This interview is part of our series of Growth Stories. We interviewed the founders and CEOs of 20 of the fastest growing startups in Europe. We asked them about their companies, their companies’ culture, and their lives, trying to understand how these three factors played a role in the achievement of such impressive growth.

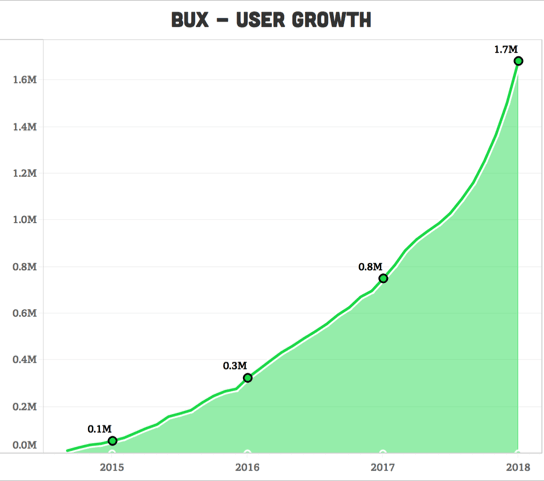

Founded in 2013, Bux is an app (iOs, Android) that uses gamification to make the financial markets more accessible giving its users (1.2 million) the opportunity to trade in stocks, first in virtual currency (“funBUX”) then, if they want, in real money. Thanks to a solid community, an in-app news channel and the trading itself, users don’t have only the opportunity to make money but also and foremost to learn new things about finance.

To find out more, I meet with CEO and founder Nick Bortot at Bux headquarters in the heart of Amsterdam. It’s a nice office with a home-vibe to it, but for a big family, given that the company just passed the 50-person headcount. It also just raised 10.6 million in a series C investment round and over 1 million thanks to a round of crowdfunding on Seedrs, an amount that will fuel even more an already impressive growth.

I sit down with Nick in a cozy corner of the office, in between the work environment and a granma-style, spacious kitchen, and start by asking him about the massive funding round.

What do you want to do with this pretty penny that you just raised?

We will mainly put it in product development. By summer 2018, we want to start our family of apps that will widen the portfolio of our offer. We want to become the ‘single destination’ for all millennials that want to do something more with their money. And I mean investing, trading, crowdfunding — basically everything apart from loans and mortgages.

When you have these ambitions, one single app is not enough. There are many reasons for this but mainly because long-term investing is really different from short-term and you can’t put them together in the same environment. We also want to develop an app dedicated to cryptocurrencies, to make them easier to use and understand. So: different apps but under the same umbrella.

OK, flashback to four years ago. How did it all start?

Well, I worked for 12 years at Binck, a successful Dutch financial company. During that time, I discovered that there were tons of people interested in the financial market but also that they were pushed back by its complexity and also by its cost. Don’t forget that the average cost of a transaction in Europe is 5 euros.

Moreover, I was interested in the young segment and I discovered that all these brands of traditional banks and brokers didn’t appeal to them at all. So, in 2013, I said, “let’s build an app!” And, apparently, the idea worked.

How did you launch your product?

I think that when you launch a product you can do two things: you can wait for virality or you can just market heavily from the beginning. We went for the second approach and immediately started with performance marketing, radio and TV commercials.

What’s a key characteristic of your product that in your opinion positively influenced Bux’ growth?

I think that our product is something unique. Indeed, we don’t have (yet) direct competitors that sell anything similar to Bux. It’s easier to attract investments when you create new consumption patterns.

What has been at the opposite a significant challenge for the growth of Bux?

We have to deal with the volatility of stock markets, something other companies don’t have to. For this reason, from one month to the other, we can increase in revenue of 30-40 percent. When you’re trying to attract new investors, this can be a problem because they want a steady growth. But in general, for us the more markets move, the better.

For example, after Trump was elected everyone was enthusiast thinking that the market would have roller-coasted but instead it just grew quite steadily. And, obviously, if markets are quiet we have less accounts opened and less transactions. In this sense, the past weeks here have been among the best ever thanks to Bitcoin’s growth.

Can you name three core values for your brand?

We try to be fun, fair, and human. Think of the teachers that you had in high school: who is the one that taught you the most? Usually, it’s the one that was able to teach serious things in a funny way. And that’s our approach to the complex world of finance: it just sticks better if you learn it with a bit of fun.

And we want to deal with things humanly because yes, our product is about money but we want to be fair, avoiding, for example, to expose our customers to useless risks. As you can see, our brand and company culture are the same. It’s not the eighties anymore, when they could be completely separated.

How do you conceive your role as CEO of the company?

I recently read a book by Simon Sinek [the author of Start with Why] where he writes that it’s essential that people feel safe in their companies. In this sense, my task as CEO is to make this company feels like a family, a place where they don’t have to be worried about things.

I believe that there are two types of leaders: the Steve Jobs/Elon Musk visionaire that says “my way or no way” and the facilitator, the one that puts the right people together, trying to create an environment where they don’t feel blocked. I surely belong to the second group. When I look at my team, I can’t help but think: as a single person I can never be smarter than all these people together.

—

In the lead-up to Tech5 2018 – the annual competition organized by TNW and Adyen which celebrates Europe’s fastest-growing tech companies in the Netherlands, UK, Germany, Spain, France, and Sweden– we’re launching a series of remarkable stories of businesses that experienced extreme growth. If you are a startup with an inspiring/remarkable/interesting story about finding your special metric that led to growth, please share it with davide@thenextweb.com.

Get the TNW newsletter

Get the most important tech news in your inbox each week.