Update 08:26 UTC, June 29: Hard Fork has published a revised version of this analysis that includes both stock splits and dividends.

Errata 18:30 UTC, June 27: Unfortunately, Hard Fork made an error in the calculation of the 2020 stock portfolio featured in this article, namely: we failed to accommodate for “stock splits,” which occurred for almost every stock featured in our hypothetical dot com bubble portfolio. We’re really sorry.

We’re leaving this article up because it’s okay to make mistakes, and Hard Fork is already working on a corrected version, so stay tuned!

20 years have passed since the dot com crash. In the five years leading up to the new millennium, feverous markets thirsty for internet stocks drove the Nasdaq Composite stock index up 400%, growth that proved unsustainable after Y2K.

Casualties of the bubble, one of the largest in history, are basically endless. Sock puppet peddlers Pets.com, Webvan.com, and Disney’s Go are commonly cited dot com flops, but many top companies from back then eventually evolved into our current industry giants.

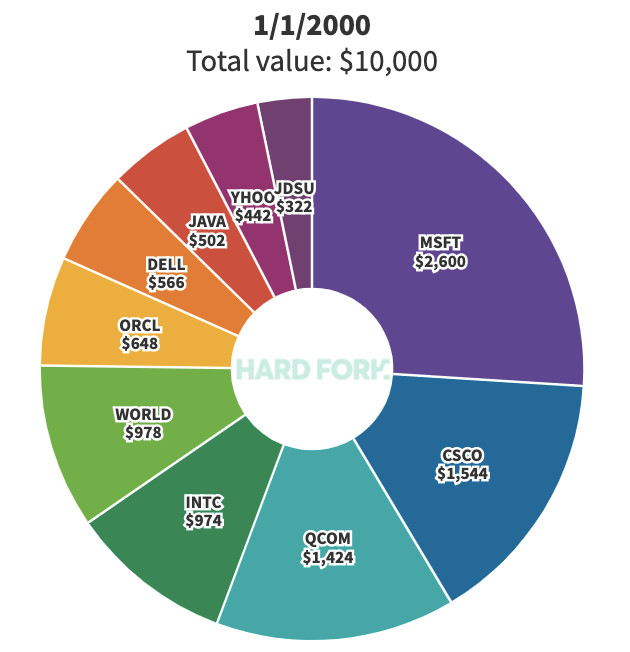

Let’s say it’s 31 December, 1999, and investing is your New Year’s resolution. You start with $10,000 split between the top 10 tech companies, weighted by market cap.

[Read: At least 7,500 Robinhood traders bought Hertz stock after its latest 100% pump]

Your portfolio would consist of some familiar names: Windows-maker Microsoft (26%); networking chief Cisco (15.4%); wireless prince Qualcomm (14.2%); insiders Intel (9.7%); fraud-laden Worldcom (9.7%); database wizards Oracle (6.4%); PC patrons Dell (5.6%); Java creator Sun Microsystems (5%); search engine Yahoo (4.4%); and the now unrecognisable JDS Uniphase (3.2%).

Now, imagine cartoon sitcom Futurama is a documentary of your life, only instead of unfreezing in the 3000, you wake up today, June 26, 2020. Could’ve picked a better year, but hey, welcome back.

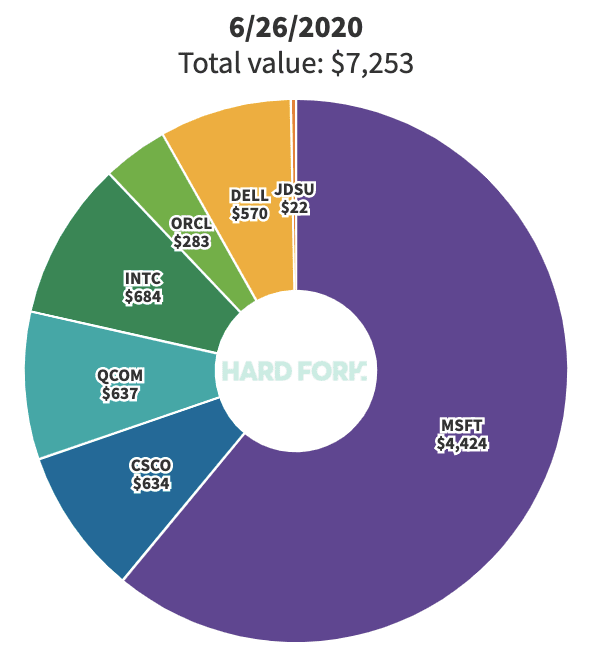

Upon checking your stocks, you’d find yourself to be only be down around $2,500. Indeed, despite the crushing demise of Worldcom and Yahoo’s gradual fall, your portfolio is now worth just 25% less.

Unfreeze, check stocks, profit?

Only 25%! Not bad considering that the Nasdaq Composite — widely recognized as the benchmark for the tech industry during the dot com boom — fell up to 78% in the years following the crash.

The stocks do look a bit different. Unfortunately, Worldcom is now at zero, but you did eventually receive small share buyouts from the Sun and Yahoo acquisitions (around $260).

Instead of JDSU shares, you’re now invested in network testers Viavi Solutions, but your stake is worth 93% less. Of the stock that survived, this is your worst performing.

You’re now holding $7,253 worth of stock: Microsoft (61%); Intel (9.4%); Qualcomm (8.8%); Cisco (8.7%); Dell (7.9%); Oracle (3.9%); and Viavi (0.0029%).

Microsoft is your one saving grace. In the 20 years that’ve passed since the dot com bubble burst, Microsoft’s market cap has risen from $606 billion to $1.49 trillion, and its price from $117 to $199.

At 70% profit, $MSFT is by far your best performer.

In fact, Microsoft is the only stock that’s risen since you were frozen. Cisco is down 59%, Qualcomm 55%, and Intel 29%. Your $1,424 invested in Oracle is now worth a measly $634.

Amazingly, Dell is even: it opened trade for the year 2000 at $51.38 — today at $51.71.

For what it’s worth, a portfolio built in the same way today would consist of: Apple (21.3%); Microsoft (20.4%); Amazon (18.5%), Alphabet (13.1%); Facebook (7.6%); Intel (4.2%); NVIDIA (4%); Adobe (3.6%); Netflix (3.5%); and PayPal (3.4%).

Now let’s see who survives the next 20 years.

Get the TNW newsletter

Get the most important tech news in your inbox each week.