If there’s been any doubt about India being the next major target market for tech businesses, Kleiner Perkins partner Mary Meeker’s latest Internet Trends Report should make that clear as day.

The report, which spans 355 pages, dedicates 55 pages solely to the state of internet and mobile access in India. The first major takeaway is that the country now has 355 million internet users, which amounts to roughly 27 percent of the population of 1.3 billion people. That’s up from 277 million in 2015.

Chalk that up to the falling prices of smartphones and mobile data. The average cost of a handset is now far more affordable than a decade ago, having dropped from about $270 in 2007 to under $150 in 2016, and from over 25 percent of per capita GDP down to 8 percent.

Data plans are now half what they cost in 2014 – and India has major conglomerate Reliance to thank for that. The company’s Jio carrier launched last September with low-cost data plans on its 4G network that blew the competition out of the water. Of the 108 million people who signed up for the free trials, 72 million have converted into paying subscribers.

So yes, mobile internet use is certainly on the rise – since 2014, it’s skyrocketed from under 100 million GB a month to nearly 1,200 million GB a month, with a 9x growth seen between last June and March 2017. It’s not surprising that music and video streaming has increased threefold and fourfold respectively in that same short time frame.

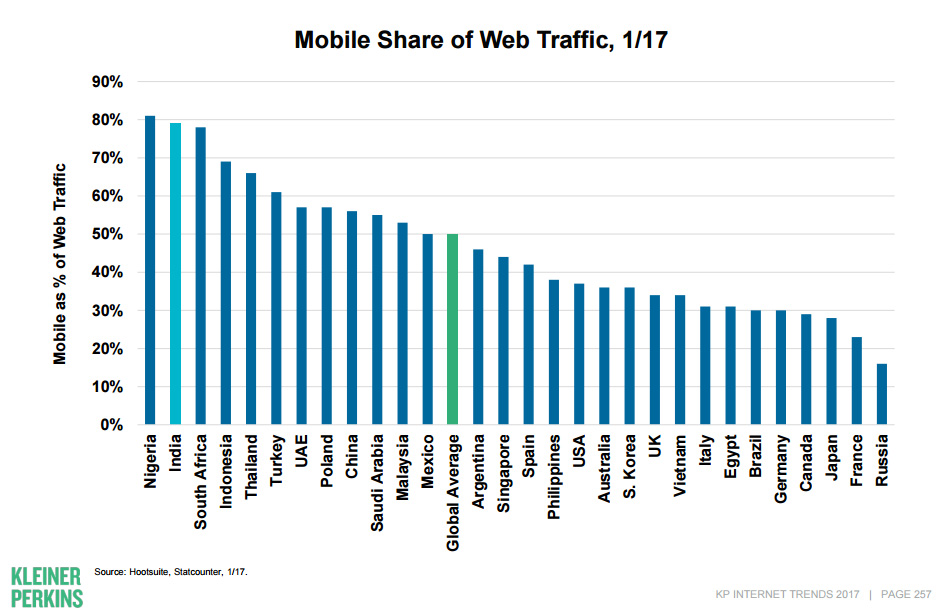

The majority of India has also largely leapfrogged desktops to experience the web – mobile devices account for about 80 percent of all traffic, far higher than the global average of 50 percent and that of the US at under 40 percent.

Mobile users in India are second only to China when it comes to time spent on Android phones (close to 150 billion hours). Facebook owns four of the top 10 most popular apps across the country, while the rest include video streaming services, a video player, an offline file transfer tool and Truecaller’s caller ID app.

Oh, and of course, a browser – but it’s not Chrome or Opera. Instead, its Chinese internet giant Alibaba’s UC Browser, which comes preinstalled on a large number of devices. It currently enjoys 50 percent market share nationwide, while Chrome is at roughly 30 percent.

The report says that about 45 percent of the time people spend with their phones is for entertainment, while 34 percent is taken up by social media and messaging services. And at 28 hours per week, mobile use also dwarfed the amount of time people spent watching TV or reading print media (two hours each).

It’s also worth noting that 82 percent of Indians have now enrolled in the Aadhaar digital ID program over the course of the past six years. The unique 12-digit identifier is paired with biometrics to allow citizens to access government services and subsidies – but lately, it’s come under fire for not being secure enough and being made mandatory by private organizations.

And while India presents tech companies across the world with tremendous opportunities to capture a massive market, there are significant challenges too. Many people in the country still don’t have formidable spending power, and education and infrastructure are still lacking. Stringent regulations and high registration costs for starting a company in India bring its global rank in the ease of doing business down to 130 out of 190 countries.

Still, it’s evident that India’s internet and mobile scene is hotting up incredibly quickly, and the time is ripe for companies to enter the market and get to grips with its idiosyncrasies and hurdles to score big bucks in the future. You can check out the entire report here.

Get the TNW newsletter

Get the most important tech news in your inbox each week.