There are lots of things you could do with a billion dollars – such as build a replica of the Titanic or attempt to bring dinosaurs back to life to build a theme park. Alternatively, you could do something a little more boring – like invest in profit-making ventures.

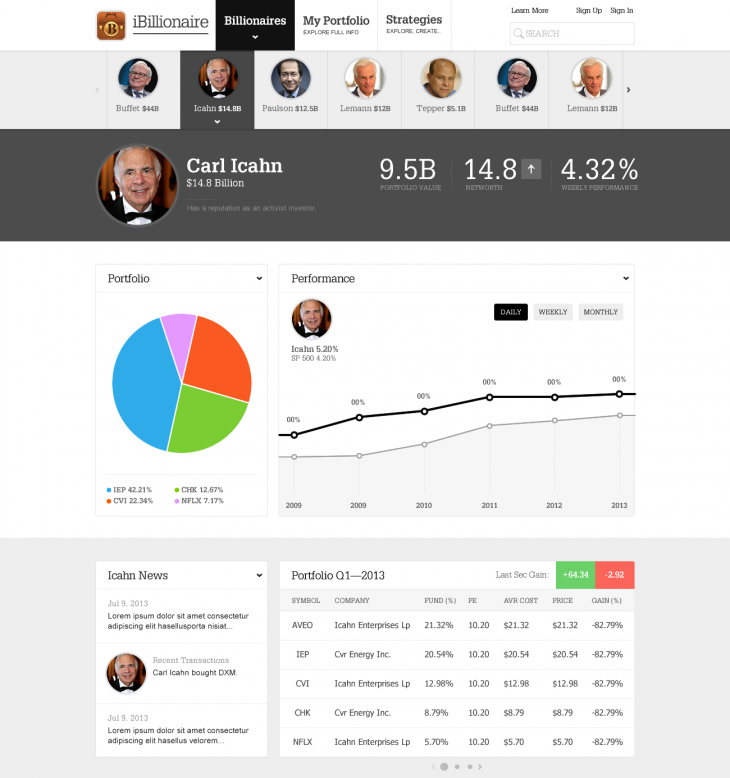

Launching initially for the iPhone back in April, iBillionaire lets budding investors follow some of the biggest movers and shakers in the business world. And in the wake of an update that brought the service to iPads a few weeks back, it’s now available on the Web too.

The New York-based startup is striving to help regular investors make smarter decisions, and it’s doing so by following the fortunes of 15 billionaire investors, including Warren Buffett and Carl Icahn. It also lets users plug their own holdings in, and compare it to that of the magnates to see what the moneymen are doing, and offer advice accordingly.

Open data

But wait – how does it access such sensitive information? Well, as it transpires, everyone has access to the information already through SEC filings that are required for any investment made in excess of $100 million. What iBillionaire does is makes the data more easily accessible, while serving up historical trends – peaks and troughs – of how big investments fared.

“The billionaire’s data is now available for everyone, in an easy to understand, and actionable format,” says Raul Moreno, iBillionaire’s co-founder. “The stock market is increasingly volatile, which often forces investors to decide when to buy, sell or hold a stock. Investors need a tool to help them make more strategically sound and profitable decisions within this volatility.”

iBillionaire is also introducing a strategy-creation tool that that lets investors create a portfolio that blends ideas from their favorite billionaires. So, this means users could create a strategy that’s composed of 75% Carl Icahn and 25% Warren Buffett, and test this portfolio strategy against their current one.

With the latest launch, iBillionaire is also introducing smart notifications, which are essentially real-time notifications (‘push’ for mobile, or email) for when a billionaire buys or sells a stock, and also when their stock is trading higher or lower than usual.

The free version of the app lets users access the billionaires’ portfolios, their own portfolio with real-time quotes, and compare it against the billionaires.

In addition, they can also create strategies by mixing billionaires’ portfolios – there is a 1 strategy limit here though. Plus, they can get real-time smart alerts with a 3 stocks limit, and access recently bought and sold popular stocks with a 5 stocks limit.

To make the aforementioned restrictions unlimited, there’s a premium monthly $5 or yearly $20 fee, which also gives a handful of additional bolt-ons, including real-time alerts each time a billionaire buys and sells stock.

“A recent example of how this information is useful to the regular investor occurred on July 23, when (billionaire) Daniel Loeb sold the majority of his holdings in Yahoo at $29.12,” explains Moreno. “Being aware of both Loeb’s cost basis and exit price, an investor that owns Yahoo! may want to consider their own position in the stock.”

Feature Image Credit – Andrew Burton/Getty Images

Get the TNW newsletter

Get the most important tech news in your inbox each week.