The most recent collapse of the cryptocurrency market has had an interesting effect on blockchain token developers.

In the past month, teams have withdrawn at least 170,000 ETH ($17.7 million) from their cryptocurrency coffers, marking the third biggest withdrawal period of this year.

In fact, over 100,000 ($10.4 million) ETH has been transferred from Initial Coin Offering (ICO) treasuries in the last week, reports blockchain research unit Diar.

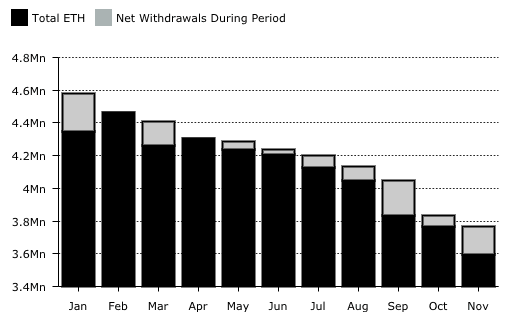

January and September are the only months to see such increased access to “development funds” this year.

This comes at a time when trading volumes across the cryptocurrency markets have fallen significantly, with 60 percent of exchanges like Binance, OKEx, Huobi, and Kraken hosting less token trading volume than in January this year.

This is especially true of tokens launched in 2018. Diar reports that over 75 percent of the cryptocurrencies that were added to exchanges this year have seen volumes in “complete decline” since October.

Despite the drop in retail interest and resurgence in volatility, you could argue devs have played it cool. Diar analysts concluded teams have withdrawn just 22 percent of overall funding held in treasuries to date.

Before the liquidation periods began earlier this year, the total amount of cryptocurrency held in ICO treasuries exceeded 4,651,675 ETH ($1.7 billion at the time).

Get the TNW newsletter

Get the most important tech news in your inbox each week.