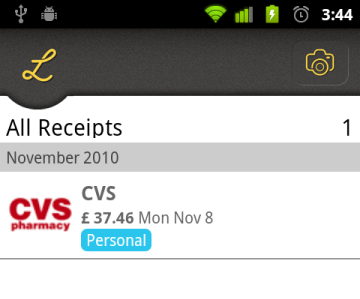

Receipts

Is your wallet filled with scraps of paper and receipts? Even if you don’t want to replace your wallet with your smartphone, there is certainly something to be said for getting rid of scraps of paper and storing that information on a computer or in the cloud. Why not take things one step further and implement a system which keeps track of your spending? That’s certainly something your wallet isn’t going to do for you.

Expensify is a good option to scan receipts, and additionally allows US users to link credit card and bank information to the app to record their payments as they happen. Available for Android, iOS, Blackberry and Web OS, the app allows you to scan receipts on the fly, by simply taking a photo of the receipt.

The app does the rest for you, by extracting the main details from the receipt. Expensify also allows you to scan and add data from business cards. All of the data can then be accessed on your online account from your computer.

Google Wallet has finally launched, albeit to a limited audience, available only for Sprint Nexus S 4G users. That said, the concept is brimming with potential. If you use Google Wallet, it could also possibly eliminate the need for Key Ring or similar apps, provided that your preferred retailers are included in the service.

Although there is nothing currently available, Google Wallet isn’t the only app vying for your attention in the mobile payment space. Isis has AT&T, Verizon and T-Mobile backing its mobile payment system so it could prove to be competition for Google in the US. Zoosh, a service created by Narette is also aiming to turn your phone into a replacement for your wallet. Banks are also catching up with the times, with Movenbank, dubbed “the world’s first cardless bank” launching its Alpha site, just this past weekend.

As far as credit cards are concerned, it’s still early days and it’s hard to say whether or not the concept will catch on, and go mainstream. It’s also worth remembering that credit cards were far from an overnight success.

Would you do it?

I like the idea of doing away with my wallet and depending purely on my phone, but there are of course risks and obstacles. First, you have to depend on your phone’s battery – and if it dies you’re in trouble. But if you think about it, even your physical wallet isn’t foolproof – those of you who’ve had the misfortune of losing a wallet know what a hassle that can be. In fact, because all of your data is stored online, you can’t “lose” your credit cards. With Google Wallet, you are of course also at the mercy of Google – and who knows when the service will be available worldwide.

The very fact that you are putting all of that private information in the hands of third parties is something to think long and hard about – both from a security and privacy angle.

It may be a little too early to think about ditching your wallet once and for all, but once the option is available to you – do you think you’d do it? Let us know in the comments.

Get the TNW newsletter

Get the most important tech news in your inbox each week.